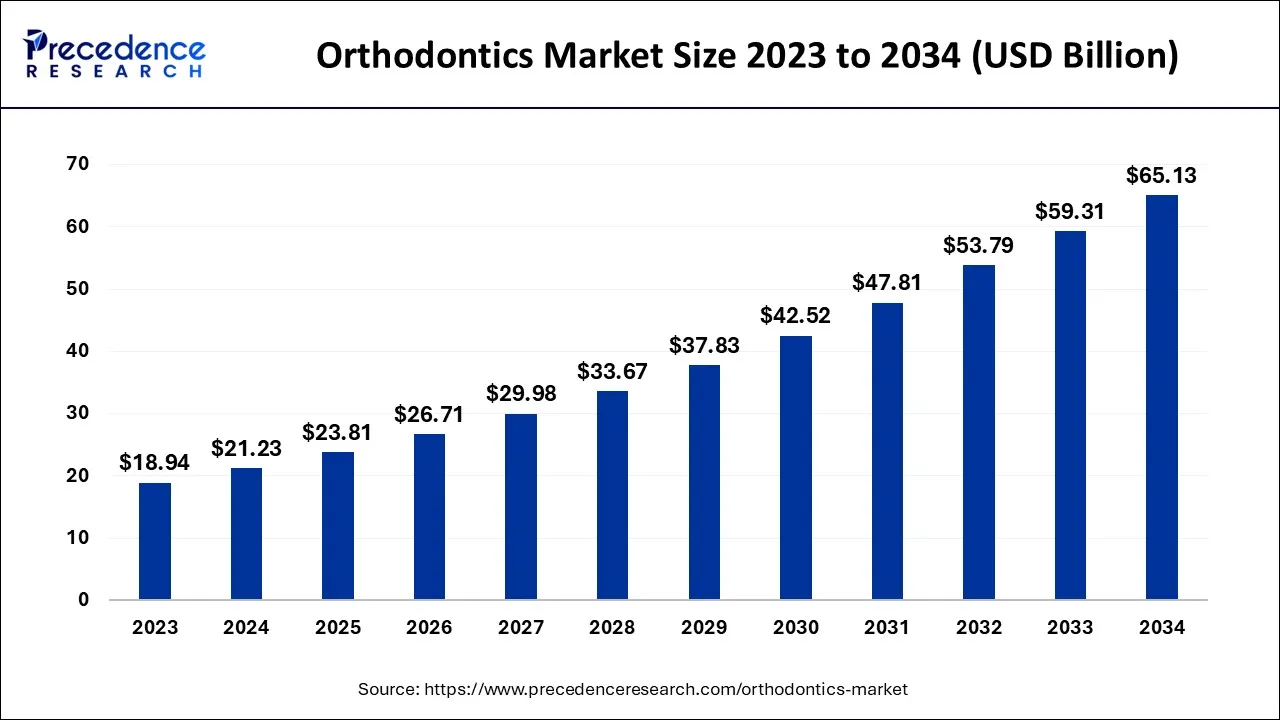

The global orthodontics market is expected to be attain USD 65.13 billion by 2034, increasing from USD 18.94 billion in 2023. It is witnessing growth 11.9% from 2024 to 2034.

The global orthodontics market is expanding rapidly, owing to factors such as increasing instances of malocclusion, rising awareness of dental hygiene, and technological advancements in dentistry. In addition, the demand for orthodontic treatments is influenced by the increase in road accidents, especially in developing nations. Moreover, the rise in awareness about the aesthetic value of dental structures propels the market. For instance, clear aligners are gaining popularity due to their ease of use to improve the aesthetics of dental structures.

Key Insights

- North America region has generated revenue share of 37.66% in 2023.

- Asia Pacific region will hit remarkable revenue share.

- By product type, the supplies segment has generated revenue share of 79.85% in 2023.

- By end user, the dental clinics segment has generated highest revenue share of 52.47% in 2023.

- By age group, the adults segment has captured highest revenue share of 75.22% of in 2023.

Regional Stance

North America dominated the global orthodontics market in 2023. The North American orthodontics market is predominantly influenced by increasing dental care awareness and growing demand for braces, clear aligners, and other treatments among adults. This can be attributed to three primary reasons – the best healthcare services in the region, technological advancement in clinics, and knowledge about aesthetic orthodontics. The growth of the market is also aided by the growing senior population and enough dentists and orthodontists.

On the other hand, Asia Pacific is expected to grow at the fastest rate in the orthodontics market during the forecast period. The regional market growth is attributed to the availability of many dental care centers and the increasing use of updated technologies. The market is anticipated to grow due to the high population base in the region. The demand for orthodontics is also expected to grow due to the increasing incidence of malocclusion, the proliferation of private dental practices, and the utilization of modern machinery. According to the MDPI report, the prevalence of malocclusion is high in Asia Pacific.

Global Orthodontics Market, by region ($Million)

| Region | 2020 | 2021 | 2022 | 2023 |

| North America | 5,124.40 | 5,717.00 | 6,383.83 | 7,131.56 |

| Europe | 2,966.76 | 3,326.44 | 3,733.06 | 4,191.23 |

| Asia Pacific | 4,315.28 | 4,852.94 | 5,462.47 | 6,151.26 |

| LAMEA | 1,078.82 | 1,193.62 | 1,321.43 | 1,463.15 |

Product Insight

The supplies segment dominated the global orthodontics market with the largest share in 2023. The expansion and increasing demand for dental instruments and devices, along with the rising adoption of transparent or clear aligners and the introduction of innovative products and cosmetic dentistry fueled the growth of the segment. The increasing demand for clear aligners is set to have a significant influence on segment’s growth.

- In September 2024, OrthoFX launched its advanced NiTim Clear Aligners in India, which is designed for shorter wear times. The FDA-cleared aligner system is now available for treating all dental malocclusions.

Global Orthodontics Market, by Type ($Million)

| Type | 2020 | 2021 | 2022 | 2023 |

| Instruments | 2,697.05 | 3,025.55 | 3,397.08 | 3,815.92 |

| Supplies | 10,788.20 | 12,064.46 | 13,503.72 | 15,121.28 |

End-user Insights

The dental clinics segment led the orthodontics market in 2023. Dental clinics provide major advantages that enhance the dental treatment services for their patients. The first evaluation determines a patient’s eligibility in terms of the approaches taught in dental school. Specific treatment is indispensable because each patient presents a different problem. Technology advancement is important to the facilities for treatments to be effective and efficient. Medical professionals are trained to treat and diagnose certain dental issues, so it’s effortless for patients to get to the core of their problems. Most of the patients come for root canals and mixed types of gum conditions since surgery has become complex and sophisticated.

- In October 2024, Nasser Orthodontics and Cosse & Silmon Orthodontics merged to provide an enhanced orthodontic experience for Louisiana families.

The hospital segment is expected to grow at the fastest rate in the orthodontics market during the forecast period. Hospitals offer holistic services that include preventive, curative, and emergency services like check-ups, filling of cavities, fitting and cementing of crowns and other materials, and dressing of wounds, among others. They make use of innovative technologies, such as digital radiographs, which provide clearer pictures and reduce radiation risks to patients. The availability of practitioners, such as orthodontists, periodontists, endodontists, and oral surgeons, in hospital settings, who provide specific services to the patients fuels the segment’s growth. In addition, dental hospitals also engage in providing preventive care, such as regular check-ups and the dissemination of information regarding oral health for members of the public. They also perform dental procedures that are meant to enhance the aesthetic appearance, like teeth whitening, which helps to remove stains and discoloration from the teeth.

Global Orthodontics Market, by End User ($Million)

| End User | 2020 | 2021 | 2022 | 2023 |

| Hospitals | 4,719.84 | 5,270.94 | 5,891.64 | 6,588.33 |

| Dental Clinics | 7,012.33 | 7,870.34 | 8,841.23 | 9,936.23 |

| Others | 1,753.08 | 1,948.72 | 2,167.93 | 2,412.63 |

Market Dynamics

Driver

High prevalence of dental malocclusion

In the orthodontics market, the differential diagnosis of malocclusion explores the risk factors that may include but are not limited to genetic factors, habits such as thumb or pacifier sucking, bony deformities such as jaw/facial shape or size, tooth agenesis, dental arch crowding, trauma as well as skeletal framework problems. Malocclusion has a significant impact on adolescents, leading to avoidance strategies like hiding teeth, avoiding smiling, or seeking treatment. This can lead to negative feelings and low self-esteem.

- A study found that females had a higher prevalence of malocclusion (55% compared to males). Most females were more prevalent than males in all classes except for Class III. The study also found that Class III malocclusion was 6%, consistent with previous studies.

Restraint

High cost of treatment

Orthodontic treatments are costly, and not everyone can afford them. It is difficult for low-income people to get braces or even aligners. The rising cost of raw materials, machinery, equipment, and professionals in the field leads to very few people accessing these services, leaving most of the population in such regions. Some of the contributing cost factors include the high cost of consumables, brackets, and other types of orthodontic appliances, as well as the time taken to complete the orthodontic treatment and the personal dental malposition of the patient.

Opportunity

Technological advancements

The evolution of orthodontics has brought about progress in the methods of diagnosis and treatment in the orthodontics market. Moreover, the introduction of AI in medicine has enhanced patient care, cut treatment costs, and facilitated treatment planning. The introduction of intraoral scanners, digital models, and CBCT systems has greatly improved patient care and treatment delivery. The technology of AI has also drastically changed the way how oral disorders can be detected. A lot of literature continues to be published in periodicals now and then, which aids in scientific and clinical advancement and further encourages the seeking of knowledge in all aspects of orthodontics.

Recent Developments

- In September 2024, WVU School of Dentistry alumni raised nearly USD 1 million to name an orthodontic clinic for their longtime department chair.

- In August 2024, G&H Orthodontics introduced updates to its Tune clear aligner system, providing greater control over tooth movement, and enhancing treatment planning and patient comfort.

- In May 2024, DentalMonitoring, an AI-powered orthodontic treatment solution, received FDA De Novo approval for its use in optimizing clinical care by orthodontists.

Orthodontics Market Top Companies

- 3M Company

- Align Technology, Inc.

- American Orthodontics

- Danaher Corporation

- Dentaurum GmbH & Co. KG

- DENTSPLY International, Inc.

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

Market Segmentation

By Product

- Instruments

- Supplies

- Fixed

- Archwires

- Brackets

- Bands & buccal tubes

- Others

- Removable

- Retainers

- Aligners

- Others

- Fixed

By End-user

- Hospitals

- Dental clinics

- Others

By Age Group

- Adults

- Children

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1493

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344