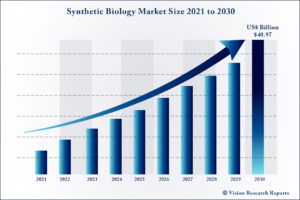

The global Synthetic Biology market size is expected to be worth around US$ 40.97 billion by 2030, according to a new report by Vision Research Reports.

The global Synthetic Biology market size was valued at US$ 10.88 billion in 2020 and is anticipated to grow at a CAGR of 21.8% during forecast period 2021 to 2030.

Download Exclusive Sample of Report@ https://www.visionresearchreports.com/report/sample/39050

Table of Contents

Synthetic Biology Market Growth Factors

Extensive applications of synthetic biology in multiple fields is a major impact rendering driver of the market. For instance, the technique is used for the development of biofuel from microorganisms in the bioenergy field.

Several market participants have produced materials and textiles with the use of synthetic biology. Bolt Threads, a material developing company that produced engineered spider silk ties, and Colorifix are developing dyes with biological systems. In addition, the market has provided the agriculture industry with alternative fertilizer options, which are not harmful. For instance, Pivot Bio, a California-based company, has established a technique of fertilizing crops without relying on a harmful polluting chemical process. Extending clinical applications of synthetic biology, the potential of the technique to accelerate drug development, and enhancing market competition are some key aspects driving the industry. The COVID-19 pandemic is set to drive applications and investments in this space.

Synthetic Biology Market Report Coverage

| Report Scope | Details |

| Market Size | US$ 40.97 billion by 2030 |

| Growth Rate | CAGR of 21.8% From 2021 to 2030 |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Technology, Product, Application, End use |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Bota Biosciences; Codexis, Inc.; Creative Biogene; Creative Enzymes; EnBiotix, Inc.; Eurofins Scientific; Illumina; Merck (Sigma Aldrich); New England Biolabs; Novozymes; Pareto Biotechnologies, Inc.; Scarab Genomics; Synthego; Synthetic Genomics; Thermo Fisher |

By Product Analysis

Oligonucleotide/oligo pools and synthetic DNA were the largest revenue-generating product segment in 2020 and accounted for a revenue share of more than 35% in the same year.

The segment is anticipated to expand further growing at the fastest CAGR over the forecast period. The ability to design custom DNA oligos for experiments has created ample opportunities in the fields, such as molecular and synthetic biology.

Companies, such as Integrated DNA Technologies, Life Technologies, Operon, and Eurofins, are providing custom primer services. Furthermore, the decreasing cost of synthesis and rising demand for synthetic DNA, RNA, and genes that are used in various applications contribute to the segment’s growth.

The enzymes segment is also expected to register a significant CAGR over the forecast period. Companies are focusing on the efficient, cost-effective, and eco-friendly production of enzymes.

By Technology Analysis

The PCR technology segment accounted for the largest revenue share of more than 28% in 2020 due to the high usage of this technology as it is fast, convenient, easily reproducible, extremely specific, and highly sensitive.

PCR cloning is applied to gene cloning, DNA recombination, and gene quantification in synthetic biology workflows. Syno 2.0 platform offered by Synbio Technologies can efficiently clone target genes without relying on the restriction enzyme sites.

An increase in R&D for the development and launch of reagents also drives segment growth. In June 2021, a group of researchers from the U.S., U.K., and Ghana developed cellular reagents, which can substitute enzymes in molecular biology, diagnostic reactions, and common synthetic biology processes including qPCR and PCR.

The NGS technology segment is expected to register the fastest CAGR during the forecast period. The ability of NGS to synthesize DNA sequences from the start, along with new technologies, such as CRISPR/Cas9, is enabling the targeted introduction of DNA sequences into living cells.

By Application Analysis

The healthcare application segment accounted for the largest revenue share of more than 77% in 2020. Synthetic biology has offered significant advancements in the scale and scope of biopharmaceutical drug development.

Diagnostics based on synthetic biology provide a real-time, specific & sensitive, and noninvasive process for detecting cancer cells, infectious agents, and therapeutics. Researchers use rational engineering approaches to make novel biosensing systems that are dynamic and constituted of a sensor, processor, and reporter.

Bio-fuels is the largest revenue-generating, non-healthcare application. Synthetic biology has created the possible way for the fourth generation of biofuels. Researchers are involved in developing alternative biofuel molecules as these are expected to have the potential to reduce Greenhouse Gas (GHG) emissions.

By End-use Analysis

The biotechnology and pharmaceutical companies segment dominated the market with a revenue share of more than 51% in 2020. Synthetic biology has helped biotechnology and pharmaceutical companies to develop novel drugs, which can treat chronic conditions.

Various companies have used synthetic biology to engineer pathways that enable microorganisms to produce medically relevant drugs. For instance, Amyris Inc. engineered yeast strains to develop the antimalarial drug Artemenisin. Moreover, synthetic biology can also improve in-vitro drug production.

Technological advancements in this field further stimulate the growth of the market. Computational protein design develops proteins from scratch and makes calculated variants of protein design and variants of protein structure. Scientists can create innovative enzymes that are not common to nature.

By Regional Analysis

North America accounted for the largest revenue share of over 40% in 2020 due to the increased investments for the development of synthetic biology products, favorable regulations, and government assistance.

Rising support from the U.S. government & private institutions and increasing research and development investments in drug discovery and development are expected to propel the market growth over the forecast years.

Read also @ Dentures Market Size Hit US$ 7.3 billion by 2030

Major Key Players Covered in The Synthetic Biology Market Report include

- Bota Biosciences

- Codexis, Inc.

- Creative Biogene

- Creative Enzymes

- EnBiotix, Inc.

- Eurofins Scientific

- Illumina

- Merck (Sigma Aldrich)

- New England Biolabs

- Novozymes

- Pareto Biotechnologies, Inc.

- Scarab Genomics

- Synthego

- Synthetic Genomics

- Thermo Fisher

Synthetic Biology Market Segmentation

- By Product

- Oligonucleotide/Oligo pools and Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-nucleic Acids

- Chassis Organism

- By Technology

- NGS

- PCR

- Genome Editing

- Bioprocessing Technology

- Others

- By Application

- Healthcare

- Clinical

- Bio/Pharmaceuticals

- Diagnostics

- Non-Clinical/Research

- Clinical

- Non-Healthcare

- Biotech Crops

- Specialty Chemicals

- Bio-Fuels

- Others

- Healthcare

- By End-use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Others

- Regional

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- North America

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Synthetic Biology Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Synthetic Biology Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Synthetic Biology Market, By Product

7.1. Synthetic Biology Market, by Product, 2021-2030

7.1.1. Oligonucleotide/Oligo pools and Synthetic DNA

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Enzymes

7.1.2.1. Market Revenue and Forecast (2017-2030)

7.1.3. Cloning Technologies Kits

7.1.3.1. Market Revenue and Forecast (2017-2030)

7.1.4. Xeno-nucleic Acids

7.1.4.1. Market Revenue and Forecast (2017-2030)

7.1.5. Chassis Organism

7.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Synthetic Biology Market, By Technology

8.1. Synthetic Biology Market, by Technology, 2021-2030

8.1.1. NGS

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. PCR

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Genome Editing

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Bioprocessing Technology

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Synthetic Biology Market, By Application

9.1. Synthetic Biology Market, by Application, 2021-2030

9.1.1. Healthcare

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Non-Healthcare

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Synthetic Biology Market, By End-use

10.1. Synthetic Biology Market, by End-use, 2021-2030

10.1.1. Biotechnology & Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Academic & Government Research Institutes

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Synthetic Biology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.8.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Bota Biosciences

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Codexis, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Creative Biogene

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Creative Enzymes

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. EnBiotix, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eurofins Scientific

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Illumina

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Merck (Sigma Aldrich)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. New England Biolabs

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Novozymes

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

Glossary of Terms

Buy this Research Report study@ https://www.visionresearchreports.com/report/cart/39050

Contact Us:

Vision Research Reports

Call: +1 9197 992 333