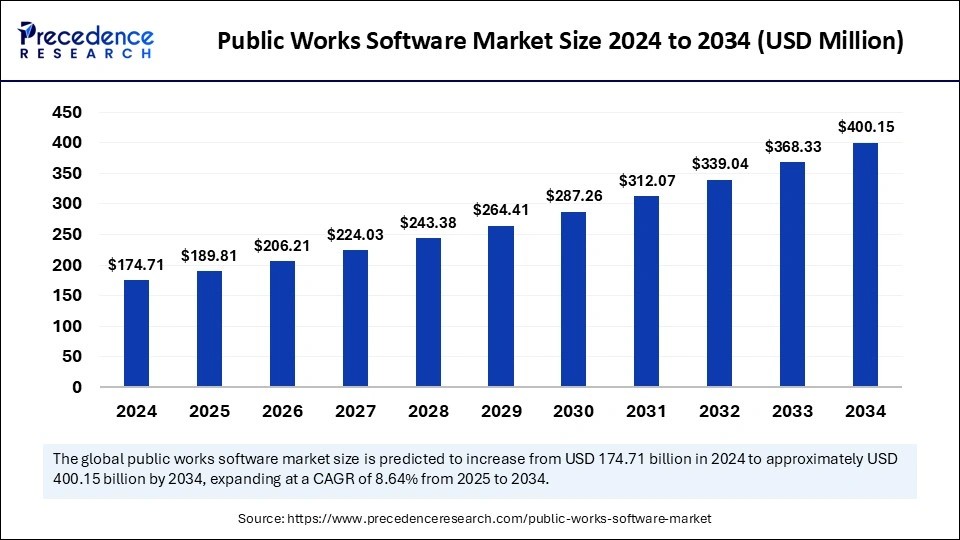

The global public works software market size was valued at USD 174.71 million in 2024 and is expected to reach around USD 400.15 million by 2034, growing at a CAGR of 8.64%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/5729

Key Insights

-

North America held the largest market share in 2024.

-

Asia Pacific is projected to experience the fastest market growth during the forecast period.

-

The project management software segment led the market by type in 2024.

-

The asset management software segment is expected to witness significant growth in the coming years.

-

The cloud-based deployment segment dominated the market in 2024.

-

The on-premises deployment segment is anticipated to grow at a notable rate during the forecast period.

-

The small and medium enterprises segment held the dominant market share in 2024.

-

The large enterprises segment is projected to grow at the fastest rate in the coming years.

-

The government agencies segment accounted for a significant market share in 2024.

Market Overview

The public works software market is experiencing significant growth due to the rising need for efficient management of infrastructure projects, municipal assets, and public services. Governments and private organizations are adopting digital solutions to streamline operations, improve transparency, and optimize resource allocation. The growing emphasis on smart city initiatives and automation in public works is further driving market expansion.

Also Read: Multimodal AI Market

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 400.15 million |

| Market Size in 2025 | USD 189.81 million |

| Market Size in 2024 | USD 174.71 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, Organization Size, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East |

Market Drivers

The increasing adoption of cloud-based software solutions is a major driver, enabling real-time collaboration, data sharing, and remote access. Governments worldwide are investing heavily in digital transformation to enhance efficiency and accountability in public infrastructure projects. The need for compliance with regulatory frameworks and the rising complexity of public works projects also contribute to market growth.

Market Opportunities

The integration of artificial intelligence (AI) and Internet of Things (IoT) in public works software presents new opportunities. AI-powered predictive analytics can enhance maintenance planning, while IoT-enabled sensors improve real-time monitoring of public assets. Additionally, the expansion of public-private partnerships is creating demand for scalable and cost-effective solutions tailored for large-scale projects.

Market Challenges

Cybersecurity concerns and data privacy issues pose challenges, as public works software solutions handle sensitive government and citizen data. The high initial cost of implementation and the need for specialized training for personnel also hinder market adoption. Additionally, legacy system integration remains a challenge for many municipalities transitioning to modern digital solutions.

Regional Outlook

North America leads the market due to the widespread adoption of advanced public works management systems and strong government investments in smart infrastructure. Europe is also a key player, driven by regulatory initiatives for digital governance. The Asia-Pacific region is witnessing rapid growth, fueled by urbanization, increasing infrastructure spending, and digital transformation efforts in developing economies.

Recent Developments

- In March 2025, gWorks, an established company that offers cloud-based solutions for local governments and utilities, declared the acquisition of BBI Inc., a software company serving municipalities and water agencies across Mississippi and Louisiana. The acquisition enables gWorks to expand its capabilities to serve small and medium-sized governments with user-friendly, purpose-built solutions that enhance financial and operational efficiency.

- In January 2025, a leading provider of public work software, CentralSquare Technologies, signed a definitive agreement to acquire the operating assets of Blueline AI, an AI-based platform that augments routine tasks, such as police report narratives and search warrant routing.

- In September 2024, Avaya announced the launch of its Experience Platform (AXP) Public Cloud in India, making all of its AXP offerings are now available to businesses in the country. This customer experience-focused platform has various deployment models, including public cloud, private cloud, on-premises, and hybrid, to align with organizations from public services, telecommunications, healthcare, and BFSI.

Public Works Software Market Companies

- Accela Inc.

- Agiline Software

- Esri (ArcGIS)

- Infor (Koch Industries)

- IWorQ Systems Inc.

- Lucity (CENTRALSQUARE)

- Tyler Technologies

- VertexOne

Segments Covered in the Report

By Type

- Project Management Software

- Asset Management Software

- Others

By Deployment

- Cloud-based

- On-premises

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-user

- Government Agencies

- Private Construction Firms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/