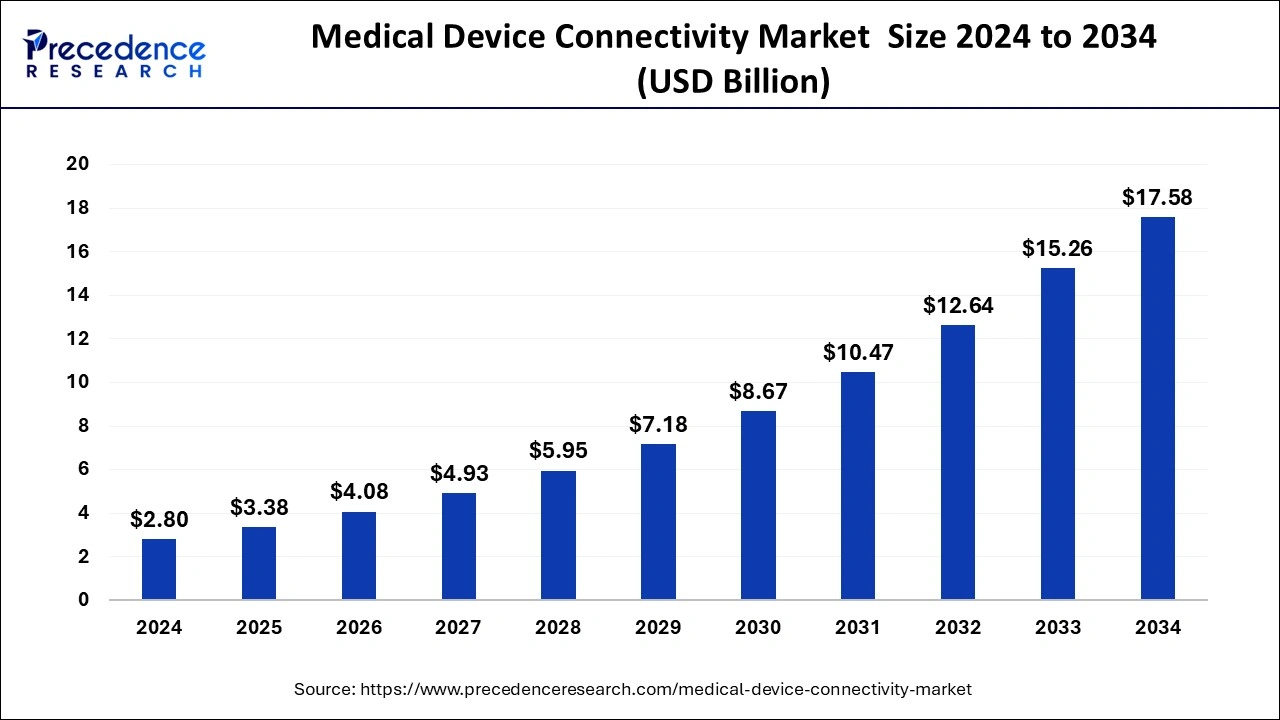

The global medical device connectivity market size was estimated at USD 2.32 billion in 2023 and is projected to rake around USD 15.26 billion by 2033, growing at a CAGR of 20.74% from 2024 to 2033.

Key Points

- North America has contributed 36% of market share in 2023.

- Asia Pacific is estimated to expand the fastest CAGR of 25.7% between 2024 and 2033.

- By components, in 2023, the wireless segment held the highest market share of 48%.

- By components, the wired segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By application, the hospitals segment has held the biggest market share in 2023.

- By application, the ambulatory care centers segment is anticipated to witness significant growth over the projected period.

The medical device connectivity market is witnessing significant growth, driven by the increasing adoption of electronic health records (EHRs) and the demand for streamlined healthcare processes. Medical device connectivity refers to the ability of medical devices to securely share data with healthcare information systems, such as electronic medical records (EMRs) and hospital information systems (HIS). This connectivity enables healthcare professionals to access real-time patient data, improve clinical decision-making, and enhance patient care. With the growing emphasis on interoperability and data integration in healthcare, the demand for medical device connectivity solutions is expected to continue rising.

Get a Sample: https://www.precedenceresearch.com/sample/3996

Growth Factors:

Several factors are contributing to the growth of the medical device connectivity market. Firstly, the rising prevalence of chronic diseases and the aging population are driving the demand for remote patient monitoring and telehealth services, which rely on medical device connectivity for data transmission. Additionally, government initiatives promoting the adoption of healthcare IT systems, such as the meaningful use program in the United States, are fueling the adoption of medical device connectivity solutions. Moreover, the increasing focus on improving healthcare efficiency and reducing medical errors is prompting healthcare providers to invest in connectivity solutions to streamline workflows and enhance patient safety.

Region Insights:

The medical device connectivity market is witnessing robust growth across various regions, with North America leading the market due to the presence of advanced healthcare infrastructure and supportive government policies. The region is characterized by widespread adoption of electronic health records and increasing investments in healthcare IT infrastructure. Europe is also a significant market for medical device connectivity, driven by the growing adoption of digital health technologies and initiatives to promote interoperability among healthcare systems. Meanwhile, the Asia-Pacific region is experiencing rapid growth, attributed to the increasing healthcare expenditure, expanding patient population, and rising adoption of telemedicine and remote patient monitoring solutions.

Medical Device Connectivity Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 20.74% |

| Global Market Size in 2023 | USD 2.32 Billion |

| Global Market Size by 2033 | USD 15.26 Billion |

| U.S. Market Size in 2023 | USD 580 Million |

| U.S. Market Size by 2033 | USD 3,850 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Components and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Device Connectivity Market Dynamics

Drivers:

Several drivers are propelling the growth of the medical device connectivity market. One key driver is the growing demand for integrated healthcare solutions that enable seamless data exchange between medical devices and electronic health records. Additionally, the proliferation of wearable medical devices and IoT-enabled healthcare devices is driving the need for connectivity solutions to collect, transmit, and analyze patient data in real-time. Moreover, the shift towards value-based care models and the emphasis on population health management are driving healthcare organizations to adopt connectivity solutions to improve care coordination and patient outcomes.

Opportunities:

The medical device connectivity market presents numerous opportunities for growth and innovation. One such opportunity lies in the development of interoperable connectivity standards that facilitate seamless data exchange between different medical devices and healthcare systems. Furthermore, there is a growing opportunity for vendors to develop secure and scalable connectivity solutions that comply with data privacy and security regulations, such as HIPAA in the United States and GDPR in Europe. Moreover, the integration of artificial intelligence and machine learning technologies into medical device connectivity solutions presents opportunities to automate data analysis, enhance clinical decision support, and improve predictive analytics for better patient outcomes.

Restraints:

Despite the promising growth prospects, the medical device connectivity market faces certain restraints that could hinder its growth. One major restraint is the complexity and cost associated with implementing connectivity solutions, particularly for smaller healthcare organizations with limited resources. Additionally, concerns regarding data privacy and security pose significant challenges, as the transmission of sensitive patient information over networks increases the risk of data breaches and cyberattacks. Moreover, interoperability issues between different medical devices and healthcare IT systems can hinder seamless data exchange and interoperability, limiting the effectiveness of connectivity solutions in improving clinical workflows and patient care.

Read Also: Cord Blood Banking Market Size to Rise USD 27.55 Bn by 2033

Recent Developments

- In October 2023, Philips unveiled new interoperability features aimed at providing hospitals with a comprehensive patient health overview for enhanced monitoring and care coordination. By integrating Philips Capsule Medical Device Information Platform (MDIP) with Philips Patient Information Center iX (PIC iX), the company offers a unique patient monitoring ecosystem, bringing together diverse medical devices and systems onto a single interface. This interoperability allows clinicians to access streaming data from various device manufacturers on an open, secure platform, offering a new clinical perspective.

- In February 2023, the province of Nova Scotia collaborated with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) to implement an integrated electronic care record system across the province, facilitated by Oracle Cerner. This technology aims to improve healthcare professionals’ access to patient information.

- In 2021, Koninklijke Philips N.V. entered into an agreement to acquire Capsule Technologies Inc., a leading provider of medical device integration and data technologies to healthcare organizations. This strategic move was intended to bolster Philips’ position in delivering connectivity solutions for patient care management within hospital settings.

- In 2021, Masimo Corporation introduced iSirona, a connectivity solution designed to integrate with electronic medical records (EMRs), surveillance monitoring, alarm management, mobile notifications, smart displays, and analytics.

Medical Device Connectivity Market Companies

- Cerner Corporation (U.S.)

- Medtronic (Ireland)

- Masimo (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- General Electric (U.S.)

- Stryker (U.S.)

- iHealth Labs Inc., (U.S.)

- Cisco Systems, Inc. (U.S.)

- Lantronix Inc. (U.S.)

- Infosys Limited (India)

- Silicon & Software Systems Ltd. (Ireland)

- Hill-Rom Services Inc. (U.S.)

- Silex Technology America, Inc (Japan)

- Digi International Inc. (U.S.)

- Baxter (U.S.)

- TE Connectivity (Switzerland)

- Bridge-Tech (U.S)

- MediCollector (U.S.)

Segments Covered in the Report

By Components

- Wireless

- Wired

- Hybrid Technologies

By Application

- Hospitals

- Home Healthcare Centers

- Diagnostic Centers

- Ambulatory Care Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/