According to a research report “Power Rental Market (By Fuel: Diesel and Natural Gas; By Application Type: Continuous Load, Standby Load, Peak Load; By End User: Mining, Construction, Utility, Events, Manufacturing, Oil & Gas, Others) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030″ published by Precedence Research.

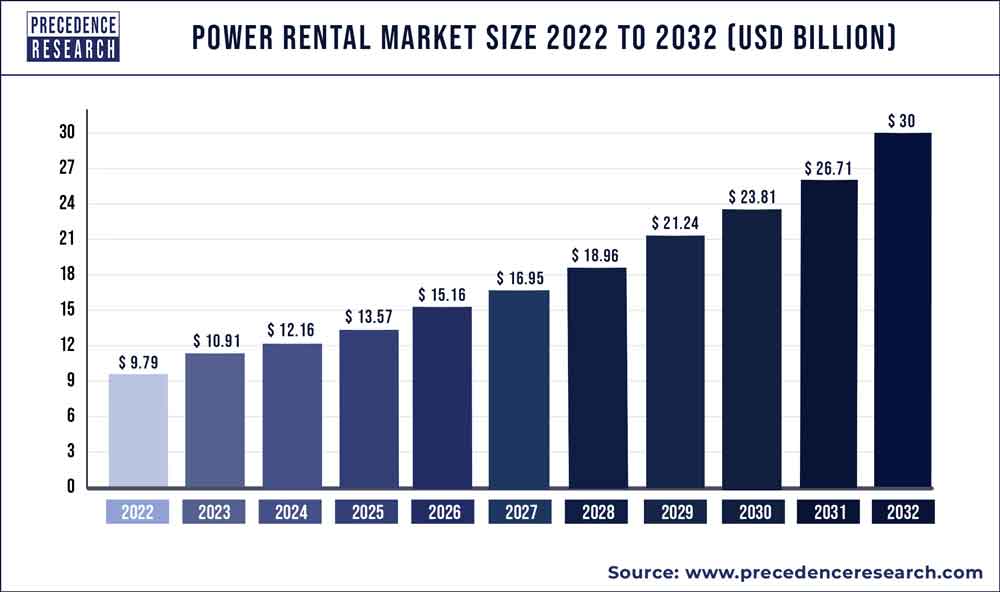

The power rental market size is projected to hit from USD 10.40 billion in 2022 to USD 26.02 billion by 2030, growing at a CAGR of 12.1% every year.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The term ‘power rental’ refers to the facility of leasing equipment or systems that provide prime or standby power supply on a temporary basis as needed. The generator sets, electrical distribution systems, and load banks among the essential products involved.

The industry’s growth will be fueled by strong infrastructure construction, as well as the growing importance of power backup solutions and disaster management among end users. The growing population and fast urbanization have resulted in a higher demand for steady supply of electricity. The market for power rental will be driven by the need for less infrastructure and lower setup costs, as well as a growing desire to maintain ongoing corporate operations.

Get a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1456

Table of Contents

Scope of the Power Rental Market

| Report Coverage | Details |

| Market Size | US$ 26.02 Billion by 2030 |

| Growth Rate | CAGR of 12.1% from 2021 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Fuel, Application, End Use, Region |

Report Highlights

- Based on the fuel, the diesel segment dominated the global power rental market in 2020 with highest market share. The capacity to deliver weather-independent, scalable, and flexible operations is expected to drive a consistent deployment rate for diesel-fueled units.

- Based on the application, the continuous load segment is estimated to be the most opportunistic segment during the forecast period. The rental power systems are increasingly being used in various industries. As they are located distant from the power grid, these industries require a continual supply of electricity. This has driven the growth of continuous load segment.

Market Dynamics:

Drivers

Surge in demand for power rental in diverse sectors

The mining and oil and gas exploration are typically carried out in remote areas. Because of the highly flammable nature of the extracted products, human life is constantly at risk in such locations; thus, proper illumination and power are critical requirements for such operations.

Mining and oil and gas industries in the developed countries are expected to expand significantly as a result of increased investment. In the coming years, new mining projects are expected to begin in developing economies. The above-mentioned factors are critical in driving demand for power rental solutions.

Restraints

Stringent government regulations

To limit carbon emissions from power generation operations, developed economies have enacted a number of stringent regulations. Such regulations also specify the permissible noise levels for diesel generators in order to reduce noise pollution caused by diesel genset operations.

Each country has its own set of rules and regulations. Several power rental companies offer a variety of pollution control measures, such as silencers, solid foundations, and rubber in shear mounts, canopies, and flexible elbows, to reduce noise levels, which raises the overall cost of generator sets. As a result, the stringent government regulations is hampering the growth of power rental market during the forecast period.

Opportunities

Technological advancements

As power rental requirements become more complex, sophisticated control systems that integrate a variety of equipment are required to ensure stable, efficient, and reliable operations. The digitalization also changes the way people consume energy and gives them more control over how much they use.

Furthermore, digitalization allows for real-time feedback, which aids in predictive maintenance. It can aid in improving the efficiency of temporary power systems in order to meet customer expectations and demands. The market players are looking to invest more in digital technologies in order to reduce costs and provide more customized services to customers, creating an opportunity for power rental service providers.

Challenges

Shifting trends towards renewable power generation

The development of distributed energy supply technology based on renewable energy power generation has become a priority in the energy sector. The fluctuations and intermittent nature of wind energy, solar energy, and other renewable energy sources, on the other hand, accentuates the conflict between new energy and the grid. Meanwhile, major grid outages highlight the critical need for a reliable and large-scale energy storage system.

Using energy storage technology to store and reliably transmit wind and solar energy power can provide rapid active power support, improve grid frequency modulation capacity, and allow large-scale wind and solar power to be conveniently and reliably integrated into regular grids. As a result, energy storage technology has emerged as a critical component in the large-scale deployment of new energy power generation. Thus, shifting trends towards renewable power generation is major challenge for the market growth.

Read Also: Steam Boiler Market Size to Hit USD 20.7 Billion by 2030

Regional Snapshot

North America is the largest segment for power rental market in terms of region. The U.S. is one of the most renowned countries that use natural gas power generators to keep the environment cleaner. The reason for this is that natural gas generators have a lower failure rate during operation.

Asia-Pacific region is the fastest growing region in the power rental market. This is attributed to the growing investments in mining related exploratory activities in the Asia-Pacific region are further driving the need for power rental in the market.

Some of the prominent players in the global power rental market include:

- Pump Power Rental

- Global Power Supply

- Jassim Transport & Stevedoring Co. K.S.C.C.

- Newburn Power Rental Ltd.

- ProPower Rental

- Shenton Group

- Modern Hiring Service

- United Rentals

- FG Wilson

- APR Energy

Segments Covered in the Report

By Fuel

- Diesel

- Natural Gas

By Application

- Continuous Load

- Standby Load

- Peak Load

By End User

- Mining

- Construction

- Utility

- Events

- Manufacturing

- Oil & Gas

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Regional Snapshot

North America is the largest segment for power rental market in terms of region. The U.S. is one of the most renowned countries that use natural gas power generators to keep the environment cleaner. The reason for this is that natural gas generators have a lower failure rate during operation.

Asia-Pacific region is the fastest growing region in the power rental market. This is attributed to the growing investments in mining-related exploratory activities in the Asia-Pacific region are further driving the need for power rental in the market.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Power Rental Market

5.1. COVID-19 Landscape: Power Rental Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Power Rental Market, By Fuel

8.1. Power Rental Market, by Fuel Type, 2021-2030

8.1.1. Diesel

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Natural Gas

8.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Power Rental Market, By Application

9.1. Power Rental Market, by Application, 2021-2030

9.1.1. Continuous Load

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Standby Load

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Peak Load

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Power Rental Market, By End User

10.1. Power Rental Market, by End User, 2021-2030

10.1.1. Mining

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Construction

10.1.2.1. Market Revenue and Forecast (2019-2030)

10.1.3. Utility

10.1.3.1. Market Revenue and Forecast (2019-2030)

10.1.4. Events

10.1.4.1. Market Revenue and Forecast (2019-2030)

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast (2019-2030)

10.1.6. Oil & Gas

10.1.6.1. Market Revenue and Forecast (2019-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Power Rental Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.1.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.3. Market Revenue and Forecast, by End User (2019-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.1.5.3. Market Revenue and Forecast, by End User (2019-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.2.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.3. Market Revenue and Forecast, by End User (2019-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.5.3. Market Revenue and Forecast, by End User (2019-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.6.3. Market Revenue and Forecast, by End User (2019-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.2.7.3. Market Revenue and Forecast, by End User (2019-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.3.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.3. Market Revenue and Forecast, by End User (2019-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.5.3. Market Revenue and Forecast, by End User (2019-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.6.3. Market Revenue and Forecast, by End User (2019-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.3.7.3. Market Revenue and Forecast, by End User (2019-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.5.3. Market Revenue and Forecast, by End User (2019-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.6.3. Market Revenue and Forecast, by End User (2019-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2019-2030)

11.4.7.3. Market Revenue and Forecast, by End User (2019-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.3. Market Revenue and Forecast, by End User (2019-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.4.3. Market Revenue and Forecast, by End User (2019-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Fuel (2019-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2019-2030)

11.5.5.3. Market Revenue and Forecast, by End User (2019-2030)

Chapter 12. Company Profiles

12.1. Oil & Gas

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Global Power Supply

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Jassim Transport & Stevedoring Co. K.S.C.C.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Newburn Power Rental Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. ProPower Rental

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Shenton Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Modern Hiring Service

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. United Rentals

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. FG Wilson

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. APR Energy

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1456

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com