The global Operational risk management solution market size was estimated to be around US$ 1.5 billion in 2022. It is projected to reach US$ 3.67 billion by 2032, indicating a CAGR of 9.40% from 2023 to 2032.

Key Takeaways

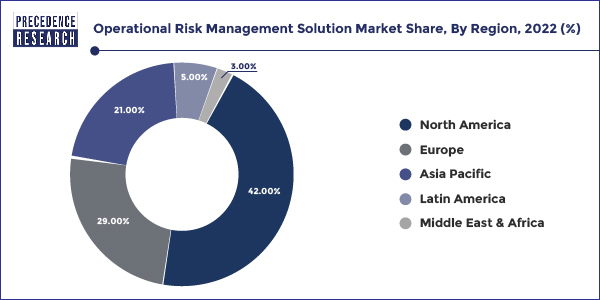

- North America contributed more than 42% of revenue share in 2022.

- Asia Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By deployment, the on-premise segment has held the largest market share of 61% in 2022.

- By deployment, the cloud segment is anticipated to grow at a remarkable CAGR of 10.2% between 2023 and 2032.

- By enterprise size, the large enterprise segment generated over 59% of revenue in 2022.

- By enterprise size, the SME segment is expected to expand at the fastest CAGR over the projected period.

Operational Risk Management Solutions encompass a range of software and tools that aid businesses in identifying, evaluating, and controlling operational risks. These solutions provide a comprehensive framework for risk assessment, incident reporting, and compliance management. The primary goal is to minimize the impact of unforeseen events and enhance the organization’s ability to navigate challenges effectively.

Get a Sample: https://www.precedenceresearch.com/sample/3515

Growth Factors

Several factors contribute to the growth of the Operational Risk Management Solution market. The increasing complexity of business operations, coupled with the rising awareness of the importance of risk mitigation, drives the demand for advanced solutions. Regulatory compliance requirements also fuel the adoption of these solutions, as organizations strive to meet industry standards and legal obligations. Additionally, the continuous advancements in technology, such as artificial intelligence and machine learning, further drive the innovation and expansion of operational risk management tools.

Operational Risk Management Solution Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 9.40% |

| Market Size in 2023 | USD 1.63 Billion |

| Market Size by 2032 | USD 3.67 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Deployment and By Enterprise Size |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Natural Food and Drinks Market Size To Attain USD 362.77 Billion By 2032

Operational Risk Management Solution Market:

The Operational Risk Management Solution market is a dynamic sector that plays a crucial role in helping organizations identify, assess, and mitigate potential risks associated with their operational activities. These solutions are designed to enhance decision-making processes and improve overall business resilience by addressing risks that may arise from various internal and external factors.

Overview: Operational Risk Management Solutions encompass a range of software and tools that aid businesses in identifying, evaluating, and controlling operational risks. These solutions provide a comprehensive framework for risk assessment, incident reporting, and compliance management. The primary goal is to minimize the impact of unforeseen events and enhance the organization’s ability to navigate challenges effectively.

Growth Factors: Several factors contribute to the growth of the Operational Risk Management Solution market. The increasing complexity of business operations, coupled with the rising awareness of the importance of risk mitigation, drives the demand for advanced solutions. Regulatory compliance requirements also fuel the adoption of these solutions, as organizations strive to meet industry standards and legal obligations. Additionally, the continuous advancements in technology, such as artificial intelligence and machine learning, further drive the innovation and expansion of operational risk management tools.

Region Snapshot

The market for Operational Risk Management Solutions is not confined to a specific geographic location; instead, it has a global footprint. North America, Europe, Asia-Pacific, and other regions each play a significant role in the market’s growth.

In North America, stringent regulatory frameworks and the presence of a large number of enterprises contribute to the adoption of these solutions. In the Asia-Pacific region, the increasing awareness of risk management practices and the rapid expansion of businesses fuel the demand for operational risk management solutions.

Recent Developments

- In 2022, Prometheus Group, a prominent global provider of software for optimizing asset management operations, concluded its acquisition of RiskPoynt, a specialized firm renowned for its cutting-edge risk management software solutions.

- In 2022, IBM announced a strategic alliance with SAP to streamline the adoption of a hybrid cloud strategy for its clients. This collaboration leverages the combined expertise of both organizations, offering technological solutions and consultancy services to facilitate the migration of critical workloads from SAP solutions to cloud environments. The initiative is adaptable to meet the needs of a diverse range of industries, catering to those under stringent regulatory oversight and those operating in more flexible, non-regulated sectors.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Operational Risk Management Solution Market Players

- IBM

- SAS Institute Inc.

- RSA Security LLC (A Dell Technologies Company)

- MetricStream Inc.

- Wolters Kluwer

- Oracle Corporation

- Fidelity National Information Services, Inc. (FIS)

- Moody’s Analytics

- Verint Systems Inc.

- SAI Global (Now part of BWise)

- Thomson Reuters (Now Refinitiv)

- Resolver Inc.

- RiskWatch International

- ACL Services Ltd.

- Genpact Limited

Market Segmentations

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- SMEs

- Large Enterprise

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Operational Risk Management Solution Market

5.1. COVID-19 Landscape: Operational Risk Management Solution Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Operational Risk Management Solution Market, By Deployment

8.1. Operational Risk Management Solution Market, by Deployment, 2023-2032

8.1.1. On-Premise

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Cloud

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Operational Risk Management Solution Market, By Enterprise Size

9.1. Operational Risk Management Solution Market, by Enterprise Size, 2023-2032

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Large Enterprise

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Operational Risk Management Solution Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Deployment (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Enterprise Size (2020-2032)

Chapter 11. Company Profiles

11.1. IBM

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SAS Institute Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. RSA Security LLC (A Dell Technologies Company)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. MetricStream Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Wolters Kluwer

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Oracle Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Fidelity National Information Services, Inc. (FIS)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Moody’s Analytics

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Verint Systems Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. SAI Global (Now part of BWise)

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/