The global oil and gas infrastructure market size was approximate at US$ 4 billion in 2022 and is anticipated to grow US$ 6 billion by 2032, registering a compound annual growth rate of 5% from 2023 to 2032.

The oil and gas infrastructure market report covering various industry elements and growth trends helpful for predicting the market’s future.

The study provides a strong base for the oil and gas infrastructure market to be segmented into different segments. In fact, the study also covers the maximum market share during the assessment period by 2032.

This study is based on the partners that are highly competitive, key players as well as their market revenue in the forecast years of 2023 g0066ztr to 2032. There is also a strong focus on product revenues, sales, product categories and even the products that are experiencing the most traction. In this manner, the oil and gas infrastructure report also speaks about the effectiveness of this market along with its growth during the forecast period of 2030. Other major attributes of the oil and gas infrastructure market have been studied and analysed across many developments.

Request a Sample Copy of This Report @ https://www.precedenceresearch.com/sample/2907

Oil and Gas Infrastructure Market Report Scope:

| Report Coverage | Details |

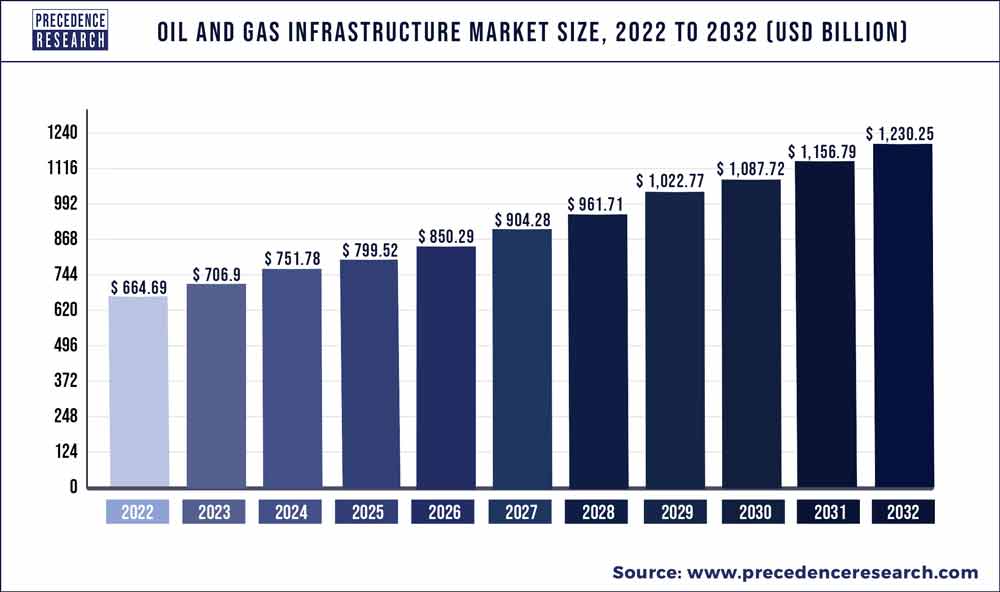

| Market Size in 2023 | USD 706.9 Billion |

| Market Size by 2032 | USD 1,230.25 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.35% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Category, By Operation, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Also read: Traction Battery Market Size to Grow US$ 339.94 Billion By 2032

Research Approach

The comprehensive report on the global oil and gas infrastructure market begins with an overview, followed by the scope and objectives of the study. The report provides detailed explanation of the objectives behind this study and key vendors and distributors operating in the market and regulatory scenario for approval of products. Following this, the report provides detailed explanation of objectives of this study and laid down by accredited agencies in the purview of research in the global oil and gas infrastructure market.

It is followed by market introduction, market dynamics, and an overview of the global market, which includes analysis of market drivers, restraints, and trends pertaining to the global market. Furthermore, Y-o-Y growth analysis with elaborated insights has been provided in order to understand the Y-o-Y growth trend of the global market.

For reading comprehensibility, the report has been compiled in a chapter-wise layout, with each section divided into smaller sections. The report comprises an exhaustive collection of graphs and tables that are appropriately interspersed. Pictorial representation of actual and projected values of key segments is visually appealing to readers. This also allows comparison of the market shares of key segments in the past and at the end of the forecast period.

Key Players

- DCP Midstream

- Gazprom

- General Electric

- MRC Global

- National Oilwell Varco

- Nippon Steel Corporation

- Redexis

- Tenaris Inc

- TMK Group

- United States Steel Corporation

Oil and Gas Infrastructure Market Segmentations

By Category

- Surface And Lease Equipment

- Gathering And Processing

- Gas And NGL Pipelines

- Oil And Gas Storage

- Refining And Oil Products Transport

- Export Terminals

By Operation

- Transmission

- Distribution

By Deployment

- Onshore

- Offshore

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Oil And Gas Infrastructure Market

5.1. COVID-19 Landscape: Oil And Gas Infrastructure Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Oil And Gas Infrastructure Market, By Category

8.1. Oil And Gas Infrastructure Market, by Category, 2023-2032

8.1.1 Surface And Lease Equipment

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Gathering And Processing

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Gas And NGL Pipelines

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Oil And Gas Storage

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Refining And Oil Products Transport

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Export Terminals

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Oil And Gas Infrastructure Market, By Operation

9.1. Oil And Gas Infrastructure Market, by Operation, 2023-2032

9.1.1. Transmission

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Distribution

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Oil And Gas Infrastructure Market, By Deployment

10.1. Oil And Gas Infrastructure Market, by Deployment, 2023-2032

10.1.1. Onshore

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Offshore

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Oil And Gas Infrastructure Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.2. Market Revenue and Forecast, by Operation (2020-2032)

11.1.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Category (2020-2032)

11.2.2. Market Revenue and Forecast, by Operation (2020-2032)

11.2.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Category (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Operation (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Category (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Operation (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Category (2020-2032)

11.3.2. Market Revenue and Forecast, by Operation (2020-2032)

11.3.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Category (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Operation (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Category (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Operation (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Category (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Operation (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Category (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Operation (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Category (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Operation (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Category (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Operation (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

Chapter 12. Company Profiles

12.1. DCP Midstream

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Gazprom

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. General Electric

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. MRC Global

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. National Oilwell Varco

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Nippon Steel Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Redexis

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Tenaris Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. TMK Group

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. United States Steel Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Why should you invest in this report?

If you are aiming to enter the global oil and gas infrastructure market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for oil and gas infrastructure are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2023-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com