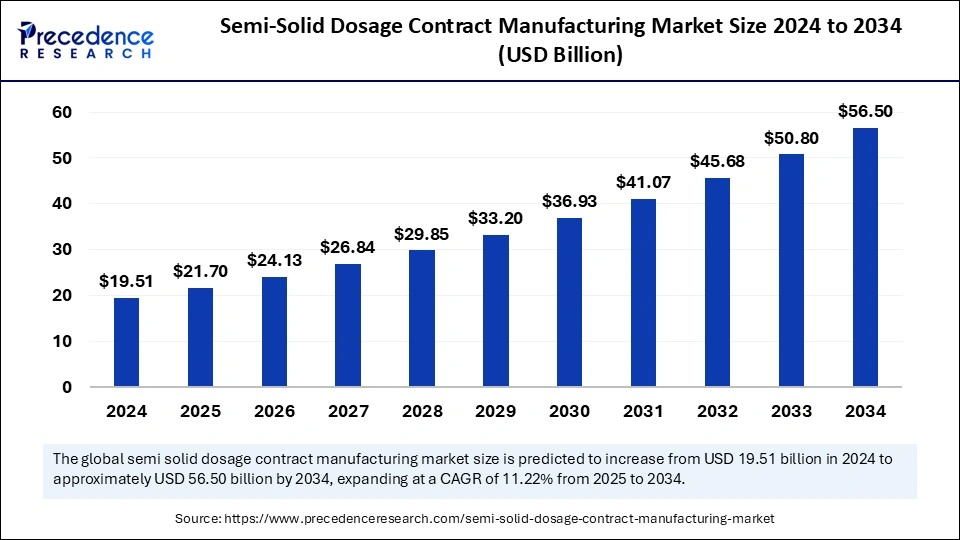

The global semi-solid dosage contract manufacturing market size was valued at USD 19.51 billion in 2024 and is expected to surpass around USD 56.50 billion by 2034, growing at a CAGR of 11.22%.

The semi-solid dosage contract manufacturing market is expanding due to the growing demand for pharmaceutical formulations like creams, ointments, gels, and lotions. Contract manufacturing organizations (CMOs) are playing a crucial role in providing specialized production services to pharmaceutical companies, helping them scale their operations while maintaining high-quality standards. Increased outsourcing by pharmaceutical firms is driving market growth as companies seek cost-effective production solutions without compromising product safety and efficacy.

Semi-Solid Dosage Contract Manufacturing Market Key Highlights

-

Asia Pacific led the market with a share exceeding 33% in 2024.

-

North America is expected to witness the highest CAGR of 10.67% during the forecast period.

-

The topical segment accounted for 50% of the market share by type in 2024.

-

The transdermal segment is projected to experience significant growth in the coming years.

-

Creams dominated the market by product segment in 2024.

-

Large-sized companies held the leading share in the global market in 2024.

-

Medium and small-sized companies are expected to expand at a notable pace in the forecast period.

-

Pharmaceutical companies remained the largest end users in 2024.

-

Cosmeceutical companies are expected to see considerable growth in the future.

Role of AI in the Semi-Solid Dosage Contract Manufacturing Market

Artificial Intelligence (AI) is revolutionizing the semi-solid dosage contract manufacturing market by enhancing production efficiency, quality control, and formulation development. AI-powered predictive analytics help contract manufacturers optimize production processes by identifying potential bottlenecks, minimizing waste, and ensuring consistent product quality.

Machine learning algorithms analyze vast datasets to improve formulation stability, enabling precise ingredient mixing and reducing variability in semi-solid drug formulations like creams, gels, and ointments. These advancements lead to better product consistency and compliance with regulatory standards.

AI also plays a crucial role in automating quality assurance and regulatory compliance. Computer vision and deep learning technologies can detect even the slightest inconsistencies in texture, viscosity, and ingredient dispersion, ensuring uniformity across batches. Additionally, AI-driven automation streamlines supply chain management by predicting demand fluctuations, optimizing inventory, and reducing production downtime.

With AI-driven digital twins and real-time monitoring systems, manufacturers can simulate different formulation scenarios and enhance process efficiency. As AI adoption continues to grow, it is expected to drive further innovation, reduce operational costs, and improve scalability in semi-solid dosage contract manufacturing.

What is Semi-Solid Dosage Contract Manufacturing?

Semi-solid dosage contract manufacturing refers to the outsourcing of production for pharmaceutical and cosmeceutical products in semi-solid forms, such as creams, gels, ointments, pastes, and lotions. These dosage forms are commonly used for dermatological, transdermal, and mucosal drug delivery applications. Pharmaceutical companies often partner with contract manufacturers to leverage their expertise, reduce costs, and ensure compliance with regulatory standards.

Market Growth and Demand

The demand for semi-solid dosage forms is growing due to the increasing prevalence of skin-related diseases, the rising need for transdermal drug delivery, and advancements in formulation technologies. Contract manufacturers play a crucial role in helping pharmaceutical companies meet market demands while focusing on research and development. The market is expanding as companies seek efficient and cost-effective solutions for product development, testing, and large-scale manufacturing.

Key Services Offered

Contract manufacturers provide a wide range of services, including:

-

Formulation Development: Optimizing the composition of semi-solid drugs for stability and efficacy.

-

Analytical Testing: Ensuring product quality, safety, and compliance with regulatory standards.

-

Manufacturing and Packaging: Large-scale production with high precision and compliance with Good Manufacturing Practices (GMP).

-

Regulatory Support: Assisting pharmaceutical companies in meeting FDA, EMA, and other global regulatory requirements.

Technological Advancements

AI, automation, and advanced formulation technologies are revolutionizing semi-solid dosage contract manufacturing. AI-driven predictive analytics help optimize formulations, while automation enhances precision and reduces human errors. Innovations such as nanoemulsions, lipid-based drug delivery, and controlled-release formulations are improving the efficiency and effectiveness of semi-solid drugs.

Regulatory Considerations

The industry is highly regulated, with strict guidelines from agencies like the U.S. FDA, the European Medicines Agency (EMA), and other regulatory bodies worldwide. Compliance with GMP, stability testing, and quality assurance protocols is essential for contract manufacturers to ensure product safety and efficacy.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 56.50 Billion |

| Market Size in 2025 | USD 21.70 Billion |

| Market Size in 2024 | USD 19.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.22% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Company Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Key factors fueling market growth include the rising prevalence of dermatological diseases, increasing demand for topical treatments, and the shift toward outsourcing manufacturing to reduce operational costs. Regulatory requirements for Good Manufacturing Practices (GMP) and quality control are pushing pharmaceutical companies to collaborate with experienced contract manufacturers. Additionally, advancements in formulation technologies are enhancing the effectiveness of semi-solid drugs, further boosting market expansion.

Market Opportunities

Opportunities in this market are driven by technological innovations in drug delivery systems and the growing demand for customized formulations. The increasing focus on personalized medicine and targeted drug therapies is creating a need for specialized semi-solid dosage forms. Additionally, expanding pharmaceutical markets in emerging economies present significant opportunities for contract manufacturers to establish production facilities and expand their global footprint.

Market Challenges

Despite growth, the market faces challenges such as stringent regulatory approvals, variability in raw material availability, and the need for high investments in production infrastructure. Maintaining consistency in product formulations across different contract manufacturing units is another challenge. Additionally, competition among CMOs is intensifying, making differentiation through technological expertise and regulatory compliance a key success factor.

Regional Insights

North America holds a dominant share in the semi-solid dosage contract manufacturing market due to the presence of major pharmaceutical players and stringent regulatory frameworks ensuring product quality. Europe is also a key player, with a strong emphasis on pharmaceutical innovation and contract manufacturing partnerships. Meanwhile, Asia-Pacific is emerging as a lucrative market due to lower production costs, expanding healthcare infrastructure, and increasing investment in pharmaceutical outsourcing.

Semi-Solid Dosage Contract Manufacturing Market Companies

- Lonza Group Ltd.

- Lubrizol Life Science

- Cambrex Corporation

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

- Ascendia Pharmaceuticals

- Pierre Fabre group

- Piramal Pharma Solutions

- DPT Laboratories, LTD

- MedPharm Ltd

- Catalent, Inc.

- Recipharm AB

- Aenova Group

- Almac Group

- Ajinomoto Bio-Pharma Services

Recent Developments

- In September 2023, HERMES PHARMA disclosed USD 27.44 million (€ 25 million) as an investment to improve its manufacturing processes. The financial investment will drive the company toward leading technological equipment that enables enhanced production, storage capacity, and operational excellence, matching the market need for user-friendly oral medication dosage.

- In March 2023, Adragos Pharma acquired the development unit of Clinigen known as Lamda Laboratories, enabling medicinal product development as well as regulatory affairs, including supply chain management expansion. Lamda’s team members with extensive sector knowledge will persist with developing complex products that target European, Japanese, and North American markets for multiple drug forms.

Segments Covered in the Report

By Type

- Topical

- Transdermal

- Oral

By Product

- Creams

- Ointments

- Gels

- Lotions

- Pastes

- Others

By Company Size

- Large Size Companies

- Medium and Small Size Companies

- Others

By End Use

- Pharmaceutical Companies

- Cosmeceutical Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: U.S. Patient Engagement Solutions Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/