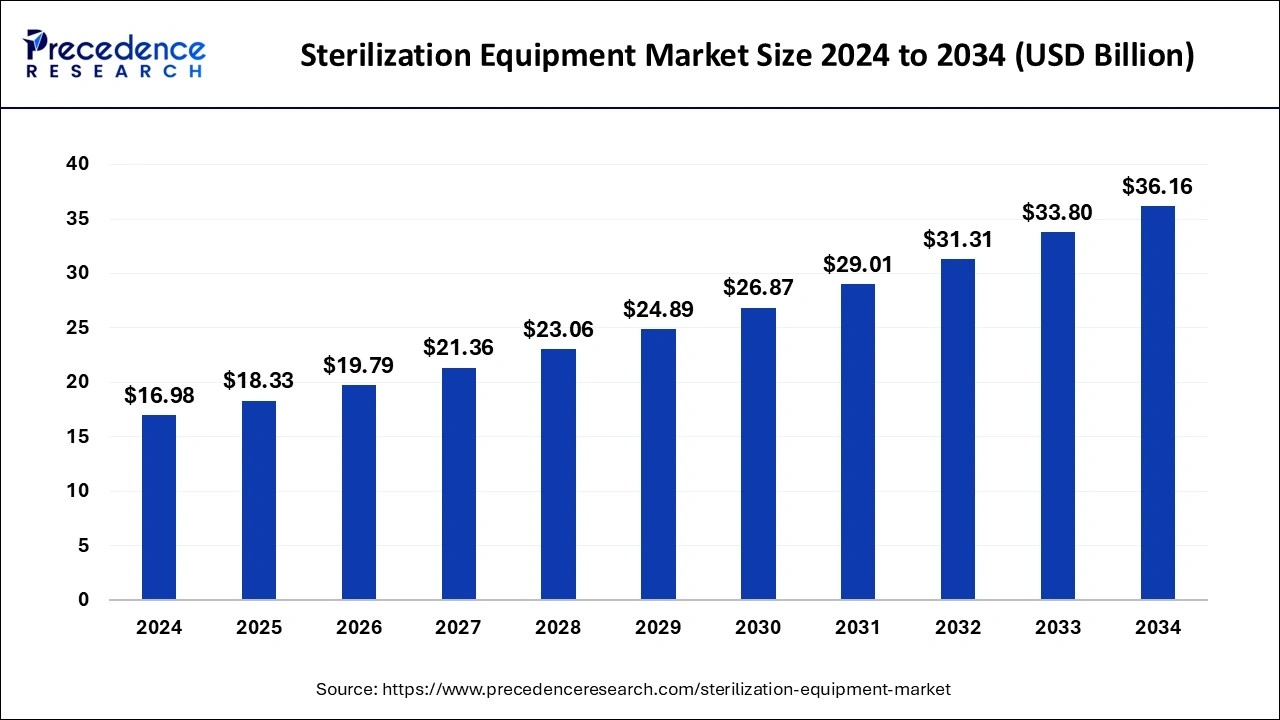

The global sterilization equipment market size was calculated at USD 15.73 billion in 2023 and is predicted to rise around USD 33.80 billion by 2033, growing at a CAGR of 7.95% from 2024 to 2033.

Key Points

- The North America sterilization equipment market size accounted for USD 5.66 billion in 2023 and is expected to attain around USD 12.17 billion by 2033.

- North America dominated the market with the largest market share of 36% in 2023.

- Asia Pacific is estimated to be the fastest growing during the forecast period of 2024-2033.

- By product type, the sterilization instruments segment dominated the market in 2023.The segment is observed to sustain the position during the forecast period.

- By technology type, the heat/high-temperature sterilization segment dominated the market in 2023.

- By end-user type, the hospitals and clinics segment dominated the market in 2023.

The sterilization equipment market is experiencing robust growth driven by increasing awareness of infection control and the growing demand for sterilization in healthcare settings, pharmaceuticals, and food processing industries. Sterilization equipment plays a critical role in eliminating pathogens and ensuring product safety, contributing to improved public health outcomes and regulatory compliance. The market encompasses a diverse range of technologies including steam sterilization, ethylene oxide (EtO) sterilization, radiation sterilization, and hydrogen peroxide sterilization, tailored to meet specific industry requirements.

Get a Sample: https://www.precedenceresearch.com/sample/4250

Growth Factors

Several factors are fueling the growth of the sterilization equipment market. The rise in healthcare-associated infections (HAIs) has heightened the importance of effective sterilization practices in hospitals and clinics, driving investments in advanced sterilization technologies. Additionally, stringent regulations and standards for product safety and quality assurance across industries such as pharmaceuticals and food processing are boosting the adoption of sterilization equipment. Technological advancements, such as low-temperature sterilization methods and automation, are further propelling market expansion by enhancing efficiency and reducing operational costs.

Region Insights

The adoption of sterilization equipment varies by region, influenced by factors such as healthcare infrastructure, regulatory environment, and industry dynamics. Developed regions like North America and Europe lead the market due to established healthcare systems and stringent regulatory standards. Asia Pacific is witnessing rapid growth driven by increasing healthcare expenditure, rising awareness of infection control, and expanding pharmaceutical and biotechnology sectors. Emerging markets in Latin America and the Middle East are also showing potential for market growth as healthcare infrastructure improves and awareness of sterilization practices increases.

Sterilization Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.95% |

| Sterilization Equipment Market Size in 2023 | USD 15.73 Billion |

| Sterilization Equipment Market Size in 2024 | USD 16.98 Billion |

| Sterilization Equipment Market Size by 2033 | USD 33.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Technology Type, and By End-user Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sterilization Equipment Market Dynamics

Drivers

Several drivers are contributing to the growth of the sterilization equipment market. In the healthcare sector, the increasing prevalence of infectious diseases and the need to prevent HAIs are driving demand for sterilization equipment in hospitals, clinics, and ambulatory surgical centers. In the pharmaceutical industry, stringent regulations for product safety and quality assurance are pushing manufacturers to invest in advanced sterilization technologies to ensure compliance and mitigate risks. Additionally, growing consumer awareness of food safety is prompting food processors to adopt effective sterilization methods to extend shelf life and maintain product integrity.

Opportunities

The sterilization equipment market presents numerous opportunities for manufacturers and service providers. Innovations in sterilization technologies, such as the development of rapid sterilization cycles and eco-friendly methods, are opening new avenues for market growth. Expansion into emerging markets with evolving healthcare systems and increasing industrialization offers strategic opportunities for market penetration. Furthermore, the integration of sterilization equipment with digital technologies like IoT and data analytics can enhance efficiency, optimize resource utilization, and improve sterilization outcomes.

Challenges

Despite its growth prospects, the sterilization equipment market faces certain challenges. High initial costs associated with purchasing and maintaining sterilization equipment can pose barriers to adoption, particularly in resource-constrained settings. Regulatory complexities and evolving standards for sterilization across different industries require continuous compliance and adaptation. Moreover, concerns related to environmental impact, such as emissions from sterilization processes and disposal of sterilization byproducts, necessitate sustainable practices and technologies to address environmental stewardship concerns.

Read Also: Polyisobutylene Market Size to Rise USD 3.13 Bn by 2033

Sterilization Equipment Market Recent Developments

- In May 2023, AquiSense launched a new product, an ultraviolet (UV) disinfection system. It helps reduce pathogens by 4 gallons per minute.

- In July 2023, the Food and Drug Administration recognized a new medical device sterilization standard. It includes the use of low-temperature vaporized hydrogen peroxide for the sterilization of medical devices, sterilization of healthcare products, and requirements for the routine, validation, and development control for the sterilization of medical devices.

- In October 2023, a ready-for-sterilization (RFS) Combiseals was launched by a high-quality system critical elastomer component, Datwyler, to reduce the load for drug manufacturers to prepare packaging components for sterilization.

- In April 2024, a new aseptic spouted pouch-filling system, the SIG Prime 55 In-line Pouch sterilization, was launched by SIG. It improves the cost of sterilized packaged products and removes the need for third-party pre-sterilization of spouted pouches and supply chain complexity.

Sterilization Equipment Market Companies

- Absolute Medical

- Advanced Sterilization Products

- Anderson Products

- Cantel Medical

- Cardinal Health

- Celitron

- Boekel Scientific

- Belimed

- E-BEAM Services Inc.

- Fedegari

- Fortive

- Getinge

- LTE Scientific

- 3M

- STERIS PLC

- Sterigenics U.S. LLC

- Sotera Health

- Stryker

Segments Covered in the Report

By Product Type

- Sterilization Instruments

- Sterilization Accessories

- Sterilization Consumables

- Sterilization Services

By Technology Type

- Heat/High Temperature Sterilization

- Low Temperature Sterilization

- Ionizing Radiation Sterilization

- Filtration Sterilization

By End-user Type

- Hospital & Clinics

- Pharmaceutical Companies

- Medical Device Companies

- Food & Beverages Companies

- Other End Users

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/