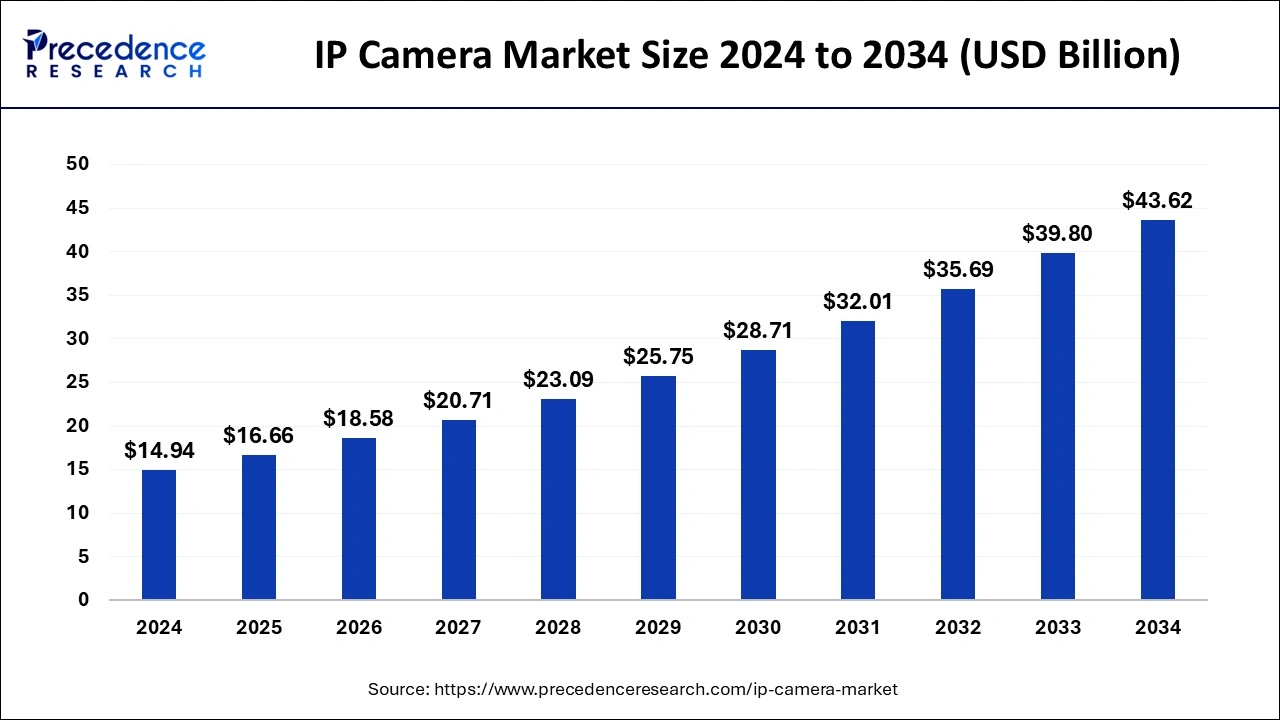

The global IP Camera market size is predicted to grow around USD 39.80 billion by 2033, expanding at a CAGR of 11.50% from 2024 to 2033.

Key Points

- Asia Pacific region has generated largest share of 49% in 2023.

- By component, the hardware components segment has dominated the global market in 2023 with revenue share of 78%.

- By product, the infrared camera segment has held the largest share of 44% in 2023.

- By connection type, the consolidated segment dominated the market with revenue share of 75% in 2023.

- By end use, the commercial segment has captured market share of 67% in 2023.

The IP camera market is witnessing rapid growth globally, driven by the increasing demand for surveillance and security solutions across various sectors such as residential, commercial, industrial, and government. IP cameras, also known as network cameras, are digital video cameras that transmit data over a network, allowing for remote viewing and recording. With advancements in technology, IP cameras offer superior image quality, scalability, flexibility, and advanced features compared to traditional analog cameras. This has led to a significant shift towards IP-based surveillance systems, fueling the growth of the market.

Get a Sample: https://www.precedenceresearch.com/sample/4101

Growth Factors:

Several factors contribute to the growth of the IP camera market. Firstly, the rising concerns regarding security and safety across different industries drive the demand for surveillance solutions, including IP cameras. Additionally, the increasing adoption of smart home and smart city initiatives further propels the market growth. Moreover, advancements in video analytics, artificial intelligence (AI), and edge computing enhance the capabilities of IP cameras, making them more efficient and intelligent. Furthermore, the declining costs of IP camera systems and the proliferation of high-speed internet connectivity facilitate their widespread adoption, especially in emerging economies.

Region Insights:

The IP camera market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market owing to the high adoption rate of advanced surveillance technologies, stringent regulations regarding security and privacy, and the presence of major market players in the region. The Asia Pacific region is anticipated to witness significant growth attributed to rapid urbanization, increasing investments in infrastructure development, and the adoption of smart city projects across countries like China, India, and Japan.

IP Camera Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.50% |

| Global Market Size in 2023 | USD 13.40 Billion |

| Global Market Size in 2024 | USD 14.94 Billion |

| Global Market Size by 2033 | USD 39.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Product, By Connection, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

IP Camera Market Dynamics

Drivers:

Several drivers propel the growth of the IP camera market. These include the increasing incidents of theft, burglary, and vandalism, which necessitate the deployment of robust surveillance systems for monitoring and deterrence. Additionally, the growing awareness regarding the benefits of IP cameras such as remote monitoring, real-time alerts, and video analytics capabilities drives their adoption across various sectors. Moreover, the integration of IP cameras with other smart devices and technologies such as IoT (Internet of Things) and cloud computing further boosts market growth.

Opportunities:

The IP camera market presents numerous opportunities for growth and innovation. One significant opportunity lies in the integration of AI and machine learning algorithms into IP cameras, enabling advanced features such as facial recognition, object detection, and behavior analysis. Moreover, the increasing demand for wireless IP cameras and the emergence of 5G technology offer opportunities for market expansion, particularly in remote and outdoor surveillance applications. Furthermore, the rising adoption of IP cameras in sectors such as healthcare, transportation, and retail opens up new avenues for market players to explore.

Challenges:

Despite the favorable growth prospects, the IP camera market faces certain challenges that may hinder its growth trajectory. One such challenge is the concern regarding data privacy and security breaches associated with IP camera systems, which may deter end-users from adopting these solutions. Additionally, interoperability issues among different brands and standards pose challenges for seamless integration and scalability of IP camera systems. Moreover, the lack of skilled personnel for managing and maintaining complex surveillance infrastructure presents a challenge for market players. Furthermore, the presence of counterfeit and low-quality IP cameras in the market raises concerns about reliability and performance, impacting consumer confidence.

Read Also: Fish Protein Hydrolysate Market Size, Share Report by 2033

Recent Developments

- In July 2023, D-Link launched an indigenous array of surveillance products manufactured in India. The series intends to cater to Indian consumers’ security concerns, and it includes a wide range of IP-based surveillance cameras and network video recorders (NVRs).

- In April 2023, 3dEYE Inc. added new features of cloud-based ALPR analytics to its existing IP cameras. The new features include scaling the analytics to existing IP cameras. It can detect authorized and unauthorized vehicle repeat offenders and enhance visitor management and access control without additional hardware investment or development.

- In March 2022, Hikvision introduced the 2nd Gen value IP camera series with enhanced motion detection and suspense technology. The new series of IP cameras from Hikvision offers several improvements over previous generations, such as enhanced motion detection and reduced false alarms. AcuSense technology can identify and classify people and vehicles, making searching for specific events in recorded footage easier.

IP Camera Market Companies

- 3DEYE Inc

- Arecont Vision Costar LLC.

- Motorola Solutions, Inc.

- Belkin

- Bosch Sicherheitssysteme GmbH

- CAMERAFTP

- CAMCLOUD

- D-Link Corporation

- EOS Digital Services

- GEOVISION Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

- Johnson Controls

- Kintronics Inc.

- Matrix Comsec.

- Panasonic

- PRO-VIGIL

- SAMSUNG

- Schneider Electric SE

- Sony Corporation

- Stealth Monitoring

- Johnson Controls.

- VIVOTEK Inc.

Segments Covered in the Report

By Component

- Hardware

- Services

By Product

- Fixed

- Pan-tilt-zoom (PTZ)

- Infrared

By Connection

- Consolidated

- Distributed

By End-use

- Residential

- Commercial

-

- BFSI

- Education

- Healthcare

- Industrial

- Real estate

- Retail

- Transportation & Logistics

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/