Table of Contents

Key Insights

- In 2024, Asia Pacific led the nutraceutical ingredients market, holding a 41% market share.

- North America is projected to experience significant growth in the nutraceutical ingredients market during the forecast period.

- The proteins and amino acids segment held the largest market share by type in 2024.

- The probiotics segment is anticipated to witness rapid growth throughout the forecast period.

- By application, the food segment dominated the market, securing the highest share in 2024.

- The dietary supplement segment is expected to grow at a fast pace over the forecast period.

- By form, the dry form segment accounted for the largest market share in 2024.

Market Overview

The nutraceutical ingredients market is experiencing robust growth due to the rising awareness of health and wellness, increasing demand for functional foods, and a growing preference for preventive healthcare. Nutraceutical ingredients, including proteins, amino acids, probiotics, vitamins, and minerals, are widely used in food, beverages, dietary supplements, and pharmaceuticals. The market is expanding as consumers seek natural, organic, and clean-label products that offer health benefits beyond basic nutrition.

Key Growth Factors Driving the Nutraceutical Ingredients Market

1. Rising Health Awareness and Preventive Healthcare Trends

- Consumers are shifting towards proactive healthcare approaches, increasing the demand for functional foods and dietary supplements.

- Growing concerns about obesity, diabetes, cardiovascular diseases, and immunity-related disorders are boosting the adoption of nutraceutical products.

2. Expansion of Functional Foods and Beverages Industry

- Food and beverage manufacturers are fortifying products with nutraceutical ingredients to enhance their health benefits.

- Categories like fortified dairy, plant-based proteins, energy drinks, and gut-health beverages are driving ingredient demand.

3. Growing Demand for Plant-Based and Clean-Label Ingredients

- Consumers prefer natural, organic, and plant-based ingredients, pushing companies to innovate with non-GMO and allergen-free formulations.

- Clean-label trends are encouraging the use of transparent, sustainably sourced nutraceuticals.

4. Aging Population and Personalized Nutrition

- The rising elderly population is driving the demand for nutraceuticals that support bone health, cognitive function, and heart health.

- Advances in personalized nutrition and DNA-based health recommendations are increasing interest in customized supplements and functional foods.

5. Technological Advancements in Ingredient Processing

- Innovations in biotechnology, microencapsulation, and nano-delivery systems are enhancing the bioavailability and efficacy of nutraceutical ingredients.

- Research in probiotics, prebiotics, and gut microbiome science is opening new opportunities in digestive health and immunity-boosting products.

6. Government Support and Regulatory Approvals

- Favorable regulatory policies in regions like North America, Europe, and Asia Pacific are encouraging the development and commercialization of nutraceutical ingredients.

- Increased investments in clinical research and product certifications are ensuring higher quality and credibility in the market.

Also Read: Off-Highway Electric Vehicle Market

Market Scope

| Report Highlights | Details |

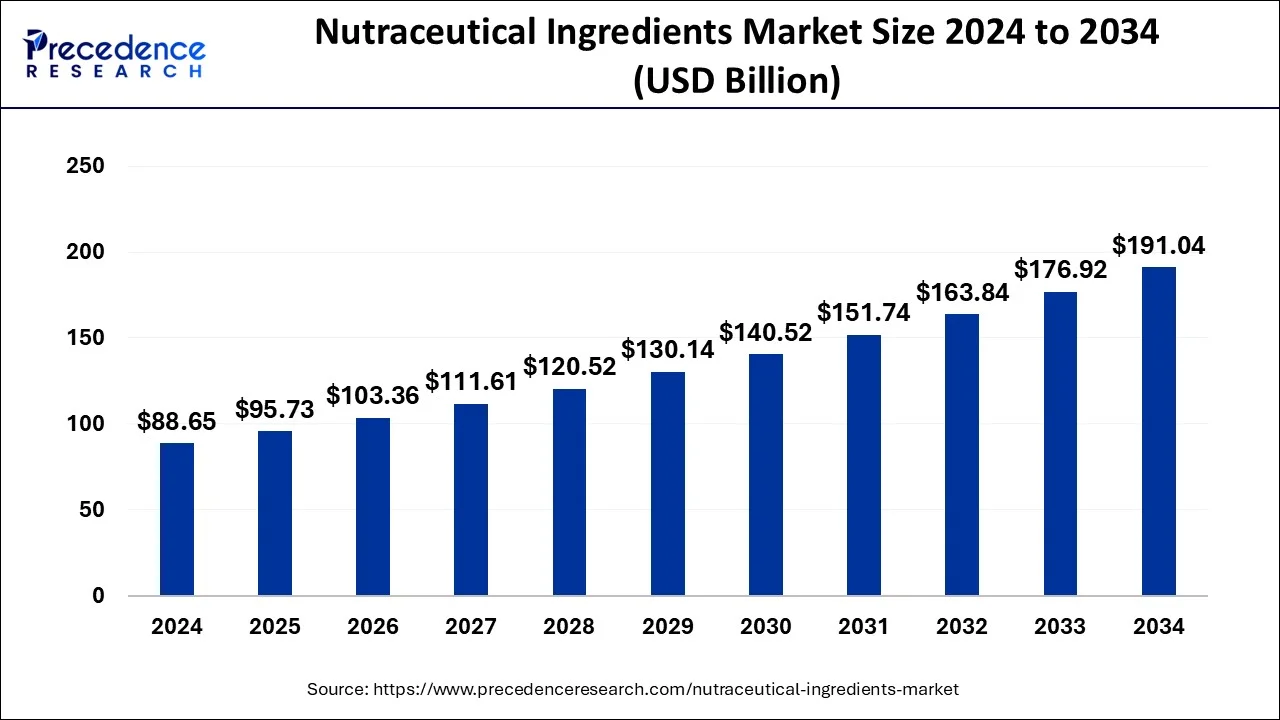

| Market Size in 2024 | USD 88.65 Billion |

| Market Size in 2025 | USD 95.73 Billion |

| Market Size by 2034 | USD 191.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.98% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Health Benefits, Form, Region |

Market Dynamics

Market Drivers

The growing awareness of health and wellness is driving demand for nutraceutical ingredients. Consumers are increasingly opting for functional foods and dietary supplements to prevent chronic diseases and improve overall well-being. Additionally, the rise in geriatric populations and increasing prevalence of lifestyle-related disorders such as obesity, diabetes, and cardiovascular diseases have fueled market expansion. Technological advancements in nutrigenomics and personalized nutrition are further accelerating the adoption of scientifically formulated nutraceuticals.

Market Opportunities

The increasing demand for plant-based and natural nutraceutical ingredients presents lucrative opportunities for market players. The shift towards clean-label, organic, and sustainable products has prompted manufacturers to invest in innovative ingredients such as probiotics, prebiotics, omega-3 fatty acids, and botanical extracts. The rapid expansion of e-commerce platforms and direct-to-consumer (DTC) models is also creating new sales avenues, enabling brands to reach a broader customer base.

Market Challenges

Despite strong growth, the nutraceutical ingredients market faces regulatory hurdles and compliance challenges due to varying international standards. The lack of uniform regulations makes it difficult for companies to market products globally. Additionally, concerns regarding ingredient adulteration and counterfeit supplements pose threats to product credibility. The high cost of R&D and clinical validation of new nutraceutical ingredients can also be a barrier to market entry for small-scale players.

Regional Insights

Asia Pacific leads the nutraceutical ingredients market, accounting for a significant market share due to high consumer demand, growing disposable income, and traditional herbal medicine influence in countries like China and India. North America is expected to witness rapid growth, driven by a well-established dietary supplement industry, growing vegan population, and rising investments in functional foods. Europe remains a key market, with strong consumer preference for natural and organic nutraceuticals, while Latin America and the Middle East are emerging as promising regions due to increasing health awareness.

Nutraceutical Ingredients Market Companies

- Kraft Heinz Company

- GlaxoSmithKline

- Amway

- Abbott

- Kellogg’s

- Danone

- Cargill Inc.,

- Nestle

- Archer Daniels Midland

- DSM

- BASF

- PepsiCo

- General Mills

- Aker Biomarine

- Procter & Gamble

- Johnson & Johnson

Latest Announcements by Industry Leaders

- In December 2024, two awards were presented to Nutralab Canada Corp at the 2024 Global Corporate Excellence Awards by Business World Magazine in recognition of company’s almost 30-year dedication for innovation, quality and excellence in the nutraceutical sector. Dr. Peter Ou, CEO and Chief Scientific Officer of Nutralab Canada Corp said, “Nutralab’s journey is built on a commitment to integrity, innovation, and quality. These awards reflect the dedication of our entire team and reinforce our mission to deliver industry-leading solutions that improve public health.”

- In December 2024, MaxScientific Inc., a global leader in the field of aging and longevity intervention decalred the launch of Revigorator G5, a next-generation nutraceutical integrating NAD+, senolytics and autophagy activators. Brandon West, Senior Product Manager at MaxScientific said, “By partnering with leading research institutions around the globe and investing in basic and translational research, we have successfully developed a groundbreaking nutraceutical that targets multiple aging mechanisms at the cellular level. By combining the most advanced aging intervention technologies available, Revigorator G5 delivers the most comprehensive approach for longevity optimization and cellular rejuvenation.”

Recent Developments

- In December 2024, Metabolic Maintenance, a leader in high-quality, physician-formulated nutritional supplements announced the launch of its latest nootropic supplement MetaMIND which is a nutraceutical particularly designed for supporting attention and learning, working memory and for boosting mental performance. The supplement is available in capsule and gummy forms.

- In December 2024, IMCD China, a global leading distribution partner and formulator of speciality chemicals and ingredients declared the signing of an agreement for acquiring the business of the food and nutraceutical ingredient distributor, Daoqin Biological Technology which will the strengthen IMCD’s presence on China’s life science market. The deal is expected to close in Q2 2025.

Segments Covered in the Report

By Type

- Probiotic

- Proteins and amino acids

- Phytochemical & plant extracts

- Fibers & specialty carbohydrates

- Omega 3 fatty acids

- Vitamins

- Prebiotic

- Carotenoids

- Minerals

- Others

By Application

- Food

- Beverages

- Personal care

- Animal nutrition

- Dietary supplements

By Health Benefits

- Cognitive health

- Gut health

- Heart health

- Bone health

- Immunity

- Nutrition

- Weigh management

- Others

By Form

- Dry

- liquid

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/