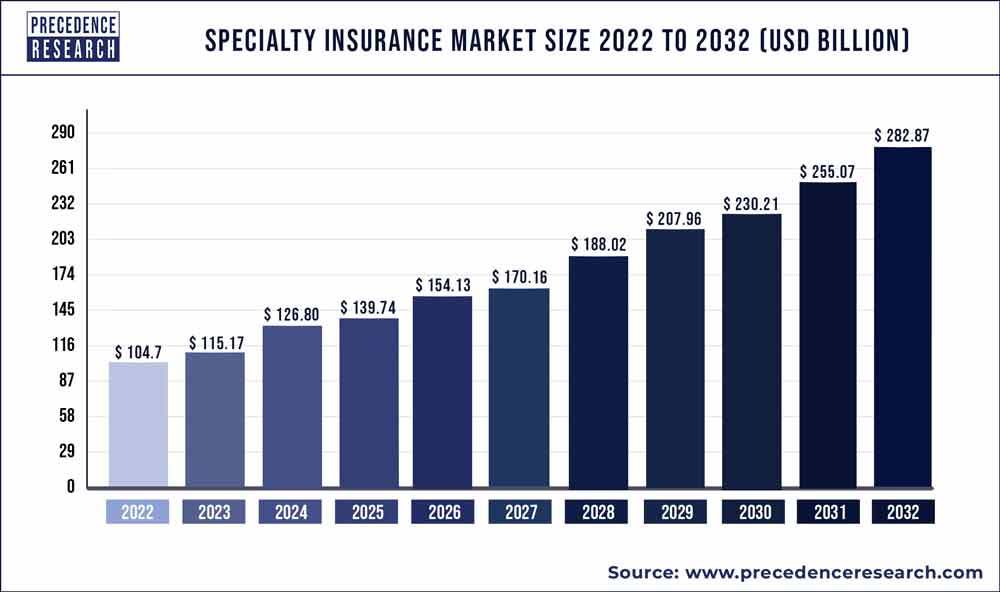

The global Specialty insurance market size was estimated to be around US$ 104.7 billion in 2022. It is projected to reach US$ 282.87 billion by 2032, indicating a CAGR of 10.50% from 2023 to 2032.

Key Takeaways

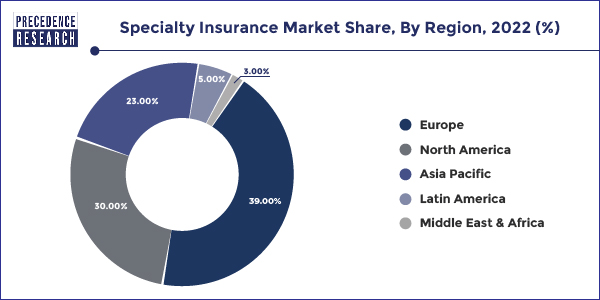

- Europe contributed more than 39% of revenue share in 2022.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2023 and 2032.

- By Type, the marine, aviation, and transport (mat) insurance segment has held the largest market share of 25% in 2022.

- By Type, the other segment is anticipated to grow at a remarkable CAGR of 11.2% between 2023 and 2032.

- By Distribution Channel, the brokers’ segment generated over 60% of the revenue share in 2022.

- By Distribution Channel, the non-brokers segment is expected to expand at the fastest CAGR over the projected period.

- By End User, the business segment generated over 59% of revenue share in 2022.

- By End User, the individuals segment is expected to expand at the fastest CAGR over the projected period.

The specialty insurance market refers to a niche segment within the broader insurance industry that provides coverage for unique or specialized risks. Unlike standard insurance policies that cover more common risks like auto or home insurance, specialty insurance caters to specific and often non-traditional areas. This can include things like cyber insurance, aviation insurance, event cancellation insurance, and other specialized lines of coverage. Companies and individuals seek specialty insurance to address risks that may not be adequately covered by standard insurance policies. The market is characterized by a range of specialized products designed to meet the diverse needs of businesses and individuals facing uncommon or complex risks.

Get a Sample: https://www.precedenceresearch.com/sample/3519

Growth Factors

The Specialty Insurance Market has witnessed a substantial growth factor in recent years. This niche sector of the insurance industry caters to unique and specialized risks that standard insurance policies often overlook. The growth in this market can be attributed to the increasing complexity of risks in various industries, prompting businesses to seek tailored coverage solutions. Factors such as technological advancements, globalization, and the evolving nature of risks have fueled the expansion of specialty insurance. Companies operating in this market offer policies for diverse risks, including cyber liability, environmental hazards, and niche areas like art and collectibles. As industries continue to diversify and face novel challenges, the Specialty Insurance Market is expected to maintain its growth trajectory, providing essential risk management solutions for businesses in an ever-changing landscape.

Specialty Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 10.50% |

| Market Size in 2023 | USD 115.17 Billion |

| Market Size by 2032 | USD 282.87 Billion |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type, By Distribution Channel, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Pet Food Packaging Market Size, Share, Growth, Report 2032

Regional Snapshot

In 2022, Europe dominated the revenue charts with a whopping 39% share. The specialty insurance market in Europe thrives on various fronts. Firstly, its diverse economy, spanning from the art market to marine activities and high-net-worth individuals, fuels a robust demand for specialized coverage. Secondly, stringent regulations push the necessity for specialty policies to navigate through intricate compliance requirements. Thirdly, Europe’s commitment to sustainability and renewable energy projects opens up avenues for insurers to tackle environmental risks head-on. The mature insurance market infrastructure and well-established specialty insurers in Europe play a crucial role, making it a significant player in this specialized niche. It’s a magnet for customers and investments alike.

On the other side of the globe, Asia-Pacific is gearing up for rapid expansion. The region’s specialty insurance market is on the fast track, thanks to several factors. Swift economic growth and a burgeoning middle class have translated into increased wealth and asset ownership, creating a surge in demand for specialized coverage like fine arts, cyber liability, and health-related policies. As industrialization and globalization sweep across the region, businesses are on the lookout for protection against unique and international risks, driving up the demand for specialty insurance. Add to that the supportive regulatory environments and the rise of insurtech solutions, and you’ve got Asia-Pacific emerging as a major player on the global specialty insurance stage.

Recent Developments

- In 2023, Lloyd’s of London introduced a fresh syndicate aimed at offering coverage for parametric risks. Parametric insurance, a unique type of coverage, disburses compensation upon the occurrence of a predefined event, such as a hurricane or earthquake, rather than depending on actual financial losses sustained. The rising prominence of this insurance is evident as corporations and governments seek strategies to alleviate the financial repercussions of climate change.

- In 2023, Munich Re unveiled its collaboration with a startup to design insurance solutions for self-driving vehicles. This category of insurance is expected to gain substantial significance as autonomous vehicles proliferate further in our transportation landscape.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Specialty Insurance Market Players

- AIG (American International Group)

- Chubb Limited

- Allianz SE

- Munich Re

- Berkshire Hathaway

- AXA

- Zurich Insurance Group

- The Hartford Financial Services Group

- Hiscox

- Tokio Marine Holdings

- XL Catlin (now part of AXA XL)

- QBE Insurance Group

- Beazley

- Argo Group

- Markel Corporation

Segments Covered in the Report

By Type

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Marine, Aviation and Transport (MAT) Insurance

- Others

By Distribution Channel

- Brokers

- Non-brokers

By End User

- Business

- Individuals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Specialty Insurance Market

5.1. COVID-19 Landscape: Specialty Insurance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Specialty Insurance Market, By Type

8.1. Specialty Insurance Market, by Type, 2023-2032

8.1.1 Political Risk and Credit Insurance

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Entertainment Insurance

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Art Insurance

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Livestock and Aquaculture Insurance

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Marine, Aviation and Transport (MAT) Insurance

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Specialty Insurance Market, By Distribution Channel

9.1. Specialty Insurance Market, by Distribution Channel, 2023-2032

9.1.1. Brokers

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-brokers

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Specialty Insurance Market, By End User

10.1. Specialty Insurance Market, by End User, 2023-2032

10.1.1. Business

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Individuals

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Specialty Insurance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.3. Market Revenue and Forecast, by End User (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End User (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.3. Market Revenue and Forecast, by End User (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End User (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End User (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End User (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.3. Market Revenue and Forecast, by End User (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End User (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End User (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End User (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End User (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End User (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End User (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.3. Market Revenue and Forecast, by End User (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End User (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End User (2020-2032)

Chapter 12. Company Profiles

12.1. AIG (American International Group)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Chubb Limited

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Allianz SE

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Munich Re

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Berkshire Hathaway

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AXA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Zurich Insurance Group

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. The Hartford Financial Services Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Hiscox

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tokio Marine Holdings

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/