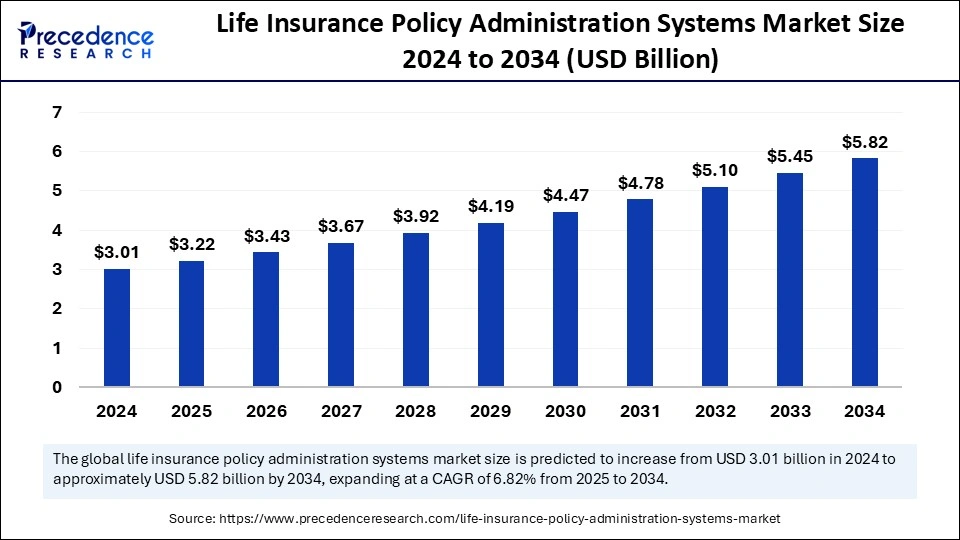

The global life insurance policy administration systems market size was valued at USD 3.01 billion in 2024 and is expected to surge around USD 5.82 billion by 2034, growing at a CAGR of 6.82%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5811

Life Insurance Policy Administration Systems Market Key Points

-

North America held the dominant share of the market in 2024.

-

Asia Pacific is projected to grow at the fastest rate over the forecast period.

-

Europe is expected to witness steady and notable growth.

-

The cloud-based segment led the market in terms of technology in 2024.

-

The on-premise technology segment is set to expand significantly in the coming years.

-

Individual life insurance policies accounted for the largest market share in 2024.

-

Group life insurance is forecasted to grow rapidly during the projected timeline.

-

New business processing was the top application segment in 2024.

-

The underwriting application segment is likely to see the fastest growth moving forward.

-

Single-tenant deployments led the market in 2024.

-

Multi-tenant deployments are expected to become the fastest-growing segment

Role of AI in Life Insurance Policy Administration Systems Market

Artificial Intelligence is reshaping the life insurance policy administration systems market by automating processes, enhancing decision-making, and improving customer experiences. Traditional policy administration involves complex, manual workflows including policy issuance, underwriting, premium billing, claims processing, and customer service. With the integration of AI, these processes are being streamlined, leading to increased efficiency, reduced operational costs, and faster turnaround times.

AI-driven solutions enable insurers to process vast amounts of data with accuracy and speed. In underwriting, machine learning models can assess risk by analyzing historical data, behavioral patterns, and third-party data sources, offering more accurate and dynamic pricing. AI also enhances fraud detection capabilities by identifying anomalies and suspicious patterns in claims and transactions. In customer engagement, chatbots and virtual assistants powered by natural language processing provide instant support, policy updates, and claims assistance, improving user satisfaction.

Moreover, AI facilitates personalized policy recommendations based on predictive analytics, helping insurers tailor products to individual customer needs. As insurers increasingly shift to cloud-based and multi-tenant platforms, AI further enhances system integration and supports scalable, adaptive solutions that are crucial in today’s digital-first insurance landscape.

Life Insurance Policy Administration Systems Market Growth Factors

Table of Contents

1. Digital Transformation in the Insurance Industry

The growing shift towards digitalization in the insurance industry is a major factor driving the adoption of advanced policy administration systems. Insurers are investing in technology to improve operational efficiency, reduce costs, and enhance customer engagement. AI, cloud computing, and data analytics are becoming integral components of modern policy administration systems, enabling insurers to streamline workflows and deliver personalized experiences to customers.

2. Increased Demand for Automation

The demand for automated systems that can manage policy lifecycle processes—from underwriting and claims to customer support—is rising. Automation reduces the need for manual intervention, minimizes human errors, and accelerates processing times, making life insurance more accessible and efficient. This is particularly critical for insurers looking to improve their speed and scalability in the face of rising competition.

3. Rising Consumer Expectations for Personalized Services

Consumers increasingly expect personalized and seamless experiences when interacting with insurers. Advanced policy administration systems powered by AI and machine learning enable insurers to provide customized offerings, including tailored policies, personalized communication, and proactive customer service. This shift in consumer expectations is driving the adoption of smarter, more agile policy administration systems.

4. Regulatory Changes and Compliance Requirements

As the insurance industry faces growing regulatory scrutiny, insurers are compelled to adopt advanced policy administration systems to ensure compliance with changing laws and regulations. These systems help insurers manage risk, track compliance, and maintain accurate records, all while streamlining reporting processes. Regulatory requirements around data security and transparency are prompting further investment in secure, technology-driven solutions.

5. Adoption of Cloud-Based Solutions

The increasing adoption of cloud technology within the life insurance sector is fueling the growth of policy administration systems. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness compared to traditional on-premise systems. Insurers can deploy and manage systems remotely, improving agility and reducing the need for significant upfront investments in infrastructure.

6. Integration of AI and Advanced Analytics

The integration of artificial intelligence (AI) and advanced analytics into policy administration systems allows insurers to process large volumes of data more efficiently. AI-driven solutions enable better risk assessment, fraud detection, customer behavior prediction, and automated claims processing. This technological advancement is enhancing the accuracy, speed, and overall effectiveness of policy administration.

7. Increasing Need for Efficient Claims Management

Efficient claims management is a critical aspect of customer satisfaction in life insurance. Policy administration systems that offer integrated claims management capabilities are becoming essential for insurers looking to enhance their customer service while reducing operational costs. Real-time tracking, automated workflows, and smart claims processing are all contributing to the growth of this market.

8. Growing Competition and Market Demand

With more life insurance companies entering the market and existing players striving to stay competitive, there is a growing need for advanced policy administration systems that can provide operational advantages. These systems enable insurers to enhance their offerings, improve their speed to market, and provide more efficient customer support, which is essential for staying competitive in a rapidly evolving market.

Market Overview

The Life Insurance Policy Administration Systems Market is growing rapidly due to the increasing adoption of digital technologies in the insurance industry. Insurers are leveraging AI, machine learning, and cloud-based solutions to streamline policy management, enhance efficiency, and offer better customer service. These technologies are driving the shift towards more automated and customer-centric policy administration systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.82 Billion |

| Market Size in 2025 | USD 3.22 Billion |

| Market Size in 2024 | USD 3.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Type, Application, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The demand for automation is one of the key drivers, as insurers seek to reduce operational costs and improve processing speeds. Additionally, the need for more personalized services and the growing regulatory pressures are pushing insurers to modernize their systems and ensure compliance, thus further fueling the market growth.

Opportunities

There are significant opportunities in the widespread adoption of cloud-based solutions, which offer scalability and cost-effectiveness. Additionally, AI and data analytics are opening doors for personalized offerings and improved risk assessment, especially in emerging markets where insurers are increasingly modernizing their infrastructure.

Challenges

The primary challenges include high upfront costs associated with implementing new systems, as well as the complexity of integrating these systems with existing legacy infrastructures. Insurers also face difficulties in navigating evolving regulatory environments and ensuring robust cybersecurity within their digital platforms.

Regional Insights

North America leads the market due to its advanced technological infrastructure, while Asia Pacific is expected to grow at the fastest rate, driven by rapid digital transformation in the region. Europe is experiencing steady growth as insurers modernize their systems to meet rising customer expectations and regulatory demands.

Life Insurance Policy Administration Systems Market Companies

- Majesco

- Accenture Life Insurance Solutions Group

- Accenture Plc

- Oracle

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

Latest Announcements

- In January 2025, Atsushi Egawa, CEO of Accenture, announced that Meiji Yasuda’s initiatives for becoming the most accessible and industry-leading life insurer are innovative as they integrate manual roles with digital technologies.

- In August 2024, Jason Wynne, the Global Vice President of the Finance, Risk, and Compliance Product Development of Oracle Financial Services, announced that Resolution Life Australasia found a solution to deliver an effective response to emerging business demands and comply with new accounting standards such as IFRS 17.

Recent Developments

- In September 2024, the Life Insurance Corporation (LIC) announced a collaboration with tech giant Infosys for the development of a next-generation digital platform that will serve as the foundation of new high-importance business applications such as portals, digital branches, customer and sales super applications, etc.

- In January 2025, Majesco announced the selection of Majesco Intelligent Claims for P&C by Celina Insurance Group to transform claim operations, improve productivity, optimize the business, and enhance customer experiences.

Segments Covered In the Market

By Technology

- Cloud-Based

- On-Premise

- Hybrid

By Type

- Individual Life Insurance

- Group Life Insurance

By Application

- New Business Processing

- Underwriting

- Policy Administration

- Claims Management

- Billing and Accounting

By Deployment

- Single-Tenant

- Multi-Tenant

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Customer Self-service Software Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/