| Report Coverage |

Details |

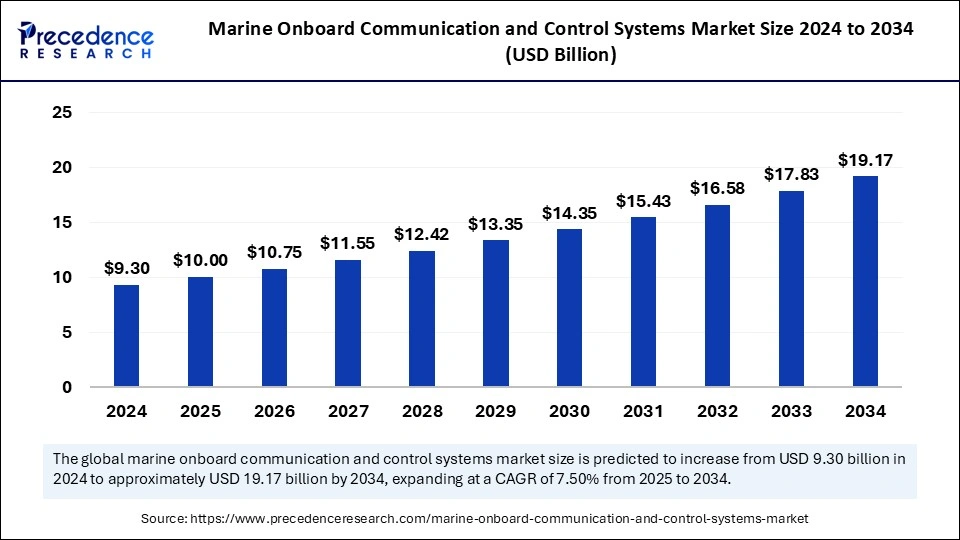

| Market Size by 2034 |

USD 19.17 Billion |

| Market Size in 2025 |

USD 10 Billion |

| Market Size by 2024 |

USD 9.30 Billion |

| Market Growth Rate from 2025 to 2034 |

CAGR of 7.50% |

| Dominated Region |

Asia Pacific |

| Fastest Growing Market |

North America |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Type, Platform, End User, and Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Drivers

The increasing demand for advanced maritime communication and control systems is driven by the growing need for real-time data exchange and enhanced safety protocols. The adoption of digitalization and automation in the marine industry has significantly boosted the demand for onboard communication and control systems. Additionally, stringent international regulations mandating improved communication and monitoring technologies for ships have accelerated market growth. The expansion of global trade and rising maritime traffic further emphasize the need for more efficient and reliable communication systems.

Market Opportunities

The integration of artificial intelligence, IoT, and cloud-based solutions presents significant opportunities for market expansion. These technologies improve data analytics, remote monitoring, and predictive maintenance, ensuring seamless ship operations. Furthermore, the rising demand for autonomous vessels creates new prospects for advanced communication and control systems. Companies investing in R&D to develop more sophisticated and efficient solutions are well-positioned to benefit from the growing adoption of smart shipping technologies.

Market Challenges

Despite the potential, the market faces challenges such as high installation and maintenance costs, which can limit adoption, especially among smaller fleet operators. Cybersecurity threats also pose a major concern, as digitalization increases vulnerability to cyberattacks. Additionally, the complexity of integrating new communication technologies with existing onboard systems can create compatibility issues, hindering smooth implementation.

Regional Insights

North America and Europe lead the market due to stringent maritime safety regulations and high investments in digital transformation. Asia Pacific is expected to experience the fastest growth due to increasing maritime trade, rising shipbuilding activities, and government initiatives to modernize naval fleets. Emerging economies in Latin America and the Middle East are gradually adopting advanced marine communication and control systems to enhance operational efficiency and comply with global safety standards.

U.S. Marine Onboard Communication and Control Systems Market Trends

The U.S. is actively integrating automation into its marine onboard communication and control systems to enhance operational efficiency and safety. Companies are incorporating satellite communications and low-earth orbit satellites to expand connectivity even in remote ocean regions. In December 2024, the U.S. launched the Maritime Energy and Emissions Innovation Action Plan, aiming to eliminate greenhouse gas emissions in the maritime sector by 2050. This initiative supports industries, communities, and subnational governments in decarbonizing the maritime sector.

To further promote sustainability, the U.S. Department of Energy (DOE), Department of Transportation (DOT), Environmental Protection Agency (EPA), and Department of Housing and Urban Development (HUD) introduced a National Blueprint for Transportation Decarbonization. This initiative focuses on creative solutions that enhance safety, equity, and accessibility across the U.S. transportation system while fostering global leadership through collaboration.

Decarbonization efforts extend to different types of vessels, including ocean-going ships, harbor crafts, and non-commercial vessels. These ships utilize electrification and sustainable maritime fuels to enhance operational efficiency while reducing emissions. The U.S. is working toward a net-zero greenhouse gas emissions strategy by 2050 and aims for 100% clean electricity by 2035. In April 2024, Anduril Industries, a California-based company, launched Menace-X, a command, control, communications, and computing system designed to operate in disrupted communication environments.

Asia Pacific Marine Onboard Communication and Control Systems Market Trends

Asia Pacific held the largest share of the marine onboard communication and control systems market due to rising maritime trade and increasing fleet sizes. Heavy investments in artificial intelligence (AI) and cybersecurity for onboard communication and control systems are driving regional market growth. The modernization of maritime transport systems further strengthens the market, with countries actively upgrading their fleets with advanced communication technologies.

In July 2024, the Economic and Social Commission for Asia and the Pacific (ESCAP) organized the Sustainable Maritime Connectivity program. This initiative focuses on establishing long-term national maritime transport policies while considering developments in digital technology, decarbonization, and climate change. These advancements are helping the region strengthen its maritime infrastructure and communication capabilities.

China Marine Onboard Communication and Control Systems Market Trends

China’s marine industry is advancing with automation, satellite communication, AI, IoT, and digitalization to enhance efficiency and performance. These technological improvements have significantly boosted the country’s onboard communication and control systems. Chinese research vessels are conducting oceanographic surveys, measuring parameters such as salinity, pressure, and water temperature to improve marine operations.

In the Indian Ocean Region (IOR), China operates specialized research vessels such as Yuan Wang 01 and Yuan Wang 02, focusing on oceanographic research. Additionally, the China Maritime Safety Administration (MSA) announced a special safety inspection in April 2024 to prevent mechanical and electrical equipment failures in ships, further strengthening the country’s maritime safety initiatives.

Japan Marine Onboard Communication and Control Systems Market Trends

Japan is making significant strides in maritime safety and technological improvements, with a strong focus on green onboard marine systems. The Japanese government is investing in sustainable maritime technologies to reduce carbon dioxide emissions and enhance energy efficiency. The country also leads in the development of maritime autonomous surface ships (MASS), creating opportunities for U.S. companies specializing in smart marine technologies.

Japan aims to achieve fully autonomous vessel operations, using AI-driven technologies for onboard control and navigation. The Nippon Foundation launched the MEGURI2040 project to develop and test new maritime technologies, accelerating progress toward autonomous navigation and operations.

Europe Marine Onboard Communication and Control Systems Market Trends

Europe is experiencing significant growth in the marine onboard communication and control systems market, driven by increasing investments in maritime safety and technological advancements. The CapTech Maritime initiative supports European naval research and defense cooperation, addressing existing and future challenges in naval technology.

Maritime transport plays a crucial role in the European Union (EU) economy, and the EU is taking proactive steps to reduce greenhouse gas emissions from shipping. The EU action plan focuses on achieving climate neutrality by 2050, aligning with global sustainability goals. The European Economic Area (EEA) is responsible for monitoring and reporting emissions under the Monitoring, Reporting, and Verification (MRV) Maritime Regulation to ensure compliance.

Integration of Automation and Digitalization in Germany

Germany is heavily investing in advanced fleet management tools that incorporate IoT, automation, and AI to improve real-time data analytics and operational efficiency. These technologies enable industries to enhance productivity and optimize fleet performance. The German Aerospace Center (DLR) plays a significant role in maritime research, studying oceans, lakes, and rivers while providing insights into aeronautics, energy, spaceflight, transport, and security.

Germany is also prioritizing maritime and coastal security, with research initiatives focusing on enhancing operational safety. These advancements are positioning Germany as a leader in digitalized and automated marine communication systems.

United Kingdom Marine Onboard Communication and Control Systems Market Trends

The UK Ministry of Defence (MOD) announced the addition of four new vessels to the Royal Navy’s Astute Class Nuclear Submarines in September 2024. These advanced submarines represent the most powerful attack submarines in the UK, reinforcing the country’s maritime defense capabilities. The UK is also focusing on modernizing its onboard communication and control systems, integrating AI-driven automation and cybersecurity enhancements to improve naval operations.

Marine Onboard Communication and Control Systems Market Companies

- Thales Group

- Wartsila

- General Dynamics Corporation

- RTX Corporation

- ABB Ltd.

- BAE Systems

- Northrop Grumman

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Emerson Electric Co.

- Navico

- Japan Radio

Latest Announcements by Leaders

In June 2024, Juha Koskela, Division President of ABB Marine & Ports, reported that the new software and services upsurge the company’s portfolio and strengthen the company’s commitment to support the marine industry’s digitalization.

In February 2025, Phil Siveter, CEO of Thales Group in the United Kingdom, announced that the company is dedicated to continuing its support to the Royal Navy to accomplish their missions through world-class communication capabilities.

Recent Developments

- In March 2024, Thales introduced an AI accelerator named cortAIx that has the potential to combine all of its AI capabilities in research, sensors, and systems. The cortAIx can offer efficient data analysis and decision support to end users like the armed forces, aircraft manufacturers, etc.

- In March 2024, Zeabuz introduced an autonomous passenger ferry vessel equipped with a large array of sensors, an automatic identification system (AIS), and an automatic tracking system powered by GPS and supplemented marine radar.

Segments Covered

By Type

- Communication Systems

- Control Systems

By Platform

By End User

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/