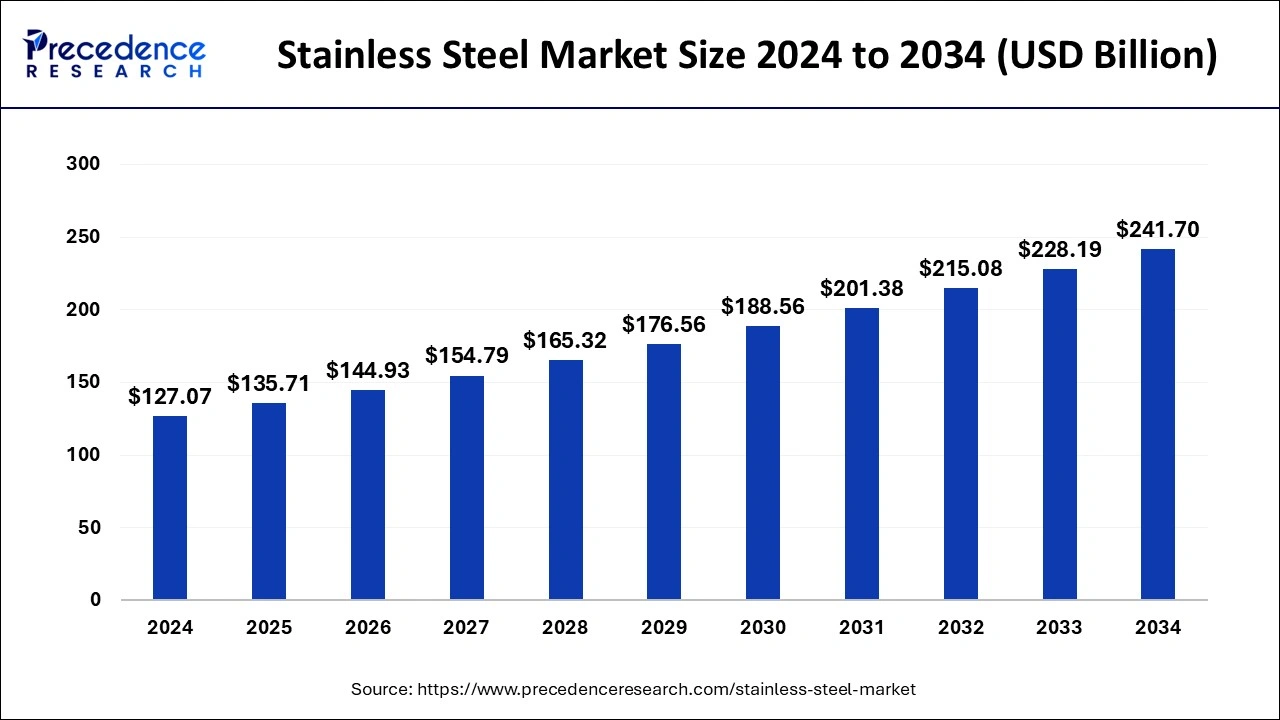

The global stainless steel market size was calculated at USD 127.07 billion in 2024 and is projected to reach around USD 241.70 billion by 2034 with a CAGR of 6.64%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1097

Key Points

- In 2024, Asia Pacific held the largest market share at 67%.

- The flat product segment captured the highest market share of 31% in 2024.

- The long product segment is projected to grow at a CAGR of 6.8% during the forecast period.

- The automotive & transportation application segment is expected to witness the fastest growth in the coming years.

Market Dynamics

Stainless Steel Market Drivers

The rising use of stainless steel in transportation, heavy machinery, and consumer goods is a major factor driving market growth. Governments worldwide are investing in public infrastructure projects, boosting demand for stainless steel in bridges, railway systems, and commercial buildings.

The growing preference for stainless steel over traditional materials due to its recyclability and environmental benefits is also contributing to market expansion. Furthermore, increased R&D efforts in high-performance stainless steel alloys are enhancing product capabilities and expanding their applications.

Opportunities

The growing focus on sustainable materials is opening new avenues for stainless steel, as it is 100% recyclable and highly durable. The rise in demand for corrosion-resistant materials in offshore wind farms and marine applications is creating new market opportunities.

Additionally, the increasing use of stainless steel in food processing and beverage industries, due to its hygiene and safety benefits, is boosting demand. Emerging economies, particularly in Southeast Asia and Africa, offer strong potential for market growth as industrial activities and urbanization continue to rise.

Challenges

The stainless steel industry faces the challenge of high energy consumption during production, leading to concerns over carbon emissions and sustainability. The dependency on raw materials like nickel, iron ore, and chromium makes the industry vulnerable to supply chain disruptions and price fluctuations.

Market saturation in developed regions and competition from alternative materials like composites and aluminum alloys further add to the challenges. Additionally, the fluctuating global economic conditions and trade restrictions can affect demand and supply dynamics.