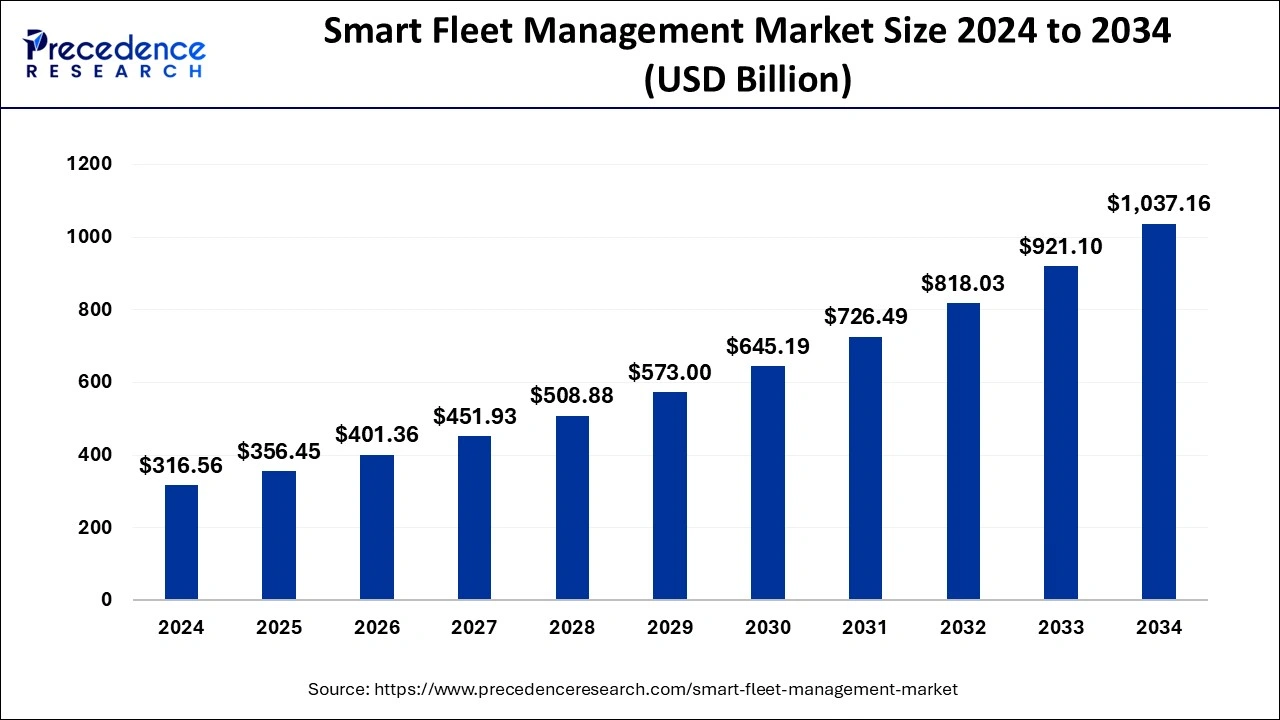

The global smart fleet management market size is expected to reach USD 1,037.16 billion by 2034 from USD 316.56 billion in 2024, growing at a CAGR of 12.6%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1058

Key Points

- In 2024, Asia Pacific dominated the market, holding the largest market share of 40%.

- The automotive segment emerged as the leading transportation category, capturing the highest market share in 2024.

- The Advanced Driver Assistance System (ADAS) hardware segment is projected to experience significant growth at a notable CAGR during the forecast period.

How AI is Reshaping the Future of Smart Fleet Management

- AI-Powered Fleet Analytics – AI processes vast amounts of fleet data to provide actionable insights for improved decision-making.

- Automated Dispatching – AI automates dispatching and scheduling to maximize efficiency and reduce delays in fleet operations.

- Fraud Detection and Prevention – AI detects anomalies in fuel usage, mileage, and driver behavior to prevent fraud and unauthorized activities.

- Energy Efficiency in Electric Fleets – AI optimizes battery usage and charging schedules for electric fleets, ensuring longer operational hours.

- Customer Experience Enhancement – AI-driven predictive analytics improve delivery time estimates and customer satisfaction by optimizing fleet operations.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 316.56 Billion |

| Market Size in 2025 | USD 356.45 Billion |

| Market Size by 2034 | USD 1,037.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hardware, Transportation, Connectivity, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Drivers

The smart fleet management market is experiencing significant growth due to the increasing need for operational efficiency and cost reduction in fleet operations. The rising adoption of telematics, IoT, and AI-driven analytics is enabling businesses to monitor fleet performance in real time, optimizing fuel consumption and maintenance schedules. Additionally, government regulations aimed at improving road safety and reducing carbon emissions are pushing fleet operators to invest in smart management solutions. The growing demand for connected vehicles and the integration of autonomous driving technologies further contribute to market expansion.

Market Opportunities

Advancements in artificial intelligence, big data analytics, and cloud computing are creating lucrative opportunities in smart fleet management. The increasing adoption of electric and autonomous vehicles is driving demand for AI-powered fleet management systems that optimize route planning and battery usage. The emergence of mobility-as-a-service (MaaS) solutions and ride-sharing platforms presents new growth areas for smart fleet technologies. Additionally, the expansion of 5G networks is expected to enhance the efficiency of real-time fleet tracking and predictive analytics.

Market Challenges

Despite its potential, the smart fleet management market faces challenges such as high initial implementation costs and the complexity of integrating new technologies with legacy fleet management systems. Data security concerns and the risk of cyber threats also pose significant hurdles, as fleet operators rely heavily on cloud-based solutions. Additionally, regulatory differences across regions make it difficult for companies to implement uniform fleet management strategies on a global scale. The shortage of skilled professionals to manage and interpret fleet data further limits the widespread adoption of smart fleet solutions.

Regional Insights

Asia Pacific dominates the smart fleet management market due to rapid urbanization, increasing vehicle sales, and government initiatives promoting smart transportation. North America is witnessing strong growth, driven by early adoption of AI-powered fleet solutions and stringent regulations on fleet safety. Europe is expanding steadily, with a focus on reducing carbon emissions and integrating electric vehicles into fleet operations. Meanwhile, Latin America and the Middle East are emerging markets, showing increasing interest in telematics and fleet optimization solutions to enhance logistics and transportation efficiency.

Smart Fleet Management Market Companies

- Continental AG

- Sierra Wireless

- Cisco Systems, Inc.

- Siemens AG

- IBM Corporation

- Tech Mahindra

- Robert Bosch GmbH

- Zonar Systems, Inc.

Latest Announcement by Industry Leaders

- In December 2024, Continental announced the sale of a leading provider of smart fleet management Zonar to GPS Trackit, a leading player in cloud-based GPS tracking and IoT fleet solutions. Continental Executive Board Member and head of Automotive Philipp von Hirschheydt said the decision to sell Zonar for enhancing and strengthening the fundamental strengths.

Recent Developments

- In September 2024, Euler Motors launched the STORM EV two variants. The company introduces the India’s first ADAS (Advanced Driver Assistance System) in a 4W Light Commercial Vehicle (LCV).

- In February 2024, Boston Dynamics introduces latest robotic fleet management platform, aiming to help businesses and maintain their robot ecosystem. The organization also updated its series of mobility to its robot dog, spot for offering ease in control.

- In September 2024, VERSES AI Inc., a cognitive computing company works on the development of next-gen intelligent systems, announced they joint the smart

- city project with an edge computing company ‘Analog’ focusing on connecting places, people, and objects using mixed reality and smart sensor technology. The project is designed to simulate Abu Dhabi’s taxi fleet management using the Genius platform.

Segments Covered in the Report

By Hardware

- Remote Diagnostics

- Tracking

- Optimization

- ADAS

By Transportation

- Rolling Stock

- Automotive

- Marine

By Connectivity

- Long Range Communication

- Short Range Communication

- Cloud

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/