According to a research report “Pumps Market (By Product Type: Centrifugal Pump and Positive Displacement Pump; By Application: Agriculture, Construction and Building Services, Water and Wastewater, Power Generation, Oil and Gas, Chemical, and Others) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030″ published by Precedence Research.

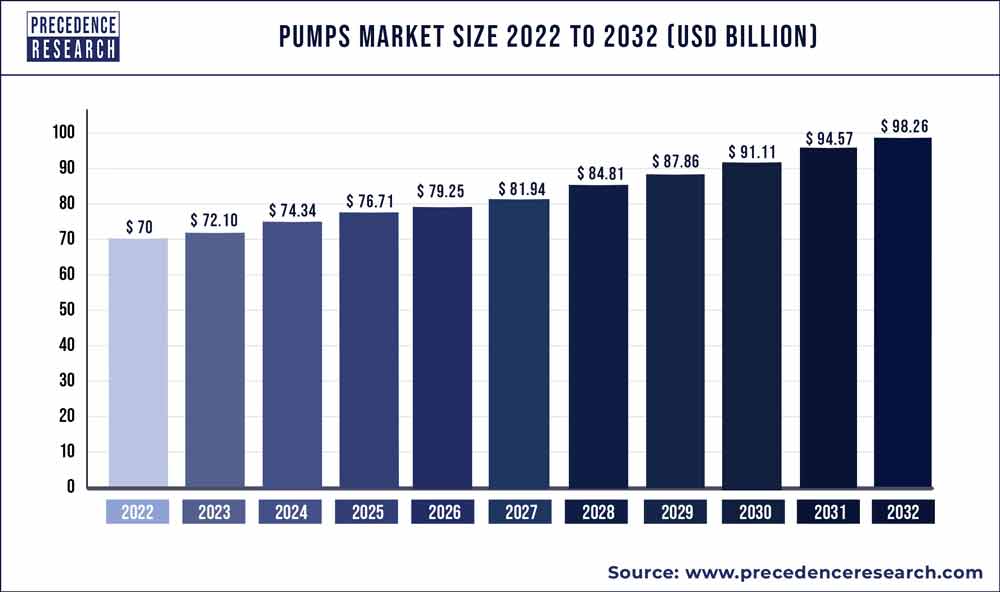

The pumps market size is projected to touch USD 72.03 billion in 2022 and is forecasted to reach USD 94.4 billion by 2030; it is expected to grow at a CAGR of 3.4% from 2021 to 2030.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The global pumps market will expand at a moderate rate, owing to increased government spending on innovative water infrastructure. The increasing use of various types of pumps in various industries, such as oil and gas, water and wastewater treatment, food and beverage, electricity generation, and chemical industries will drive the pumps market growth.

Get a Free Sample Copy of this Report with Global Industry Analysis @ https://www.precedenceresearch.com/sample/1500

Moreover, the increased need for clean water for both domestic and industrial use would increase the number of water and wastewater treatment plants, driving up demand for pumps. As governments install state of the art flood control systems in flood prone areas, product demand will surge. Water conservation measures will be aided by an increasing awareness of the consumption of water, as well as the depletion of groundwater.

Table of Contents

Scope of the Pumps Market

| Report Coverage | Details |

| Market Size | US$ 94.4 Billion by 2030 |

| Growth Rate | CAGR of 3.4% from 2021 to 2030 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Product, Application, Region |

Market Dynamics

Drivers

Increased investments in wastewater treatment plants

Wastewater reuse is a critical solution for overcoming water scarcity and meeting rising water demands. Pumps are widely used to process used water in wastewater treatment plants. Rotating impellers are used in these pumps to increase impeller velocity and push fluids through outlet valves. As a result, the increasing number of global wastewater treatment plants is expected to drive up demand for pumps.

Restraints

Increased competition from unorganized sectors from gray market players

Gray market products pose significant challenges to brand owners by offering low-cost alternatives and cost-effective maintenance services. These alternative products are provided by local and grey market players in the pump industry. In terms of price competitiveness and an efficient local supply network, the unorganized sector, which includes grey market and local players, can outperform well-established companies in this market. Furthermore, because local players are close to consumers, they can respond quickly to their needs. This serves as an add-on for the purchase of alternative locally manufactured products. Thus, the easy availability of local alternative products hampers the entry of global pump manufacturers into the local market and poses a threat to the market.

Opportunities

Surge in demand in different industries

The pumps market expansion has also been boosted by increased industrial activities and infrastructure rehabilitation. Pump demand has surged due to the increasing growth of chemical industries around the world. Pumps have become more widely used in chemical transfer systems as a result of recent developments in corrosion resistant pumps. As a result, the surge in demand in different industries is huge opportunity for the growth of the pumps market.

Challenges

Cavitation effects

Cavitation is the process by which the vapor phase of a liquid forms when it is subjected to reduced pressures at a constant ambient temperature. Vapor bubbles formed within pumps due to insufficient liquid tend to move toward areas of high pressure within them in order to collapse under sufficient pressure and return to the liquid state. Thus, the cavitation effects are a major challenge for the growth of the pumps market.

Read Also: Endoscopy Equipment Market Size to Touch US$ 54.9 Bn by 2030

Report Highlights

- Based on the product type, centrifugal pumps segment dominates the global pumps market during the forecast period. The centrifugal pumps are designed to transfer fluid through impellers using mechanical forces. The fluids are subjected to shear stress and are guided towards the outlet by rotating impellers. These aforementioned factors are driving the growth of the segment.

- Based on the application, the water and wastewater segment is expected to grow at a rapid pace during the forecast period. The water scarcity and demand for potable water are expected to increase globally, resulting in high acceptance of water and wastewater application. Pump systems are necessary to remove impurities and release them into water resources in water and wastewater applications. Pumping systems are utilized in water supply activities such as clean water systems and grey water recycling to increase efficiency.

Regional Snapshot

Asia-Pacific region lead the market and hit 47% revenue share in 2020. The presence of many low-cost product manufacturers in developing nations would help boost the regional market demand, as they can supply end users with long term tailored assistance. The existence of various small, medium, and large-scale pharmaceutical and chemical enterprises in India and China will bolster market expansion even further.

North America is the fastest growing segment for pumps market in terms of region. Due to a significant increase in construction activity in the industrial and commercial sectors, the North America market is likely to continue to grow steadily. Furthermore, throughout the projection period, a surge in the installation of independent power plants as well as technological improvements is expected to fuel product demand in North America.

Some of the prominent players in the global pumps market include:

- Flowserve Corp.

- EBARA International Corp.

- Vaughan Company Inc.

- Sulzer Ltd.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Schlumberger Ltd.

- IWAKI Co. Ltd

- Xylem

- Sulzer Ltd.

Segments Covered in the Report

By Product Type

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

- Others

By Application

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pumps Market

5.1. COVID-19 Landscape: Pumps Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pumps Market, By Product

8.1. Pumps Market, by Product Type, 2021-2030

8.1.1. Centrifugal Pump

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Positive Displacement Pump

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Pumps Market, By Application

9.1. Pumps Market, by Application, 2021-2030

9.1.1. Agriculture

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Construction and Building Services

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Water and Wastewater

9.1.3.1. Market Revenue and Forecast (2019-2030)

9.1.4. Power Generation

9.1.4.1. Market Revenue and Forecast (2019-2030)

9.1.5. Oil and Gas

9.1.5.1. Market Revenue and Forecast (2019-2030)

9.1.6. Chemical

9.1.6.1. Market Revenue and Forecast (2019-2030)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Pumps Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2019-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2019-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2019-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2019-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2019-2030)

Chapter 11. Company Profiles

11.1. Flowserve Corp.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. EBARA International Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Vaughan Company Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sulzer Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Grundfos Holding A/S

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. KSB SE & Co. KGaA

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Schlumberger Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. IWAKI Co. Ltd

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Xylem

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sulzer Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1500

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com