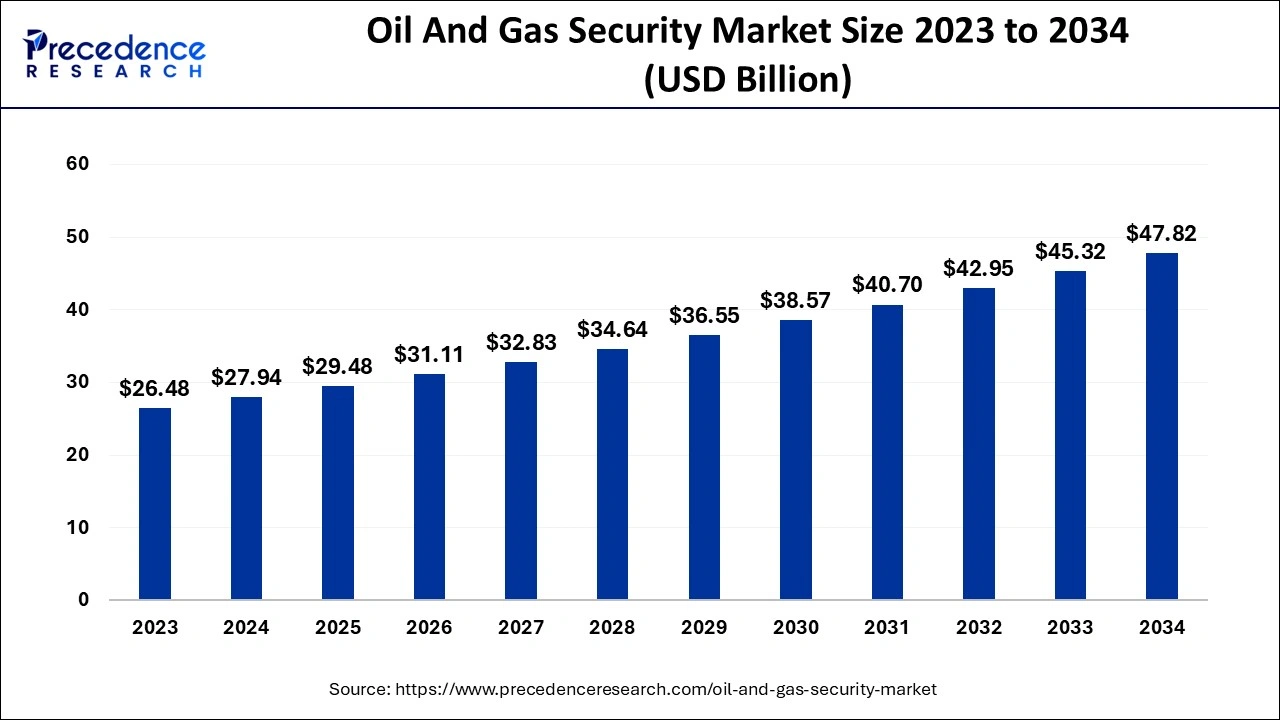

The global oil and gas security market size reached USD 27.94 billion in 2024 and is predicted to be Hit around USD 47.82 billion by 2034, growing at a CAGR of 5.52% from 2024 to 2034

Key Points

- North America dominated the oil and gas security market with the largest market share of 34% in 2023.

- Asia Pacific is expected to witness the fastest growth in the market during the studied period.

- By component, the hardware segment contributed the biggest market share of 52% in 2023.

- By component, the services segment will show significant growth in the market over the forecast period.

- By end use, the oil and gas companies segment generated the highest market share of 36% in 2023.

- By end use, the pipeline operators segment is expected to grow at the fastest rate in the market over the projected period.

The oil and gas security market has been evolving rapidly due to the growing threats faced by critical energy infrastructure. This market encompasses physical security measures, cybersecurity protocols, and risk management strategies designed to protect assets such as pipelines, storage facilities, and refineries from theft, sabotage, cyberattacks, and other security threats

Sample:https://www.precedenceresearch.com/sample/5220

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.82 Billion |

| Market Size in 2024 | USD 27.94 Billion |

| Market Size in 2025 | USD 29.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Drivers:

A key driver of market growth is the rising incidence of cyberattacks targeting the oil and gas sector. As industries increasingly rely on digital technologies, the risks associated with cyber vulnerabilities grow, driving demand for advanced cybersecurity solutions. Geopolitical instability in oil-rich regions also contributes, as companies need to protect their operations from potential disruptions caused by conflicts Moreover, tightening regulations aimed at improving the security of energy infrastructure further push organizations to adopt robust security measures

Opportunities:

With the rapid advancements in technology, there are significant opportunities for integrating AI, machine learning, and automation into security systems. These technologies can improve threat detection and enable more proactive security measures. Additionally, the expansion of energy infrastructure in regions like Asia-Pacific and the Middle East offers opportunities for the implementation of comprehensive security solutions, particularly for pipelines and storage facilities.

Challenges:

Despite the growth, the market faces challenges such as the high cost of implementing security systems, especially for smaller companies. Additionally, the complexity of global oil and gas supply chains makes it difficult to ensure uniform security across all locations, as threats can arise from diverse sources Keeping pace with rapid technological changes also requires continuous investment and training to manage new vulnerabilities effectively

Regional Insights:

North America dominates the market, particularly the U.S., which is heavily invested in both cybersecurity and physical security to protect its vast energy infrastructure.In the Asia-Pacific region, increasing energy demand and geopolitical tensions are creating a surge in security needs, particularly in nations like China and India. Meanwhile, the Middle East and Africa face heightened risks due to political instability, making security a top priority for energy companies in these region

Read Also: Stationery Products Market Size to Surpass USD 180.65 Bn By 2034

Oil And Gas Security Market Companies

- ABB Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- Waterfall Security Solutions Ltd.

- Parsons Corporation

- P2 Energy Solutions

- KBR, Inc.

- DuPont de Nemours, Inc.

- Huawei Technologies Co., Ltd.

- Shell Catalysts & Technology

- Baker Hughes Company

- Halliburton Company

- Symantec Corporation

Recent News

- In August 2024, SLB and Palo Alto Networks declared an expansion of their partnership aimed at improving cybersecurity within the energy sector. The partnership seeks to boost SLB’s security infrastructure and develop innovative solutions to address emerging cyber threats.

- In July 2024, Accenture acquired True North Solutions, a U.S.-based provider of industrial engineering solutions, to improve its capabilities in helping clients in the oil, gas, and mining sectors produce and transport energy more safely and efficiently.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By End user

- Oil and Gas Companies

- Pipeline Operators

- Drilling Contractors

- Energy Infrastructure Providers

- Third-party Security Providers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa