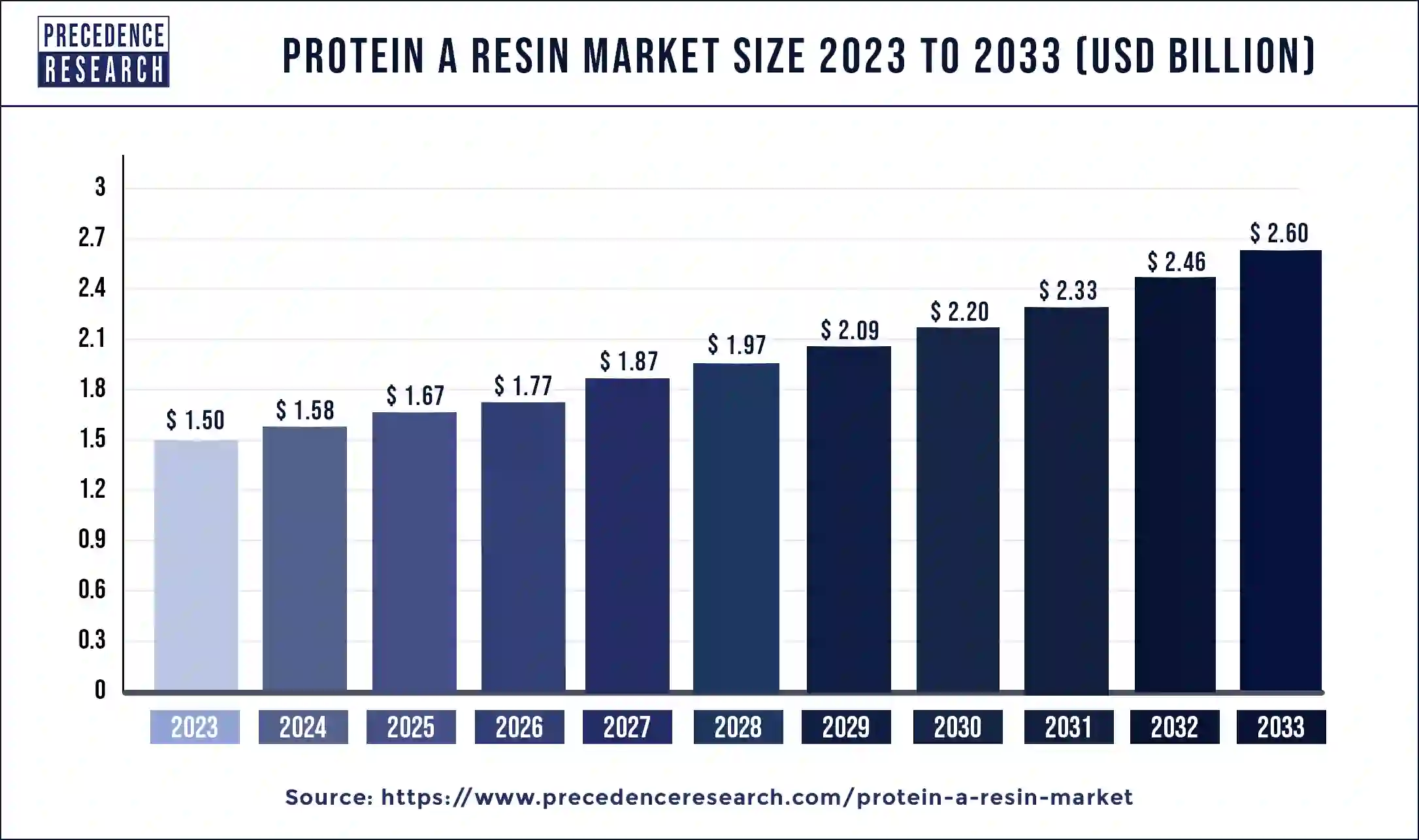

The global protein A resins market size was estimated at USD 1.50 billion in 2023 and is projected to attain around USD 2.60 billion by 2033, growing at a CAGR of 5.65% from 2024 to 2033.

Key Points

- By region, North America led the protein A resins market with the largest market share of 42% in 2023.

- By region, Asia Pacific is expected to witness the fastest growth rate in the market during the forecast period.

- By application, the antibody purification segment dominated the protein A resins market in 2023 with market share of 60%.

- By product, the recombinant protein A segment had the largest share of around 58% in 20223.

- By matrix type, the agarose-based matrix segment dominated the market in 2023 with market share of 42.3%.

- By end-user, the pharmaceutical & biopharmaceutical companies segment dominated the market in 2023 with market share of 59%.

Protein A resins are an integral component of the biopharmaceutical industry, playing a crucial role in the purification of therapeutic proteins, particularly monoclonal antibodies (mAbs). The Protein A resins market encompasses a wide range of products and solutions designed to facilitate the efficient and cost-effective purification of biopharmaceuticals, meeting the stringent quality and regulatory requirements of the industry.

Get a Sample: https://www.precedenceresearch.com/sample/4063

Growth Factors:

The Protein A resins market is driven by several key factors. Firstly, the increasing demand for monoclonal antibodies as therapeutics for various diseases, including cancer, autoimmune disorders, and infectious diseases, fuels the need for efficient purification processes. As the biopharmaceutical industry continues to expand and diversify, the demand for Protein A resins is expected to rise correspondingly.

Moreover, advancements in bioprocessing technologies and the development of novel biologics have led to higher productivity and improved yields in biopharmaceutical production. Protein A resins play a critical role in enabling scalable and high-throughput purification processes, thereby supporting the growth of the biopharmaceutical market.

Additionally, the growing prevalence of chronic diseases and the aging population worldwide drive the demand for biopharmaceuticals, including mAbs. As governments and healthcare organizations strive to improve access to advanced therapies, the demand for Protein A resins for large-scale production of biologics is expected to increase.

Region Insights:

The Protein A resins market exhibits regional variations influenced by factors such as the concentration of biopharmaceutical manufacturing facilities, regulatory landscape, and technological advancements.

North America dominates the Protein A resins market, primarily due to the presence of a robust biopharmaceutical industry, extensive R&D activities, and favorable regulatory environment. The United States, in particular, hosts numerous biopharmaceutical companies engaged in the production of mAbs and other biologics, driving the demand for Protein A resins in the region.

Europe is another significant market for Protein A resins, characterized by a strong biopharmaceutical manufacturing base and a well-established regulatory framework. Countries such as Germany, Switzerland, and the United Kingdom are prominent players in the European biopharmaceutical industry, contributing to the demand for Protein A resins for therapeutic protein purification.

Asia-Pacific is poised for rapid growth in the Protein A resins market, driven by increasing investments in biopharmaceutical manufacturing infrastructure, rising healthcare expenditure, and growing demand for advanced therapies. Countries like China, India, and South Korea are emerging as key players in the regional biopharmaceutical market, creating opportunities for Protein A resin suppliers to expand their presence in the region.

Protein A Resins Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.65% |

| Global Market Size in 2023 | USD 1.50 Billion |

| Global Market Size in 2024 | USD 1.58 Billion |

| Global Market Size by 2033 | USD 2.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Product, By Matrix Type, By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Protein A Resins Market Dynamics

Drivers:

Several drivers contribute to the growth of the Protein A resins market. The expanding pipeline of biologics, including monoclonal antibodies, bispecific antibodies, and fusion proteins, drives the demand for efficient purification technologies such as Protein A resins. As biopharmaceutical companies continue to invest in the development of novel therapeutics, the demand for Protein A resins is expected to remain strong.

Furthermore, the increasing adoption of single-use bioprocessing technologies in biopharmaceutical manufacturing enhances the flexibility, efficiency, and cost-effectiveness of protein purification processes. Protein A resins compatible with single-use systems offer advantages such as reduced cross-contamination risk, simplified process validation, and faster turnaround times, driving their adoption in the biopharmaceutical industry.

Moreover, strategic collaborations and partnerships between biopharmaceutical companies and Protein A resin manufacturers contribute to market growth. By leveraging complementary expertise and resources, companies can accelerate product development, expand market reach, and address evolving customer needs, driving innovation and competitiveness in the Protein A resins market.

Opportunities:

The Protein A resins market presents several opportunities for growth and innovation. With the increasing demand for personalized medicine and targeted therapies, there is a growing need for specialized Protein A resins tailored to specific therapeutic proteins and purification requirements. Companies investing in research and development to develop novel Protein A resins with improved selectivity, binding capacity, and cost-efficiency stand to gain a competitive edge in the market.

Furthermore, the expansion of biopharmaceutical manufacturing capacity in emerging markets offers significant opportunities for Protein A resin suppliers to tap into new customer segments and geographical regions. By establishing strategic partnerships and distribution channels, companies can capitalize on the growing demand for biologics in emerging economies and strengthen their position in the global Protein A resins market.

Additionally, the increasing adoption of continuous bioprocessing technologies presents opportunities for innovation in Protein A resin-based purification processes. Continuous manufacturing offers advantages such as reduced footprint, enhanced productivity, and real-time process monitoring, driving its adoption in the biopharmaceutical industry. Protein A resin manufacturers developing scalable and high-performance solutions optimized for continuous bioprocessing stand to benefit from this trend.

Challenges:

Despite the favorable market dynamics, the Protein A resins market faces certain challenges that could impede growth. One such challenge is the high cost associated with Protein A resins, which can pose a barrier to entry for smaller biopharmaceutical companies and contract manufacturing organizations (CMOs). As the demand for biopharmaceuticals continues to grow, there is a need for more cost-effective purification solutions to address pricing pressures and improve accessibility.

Moreover, the limited availability of raw materials for Protein A resin production, particularly Protein A ligands, can constrain market growth. Protein A ligands are derived from Staphylococcus aureus, and their sourcing and production process can be complex and costly. Ensuring a stable and sustainable supply of high-quality Protein A ligands is essential to meet the growing demand for Protein A resins in the biopharmaceutical industry.

Furthermore, regulatory requirements and quality standards governing biopharmaceutical manufacturing pose challenges for Protein A resin suppliers. Ensuring compliance with regulatory guidelines, conducting rigorous quality control measures, and providing comprehensive documentation and support services are essential to gain regulatory approval and maintain customer trust in the Protein A resins market.

Read Also: Cosmetovigilance Market Size to Rake USD 17.60 Bn by 2033

Recent Developments

- In March 2024, Ultomiris received an approval from the United States for the long-term C5 complement inhibitor for the diagnostics of geriatric patients having anti-aquaporin-4 (AQP4) antibody-positive (Ab+) neuromyelitis optica spectrum disorder.

- In March 2024, Merck, a leading player in the life science technology company expanded its M LabTM Collaboration Center in Shanghai, China, it is the organization’s biggest in the global network of 10 interconnected labs. The investment worth € 14 million was added for the new biology application lab an upstream application lab and a process development training center to its M LabTM Collaboration Center in Shanghai.

- In April 2024, BioArctic AB collaborated with Eisai and announced the organization submitted the supplemental Biologics License Application (sBLA) for its drug Leqembi to the United States Food and Drug Administration (FDA).

- In April 2024, the US FDA approved and authorized the latest antibody drug named Pemgarda marketed by the biotech Invivyd, to protect immunocompromised individuals from COVID-19.

- In April 2024, Kemp Proteins LLC, a leading company in gene-to-protein services and monoclonal antibody development announced the strategic collaboration with the Columbia Biosciences of Frederick, Maryland.

- In April 2024, Sino Biological introduced a series of in vitro bioassay services for maintaining antibody drug development projects. Sino Biological offers different reagents and a range of n vitro efficacy evaluation services for meeting the demand for testing practices and trends.

Protein A Resins Market Companies

- GE Healthcare

- Merck Millipore

- PerkinElmer, Inc.

- GenScript Biotech Corp.

- Agilent Technologies

- Repligen Corp.

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Abcam PLC.

- Novasep Holdings SAS

Segments Covered in the Report

By Application

- Antibody purification

- Immunoprecipitation

By Product

- Recombinant protein A

- Natural protein A

By Matrix Type

- Agarose-based matrix

- Glass or silica gel-based matrix

- Organic polymer-based matrix

By End-user

- Pharmaceutical & Biopharmaceutical Companies

- Clinical research laboratories

- Academic research institutes

- Contract research organization

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/