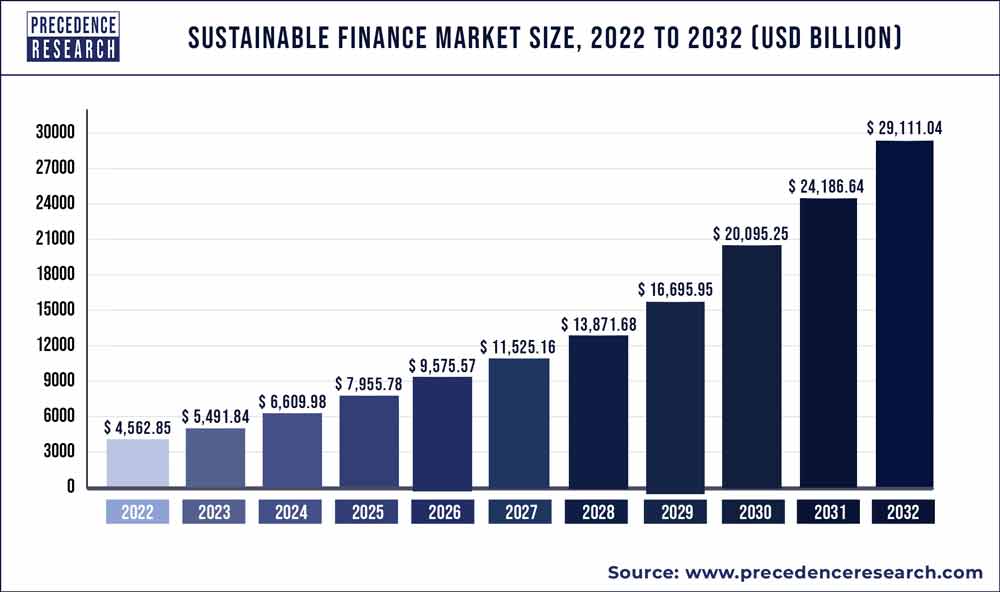

The global sustainable finance market size was estimated to be around US$ 4,562.85 billion in 2022. It is projected to reach US$ 29,111.04 billion by 2032, indicating a CAGR of 20.36% from 2023 to 2032.

Key Takeaways:

- North America led the global market in 2022.

- Asia-Pacific region is expected to expand at the fastest CAGR from 2023 to 2032.

- By Transaction Type, the green bond segment led the market in 2022.

- By Industry Verticals, the transport and logistics segment led the market in 2022.

The market research report on the Sustainable finance market provides a comprehensive analysis of various key aspects. It includes the definition, classification, and application of Sustainable finance products. The report examines the development trends, competitive landscape, and industrial chain structure within the industry. Furthermore, it presents an overview of the industry, analyzes national policies and planning, and offers insights into the latest market dynamics and opportunities at a global level.

Get a Sample: https://www.precedenceresearch.com/sample/3198

Sustainable Finance Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 5,491.84 Billion |

| Market Size by 2032 | USD 29,111.04 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 20.36% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Investment Type, By Transaction Type, and By Industry Verticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Geospatial Imagery Analytics Market Size to Garner USD 44.26 Billion by 2032

The report presents the volume and value-based market size for the base year 2022 and forecasts the market’s growth between 2023 and 2032. It estimates market numbers based on product form and application, providing size and forecast for each application segment in both global and regional markets.

Focusing on the global Sustainable finance market, the report highlights its status, future forecasts, growth opportunities, key market players, and key market regions such as the United States, Europe, and China. The study aims to present the development of the Sustainable finance market by considering factors like Year-on-Year (Y-o-Y) growth, in addition to Compound Annual Growth Rate (CAGR). This approach enables a better understanding of market certainty and the identification of lucrative opportunities.

Regarding production, the report investigates the capacity, production, value, ex-factory price, growth rate, and market share of major manufacturers, regions, and product types. On the consumption side, the report focuses on the regional consumption of Sustainable finance products across different countries and applications.

Buyers of the report gain access to verified market figures, including global market size in terms of revenue and volume. The report provides reliable estimations and calculations for global revenue and volume by product type from 2023 to 2032. It also includes accurate figures for production capacity and production by region during the same period.

The research includes product parameters, production processes, cost structures, and data classified by region, technology, and application. Furthermore, it conducts SWOT analysis and investment feasibility studies for new projects.

This in-depth research report offers valuable insights into the Sustainable finance market. It employs an objective and fair approach to analyze industry trends, supporting customer competition analysis, development planning, and investment decision-making. The project received support and assistance from technicians and marketing personnel across various links in the industry chain.

The competitive landscape section of the report provides detailed information on Sustainable finance market competitors. It includes company overviews, financials, revenue generation, market potential, research and development investments, new market initiatives, global presence, production sites, production capacities, strengths and weaknesses, product launches, product range, and application dominance. However, the data points provided only focus on the companies’ activities related to the Sustainable finance market.

Prominent players in the market are expected to face tough competition from new entrants. Key players are targeting acquisitions of startup companies to maintain their dominance. The report

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Key Players

- Green Banks

- Sustainable Asset Management Firms

- Impact Investing Funds

- Green Energy Companies

- Social Enterprises

- Sustainable Technology Companies

- Green Real Estate Developers

- Corporate Green Bond Issuers

- Sustainable Agriculture and Food Companies

Sustainable Finance Market Segmentations

By Investment Type

- Equity, Fixed Income

- Mixed Allocation

By Transaction Type

- Green Bond

- Social Bond

- Mixed- sustainability Bond

By Industry Verticals

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sustainable Finance Market

5.1. COVID-19 Landscape: Sustainable Finance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sustainable Finance Market, By Investment Type

8.1. Sustainable Finance Market, by Investment Type, 2023-2032

8.1.1 Equity, Fixed Income

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Mixed Allocation

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sustainable Finance Market, By Transaction Type

9.1. Sustainable Finance Market, by Transaction Type, 2023-2032

9.1.1. Green Bond

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Social Bond

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Mixed- sustainability Bond

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sustainable Finance Market, By Industry Verticals

10.1. Sustainable Finance Market, by Industry Verticals, 2023-2032

10.1.1. Utilities

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transport and Logistics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Chemicals

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Food and Beverage

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Government

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sustainable Finance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

Chapter 12. Company Profiles

12.1. Green Banks

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sustainable Asset Management Firms

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Impact Investing Funds

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Green Energy Companies

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Social Enterprises

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sustainable Technology Companies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Green Real Estate Developers

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Corporate Green Bond Issuers

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sustainable Agriculture and Food Companies

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com