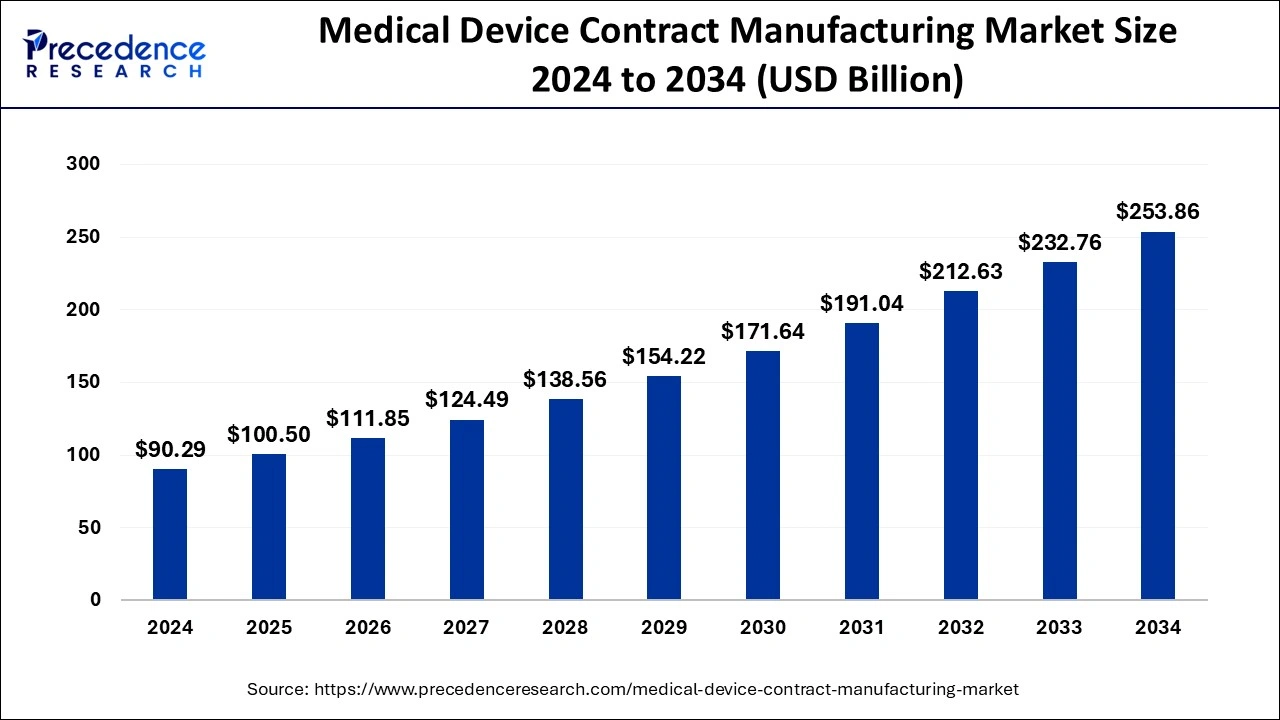

The global medical device contract manufacturing market size is projected to reach around USD 253.86 billion by 2034 from USD 90.29 billion in 2024 with a CAGR of 10.89%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1051

Key Takeaways

- In 2024, North America led the market with a 41% share.

- The IVD devices segment held the largest market share by device type.

- Device development and manufacturing services accounted for over 54% of revenue in the service segment.

- The orthopedic segment had the highest market share by application.

- The orthopedic segment is projected to grow at a CAGR of 12.9% over the forecast period.

AI’s Influence on the Future of Medical Device Contract Manufacturing

- AI optimizes workflow automation, reducing human intervention and increasing efficiency.

- Robotics integrated with AI improves precision in assembling complex medical devices.

- AI accelerates R&D by analyzing vast datasets, leading to faster innovation.

- Real-time data monitoring improves product traceability and post-market surveillance.

- AI-driven simulations enhance risk assessment, improving safety and regulatory adherence.

- Adaptive AI models support continuous improvement in manufacturing processes, ensuring long-term growth.

Drivers

The increasing complexity of medical devices, combined with the need for faster and more efficient production, is driving the growth of the medical device contract manufacturing market. Companies are outsourcing manufacturing to focus on innovation while leveraging the expertise of specialized manufacturers.

Advancements in automation, 3D printing, and AI-powered quality control have further improved production processes. Additionally, rising healthcare expenditures and the need for affordable yet high-quality medical devices continue to boost market demand.

Opportunities

As healthcare technology advances, the demand for smart medical devices, AI-integrated diagnostic tools, and wearable health monitors is growing. This presents a lucrative opportunity for contract manufacturers to develop cutting-edge solutions.

The expansion of healthcare facilities in emerging markets is also driving demand for contract manufacturing, as companies seek to establish production centers in regions with lower costs. The push for environmentally sustainable manufacturing practices is creating additional opportunities for innovation in material sourcing and production techniques.

Challenges

Despite the positive outlook, the industry faces challenges related to stringent quality regulations, supply chain instability, and rising material costs. The approval process for medical devices varies across regions, leading to delays in market entry.

Additionally, global supply chain disruptions caused by economic and political uncertainties can increase manufacturing costs and impact delivery timelines. Protecting intellectual property and ensuring cybersecurity in outsourced manufacturing operations also remains a critical challenge.

Regional Insights

North America remains a leader in the medical device contract manufacturing market due to its well-regulated industry, strong research and development sector, and high demand for advanced medical technologies.

Asia Pacific is emerging as a major player, offering lower production costs, a skilled labor force, and increasing investment in healthcare manufacturing. Europe continues to be a strong market, focusing on regulatory compliance, sustainability, and research-driven innovations in medical device production.

Medical Device Contract Manufacturing Market Companies

- Flex, Ltd.

- Nortech Systems, Inc.

- Sanmina Corporation

- Nipro Corporation

- Jabil Inc.

- Nemera Development S.A.

- TE Connectivity Ltd.

- Kimball Electronics, Inc.

- Viant Medical

- Celestica International Lp.

- Plexus Corp.

- SMC Ltd.

- Phillips-Medisize Corporation

- Benchmark Electronics Inc.

- Integer Holdings Corporation

- Gerresheimer AG

- Consort Medical PLC

- Tessy Plastics Corp

- Tecomet, Inc.

Recent Devlopments

- In January 2024, TekniPlex Healthcare completed its acquisition of Seisa Medical following the strategic agreement. This acquisition helped TekniPlex expand their product portfolio in minimal invasive and interventional therapies.

- In July 2024, Tube Investment of India (TII) announced their plans to strengthen contract manufacturing operations for their medical branch with a new facility in the state of Andhra Pradesh in India.

- In August 2024, a new company in healthcare, Salt Medical that is a contract development and manufacturing organization (CDMO). They focus on medical devices and decided to move into Claregalway Corporate Park in County Galway, Ireland, to explore innovative opportunities.

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2025 to 2034. This report includes market segmentation and its revenue estimation by classifying it depending on device, service, application and region as follows:

By Device Type

- IVD Devices

- Drug Delivery Devices

- Diagnostic Imaging Devices

- Patient Monitoring Devices

- Therapeutic Patient Assistive Devices

- Minimally Access Surgical Instruments

- Others

By Service

- Device Development and Manufacturing Services

- Quality Management Services

- Final Goods Assembly Services

By Application

- Laparoscopy

- Pulmonary

- Urology & Gynecology

- Cardiovascular

- Orthopedic

- Oncology

- Neurovascular

- Radiology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/