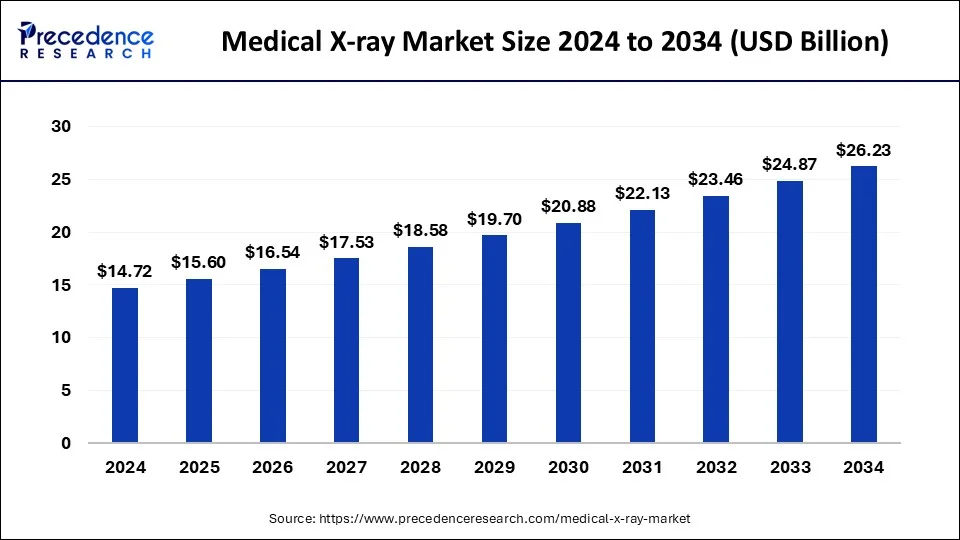

The global medical X-ray market size was estimated at USD 13.89 billion in 2023 and is projected to grow around USD 24.87 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

Key Points

- North America dominated the medical X-ray market share of 32% in 2023.

- By type, the digital segment held the largest share of the market in 2023.

- By portability, in 2023, the fixed system segment held the largest share of the market.

- By portability, the portable segment is expected to gain significant traction in the market in the upcoming years.

- By application, the chest segment captured the biggest market share in 2023.

The medical X-ray market encompasses a broad spectrum of diagnostic imaging technologies that utilize X-rays to visualize internal structures of the body for diagnostic and therapeutic purposes. X-ray imaging remains one of the most commonly used modalities in medical diagnostics due to its versatility, cost-effectiveness, and wide availability. It plays a crucial role in diagnosing various medical conditions, including bone fractures, lung infections, and gastrointestinal issues. The market for medical X-ray equipment includes X-ray machines, detectors, software, and accessories, catering to diverse healthcare settings such as hospitals, diagnostic centers, and clinics.

Get a Sample: https://www.precedenceresearch.com/sample/3998

Growth Factors

Several factors contribute to the growth of the medical X-ray market. Technological advancements have led to the development of digital X-ray systems, which offer superior image quality, faster processing times, and lower radiation doses compared to traditional film-based X-rays. Moreover, the rising prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions drives the demand for diagnostic imaging procedures, including X-rays. Additionally, the increasing geriatric population, coupled with the growing need for early disease detection and accurate diagnosis, fuels the adoption of X-ray imaging systems worldwide.

Region Insights:

The medical X-ray market exhibits significant regional variations influenced by factors such as healthcare infrastructure, economic development, regulatory policies, and technological advancements. Developed regions like North America and Europe dominate the market due to well-established healthcare systems, high healthcare expenditure, and early adoption of advanced medical technologies. In contrast, emerging economies in Asia-Pacific, Latin America, and Africa present immense growth opportunities fueled by increasing healthcare investments, rising disposable incomes, and expanding access to healthcare services.

Medical X-ray Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6% |

| Global Market Size in 2023 | USD 13.89 Billion |

| Global Market Size by 2033 | USD 24.87 Billion |

| U.S. Market Size in 2023 | USD 3.33 Billion |

| U.S. Market Size by 2033 | USD 6.01 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Portability, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical X-ray Market Dynamics

Drivers:

Several drivers propel the growth of the medical X-ray market. The growing burden of chronic diseases necessitates efficient diagnostic tools for timely intervention and treatment planning, thereby boosting the demand for X-ray imaging systems. Furthermore, the shift towards digitalization and integration of healthcare IT solutions enhances the efficiency of X-ray imaging workflows, driving market growth. Moreover, initiatives aimed at improving healthcare infrastructure, expanding access to medical services in rural areas, and promoting preventive healthcare measures contribute to market expansion.

Opportunities:

The medical X-ray market presents numerous opportunities for innovation and market penetration. Advancements in imaging technologies, such as computed tomography (CT), magnetic resonance imaging (MRI), and molecular imaging, offer new avenues for product development and differentiation. Additionally, the rising demand for portable and point-of-care X-ray systems facilitates the penetration of X-ray imaging in ambulatory care settings, emergency departments, and remote healthcare facilities. Furthermore, collaborations between healthcare providers, technology developers, and research institutions can drive innovation and address unmet needs in diagnostic imaging.

Challenges:

Despite its growth prospects, the medical X-ray market faces several challenges. Concerns regarding radiation exposure and patient safety remain significant barriers to widespread adoption, necessitating continuous efforts to optimize imaging protocols and minimize radiation doses. Moreover, the high initial cost of X-ray equipment, along with maintenance and operational expenses, poses challenges for healthcare facilities, particularly in resource-constrained settings. Additionally, regulatory compliance, reimbursement policies, and competition from alternative imaging modalities present challenges for market players seeking to expand their market presence and achieve sustainable growth.

Read Also: Corn Fiber Market Size to Rake USD 1,690.24 Million by 2033

Recent Developments

- In August 2023, Union Minister Dr. Jitendra Singh inaugurated India’s inaugural, domestically crafted, cost-effective, lightweight, ultrafast, High Field (1.5 Tesla), Next Generation Magnetic Resonance Imaging (MRI) Scanner in New Delhi.

- In July 2022, Siemens Healthineers introduced the new Mobilett Impact, a mobile X-ray system.

- In November 2022, MediView partnered with GE Healthcare to introduce Augmented Reality Solutions to Medical Imaging for the Interventional Space.

- In October 2022, Samsung introduced the AccE Glass-Free Detector for X-Ray Imaging.

- In July 2022, Siemens Healthineers expanded access to care with the launch of the new affordable X-ray system Multix Impact.

- In December 2023, Probo Medical finalized the acquisition of Alpha Source Group.

- In January 2023, Radon Medical Imaging announced the acquisition of Premier Imaging Medical Systems.

Medical X-ray Market Companies

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Mindray Medical International Limited

- Hologic, Inc

- New Medical Imaging

- AGFA

Segments Covered in the Report

By Type

- Digital

- Analog

By Portability

- Fixed Systems

- Portable Systems

By Application

- Dental

- Intraoral Imaging

- Extraoral Imaging

- Veterinary

- Oncology

- Orthopedics

- Cardiology

- Neurology

- Others

- Mammography

- Chest

- Cardiovascular

- Orthopedics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/