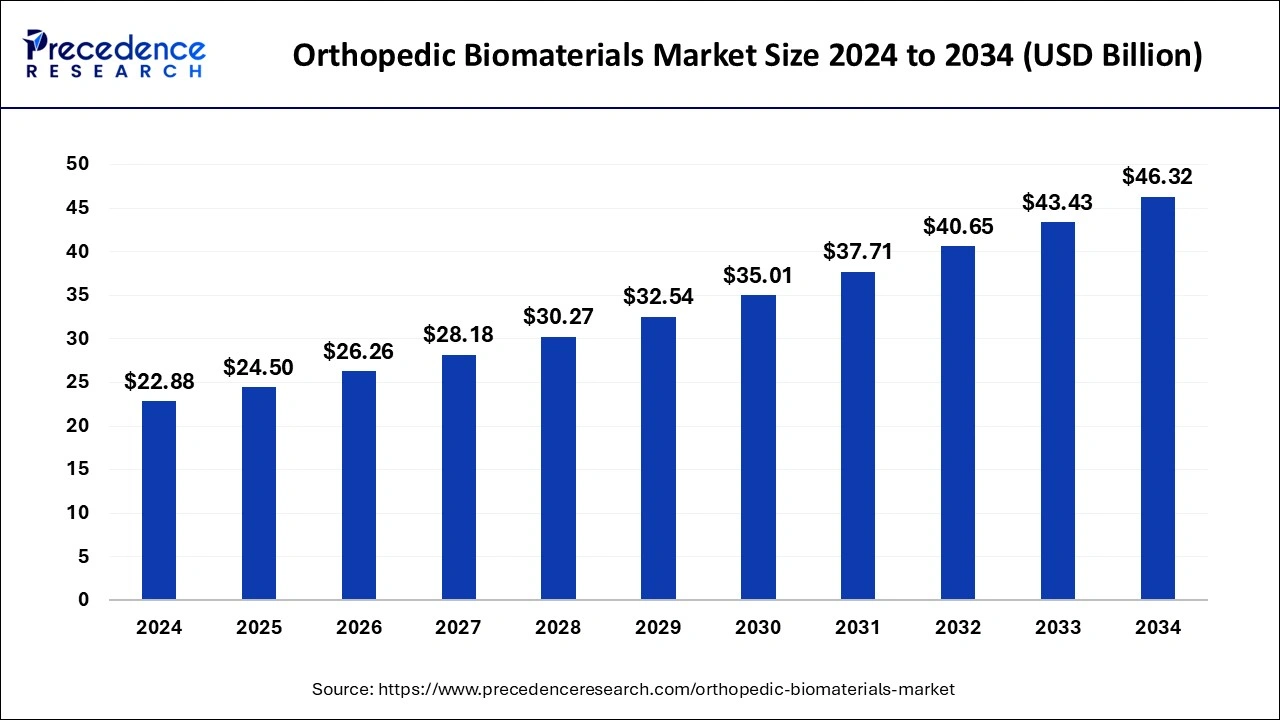

The orthopedic biomaterials market size was estimated at USD 22.88 billion in 2024 and is projected to reach around USD 46.32 billion by 2034 with a CAGR of 7.30%.

Get Sample Copy of Report@https://www.precedenceresearch.com/sample/1107

Key Insights

- North America led the global market in 2024, holding the highest market share of 37%.

- Asia-Pacific is projected to grow at the highest CAGR from 2025 to 2034.

- The ceramics & bioactive glass segment emerged as the leading material category in 2024.

- The orthopedic implant segment held the largest market share by application in 2024.

Drivers

The orthopedic biomaterials market is driven by the increasing prevalence of musculoskeletal disorders and orthopedic conditions, such as osteoporosis, arthritis, and fractures. The rising geriatric population, which is more prone to bone-related diseases, has significantly contributed to market expansion.

Advancements in biomaterial technology, such as 3D printing, bioresorbable implants, and smart biomaterials, have improved patient outcomes and enhanced the effectiveness of orthopedic procedures. Additionally, the growing demand for minimally invasive surgeries has led to higher adoption of advanced orthopedic biomaterials.

Opportunities

The increasing focus on regenerative medicine and tissue engineering presents significant opportunities for the orthopedic biomaterials market. Researchers and medical professionals are exploring innovative solutions such as stem cell therapy and bioactive materials to promote faster bone regeneration.

The expanding healthcare infrastructure in emerging economies, along with rising healthcare expenditures, is also creating lucrative market opportunities. Moreover, strategic collaborations between medical device companies and research institutions are leading to the development of next-generation biomaterials, further driving market growth.

Challenges

One of the major challenges in the orthopedic biomaterials market is the high cost of advanced biomaterials, which limits their adoption, particularly in developing regions. Strict regulatory requirements for product approval and safety standards also pose challenges for market players, increasing the time and cost of bringing new products to market.

Additionally, concerns regarding the biocompatibility and long-term performance of certain biomaterials remain a hurdle in widespread acceptance. The risk of post-surgical complications, such as infections and implant failures, further adds to the challenges faced by healthcare providers and patients.

Regional Analysis

North America holds the largest share of the orthopedic biomaterials market due to its well-established healthcare infrastructure, high healthcare spending, and strong presence of key market players. Europe follows closely, driven by an aging population and technological advancements in biomaterials.

The Asia-Pacific region is expected to experience the fastest growth due to rising healthcare investments, increasing awareness about orthopedic treatments, and the growing incidence of bone-related disorders. Latin America and the Middle East & Africa are also witnessing gradual market growth due to improving healthcare facilities and government initiatives to enhance medical care access.

Orthopedic Biomaterials Market Companies

- Acumed, LLC

- Medtronic plc

- Globus Medical, Inc.

- Stryker Corporation

- Koninklijke DSM N.V.

- Exactech, Inc.

- Johnson & Johnson

- Zimmer Biomet

- Wright Medical Group, Inc.

- NuVasive, Inc.

Segments Covered in the Report

By Material

- Polymers

- Ceramics & Bioactive Glasses

- Calcium Phosphate Cement

- Composites

- Metal

By Application Outlook

- Orthobiologics

- Orthopedic Implants

- Viscosupplementation

- Joint Replacement

- Bio-resorbable Tissue Fixation

By End User

- Hospitals

- Orthopedic Clinics

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/