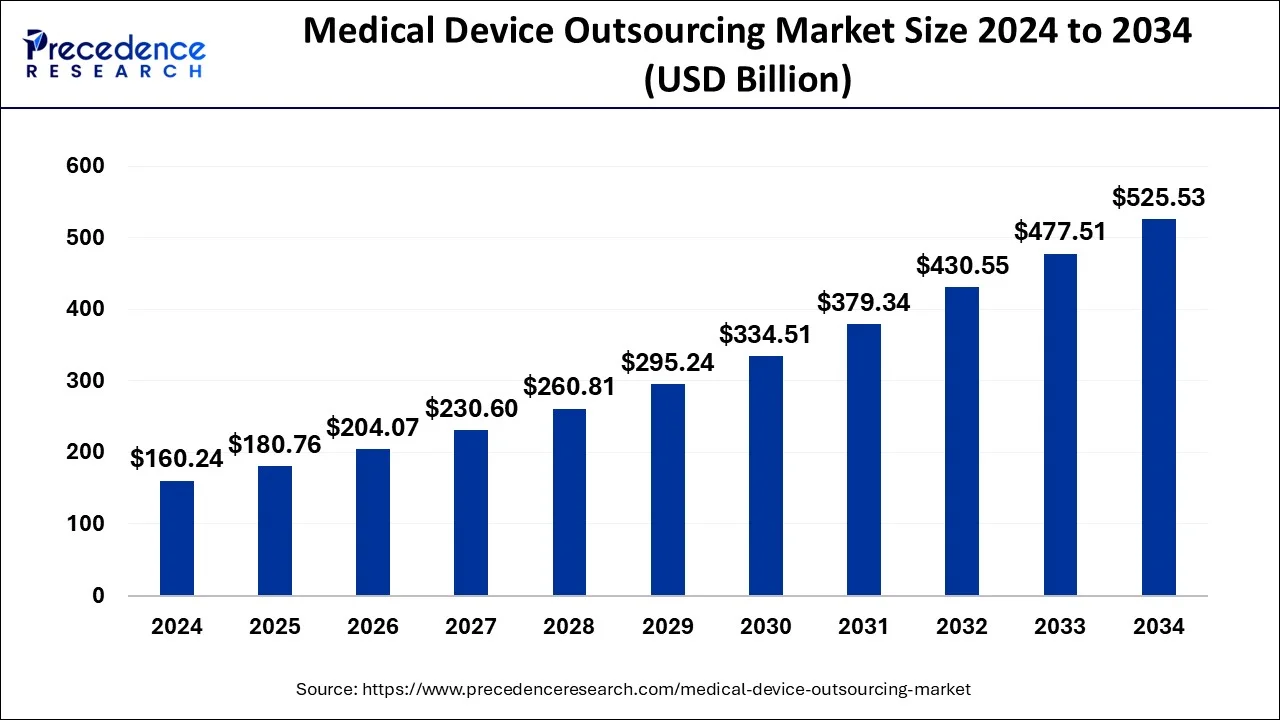

The global medical device outsourcing market size was valued at USD 160.24 billion in 2024 and is projected to reach around USD 525.53 billion by 2034 with a CAGR of 12.61%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1057

Key Points

- In 2024, Asia Pacific led the medical device outsourcing market, holding the largest market share of 41.79%.

- North America is projected to grow at the highest CAGR of 12.5% during the forecast period.

- The cardiology segment emerged as the top application, capturing the largest market share in 2024.

- Among services, the quality assurance segment recorded the highest market share of 9.56% in 2024.

- The regulatory affairs services segment is expected to witness a strong CAGR of 13.5% during the forecast period.

How AI is Transforming the Medical Device Outsourcing Market

- Automated Quality Control – AI acts like a digital inspector, identifying defects and inconsistencies in medical devices with greater accuracy and speed than human checks.

- Predictive Maintenance – Just like a car’s dashboard warning system, AI predicts equipment failures before they happen, reducing downtime and costly repairs.

- Regulatory Compliance Automation – AI streamlines compliance processes by automatically analyzing and sorting through complex regulations, ensuring manufacturers meet global standards.

- Enhanced Data Security – Like a high-tech vault, AI-powered cybersecurity solutions protect sensitive medical device data from cyber threats and breaches.

- Faster Prototyping and Development – AI-driven simulations allow companies to test medical device designs virtually, cutting development time and costs significantly.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 142.19 Billion |

| Market Size in 2025 | USD 142.19 Billion |

| Market Size by 2034 | USD 430.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.10% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The medical device outsourcing market is expanding due to rising demand for cost-effective manufacturing and the growing complexity of regulatory requirements. Companies are outsourcing production and development to specialized firms to reduce costs and focus on innovation. Additionally, the increasing prevalence of chronic diseases is driving demand for advanced medical devices, further accelerating market growth. Technological advancements such as AI-driven automation and precision manufacturing are also playing a key role in improving efficiency and quality in outsourced medical device production.

Market Opportunities

The integration of artificial intelligence, machine learning, and automation presents significant opportunities in medical device outsourcing. These technologies streamline manufacturing, enhance quality control, and reduce production errors. Emerging markets, particularly in Asia Pacific, are witnessing increased investment in medical device manufacturing, creating new growth avenues. Additionally, the rising demand for personalized medical devices, including patient-specific implants and wearables, is opening new business opportunities for outsourcing firms specializing in custom manufacturing.

Market Challenges

Despite the growth potential, the industry faces challenges such as stringent regulatory compliance, which varies across regions and increases operational complexity. Data security and intellectual property protection are also critical concerns, as outsourcing involves sharing sensitive designs and innovations with third-party manufacturers. Supply chain disruptions, fluctuating raw material costs, and dependency on external suppliers further pose risks to business continuity and profitability.

Regional Insights

Asia Pacific dominates the medical device outsourcing market, driven by cost-effective manufacturing, skilled labor availability, and strong government support for the medical device sector. North America is witnessing steady growth, particularly in contract manufacturing and regulatory consulting services, fueled by a strong demand for advanced medical technologies. Europe continues to expand with a focus on compliance and quality assurance, while emerging regions in Latin America and the Middle East are showing increasing interest in medical device outsourcing to meet growing healthcare needs.

Medical Device Outsourcing Market Companies

- Intertek Group PLC

- TüvSüd AG

- Wuxi Apptec

- SGS SA

- Toxikon, INC.

- Eurofins Scientific

- American Preclinical Services

- Sterigenics International LLC

- Pace Analytical Services LLC.

- North American Science Associates, Inc.

- Charles River Laboratories International, Inc.

Leader’s Announcement

- In November 2024, Shri JP Nadda, Union Minister for Chemicals and Fertilizers, stated on the launching of a Rs 500 crore scheme for the medical device industry in India: “The investment may seem small, but the result is huge.”

Recent Developments

- In August 2024, the U.S. Food and Drug Administration (FDA) provided approval for the Simplera™ continuous glucose monitor (CGM), launched by Medtronic plc, a global leader in healthcare technology. The Simplera™ continuous glucose monitor (CGM) is the company’s first disposable, all-in-one CGM that’s half the size of previous Medtronic CGMs.

- In March 2024, the World Health Organization (WHO) introduced an online platform called MeDevIS (Medical Devices Information System), the first global open-access clearinghouse for information on medical devices. This platform is aimed at supporting governments, regulators, and users in their decision-making on the selection, procurement, and use of medical devices for diagnostics, testing, and treatment of diseases and health conditions.

- In April 2024, the Indian Institute of Technology (IIT) Madras launched India’s first mobile medical device calibration facility. The project is developed under the ‘Anaivarukkum IITM’ (IITM for All) initiative.

Segments Covered in the Report

By Service

- Product Upgrade Services

- Regulatory Affairs Services

- Legal representation

- Clinical trials applications

- Regulatory writing and publishing

- Quality Assurance

- Product Maintenance Services

- Product Testing & Sterilization Services

- Product Design and Development Services

- Molding

- Designing & engineering

- Machining

- Packaging

- Product Implementation Services

- Contract Manufacturing

- Accessories manufacturing

- Component manufacturing

- Device manufacturing

- Assembly manufacturing

By Application

- Drug delivery

- Dental

- Diabetes care

- Cardiology

- Endoscopy

- IVD

- Ophthalmic

- Diagnostic imaging

- Orthopedic

- General and plastic surgery

- Others

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/