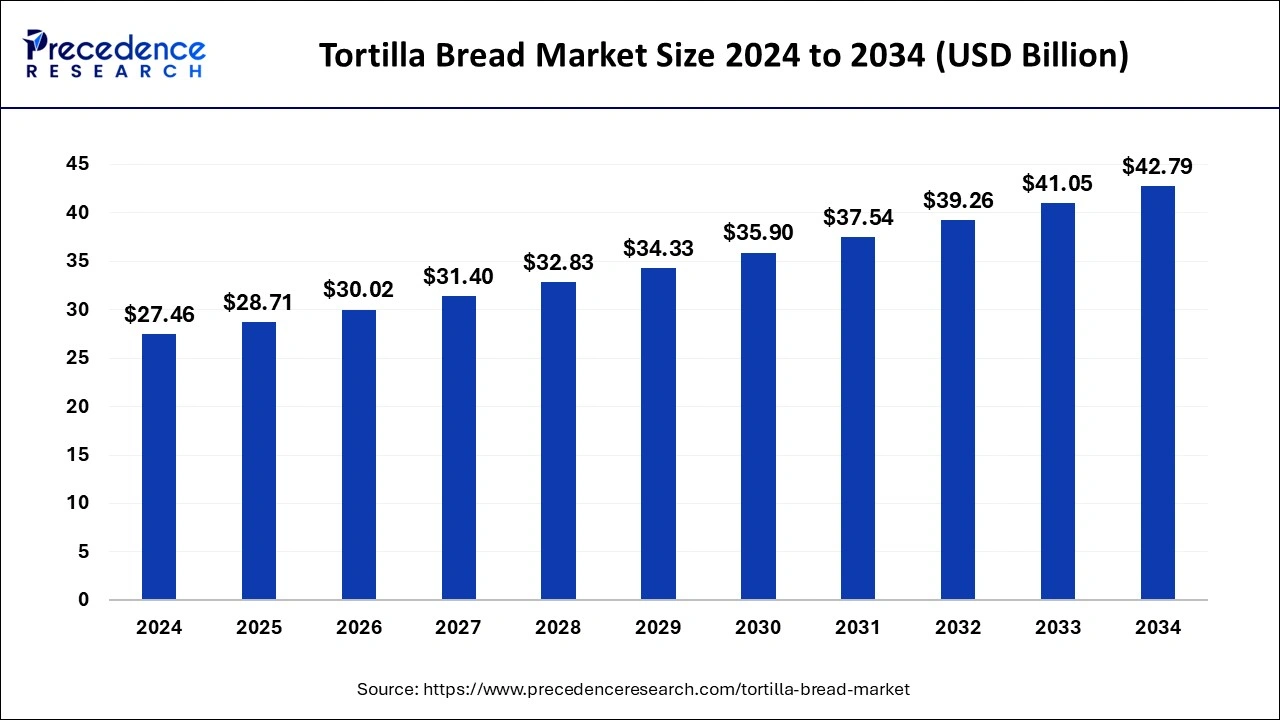

The global tortilla bread market size was estimated at USD 26.26 billion in 2023 and is anticipated to attain around USD 41.05 billion by 2033, growing at a CAGR of 4.57% from 2024 to 2033.

Key Points

- North America has generated more than 42% of market share in 2023.

- By ingredients, the corn segment has contributed more than 52% of market share in 2023.

- By processing type, the fresh segment has recorded the maximum market share of 63% 2023.

- By product type, the tortilla chips segment dominated the market with the biggest market share of 36% in 2023.

- By distribution channel, the hypermarket/supermarket distribution segment has held a major market share of 37% in 2023.

The tortilla bread market has witnessed significant growth in recent years, driven by factors such as changing dietary preferences, increasing demand for convenient and ready-to-eat food products, and the growing popularity of Mexican cuisine worldwide. Tortilla bread, a staple in Mexican and Latin American cuisine, has gained widespread acceptance beyond its traditional markets, owing to its versatility and adaptability to various cuisines. With the rise of multiculturalism and the increasing globalization of food trends, the demand for tortilla bread has expanded across regions, contributing to the overall growth of the market.

Get a Sample: https://www.precedenceresearch.com/sample/4018

Growth Factors:

Several factors contribute to the growth of the tortilla bread market. One key driver is the rising consumer inclination towards healthier food options. Tortilla bread, particularly those made from whole grains or alternative flours, is perceived as a healthier alternative to traditional bread due to its lower calorie and fat content. Additionally, the gluten-free nature of corn tortillas appeals to consumers with dietary restrictions or preferences. Furthermore, the convenience factor associated with tortilla bread, which can be used in a variety of dishes such as tacos, wraps, and quesadillas, fuels its demand among busy consumers seeking quick and easy meal solutions.

Region Insights:

The consumption of tortilla bread varies across different regions, with Mexico and the United States being the largest markets. In Mexico, tortilla bread holds cultural significance and is consumed as a staple food item in various traditional dishes like tacos, burritos, and enchiladas. The United States, on the other hand, has seen a surge in demand for tortilla bread due to the popularity of Tex-Mex cuisine and the growing Hispanic population. Outside of North America, regions such as Europe and Asia-Pacific are witnessing increasing adoption of tortilla bread, driven by the rising popularity of Mexican and Latin American cuisine among global consumers.

Tortilla Bread Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 26.26 Billion |

| Global Market Size by 2033 | USD 41.05 Billion |

| U.S. Market Size in 2023 | USD 8.27 Billion |

| U.S. Market Size by 2033 | USD 12.93 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Ingredients, By Processing Type, By Product Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tortilla Bread Market Dynamics

Drivers:

Several factors drive the demand for tortilla bread globally. One of the primary drivers is the growing multiculturalism and the resulting fusion of culinary traditions. Tortilla bread’s versatility makes it an ideal choice for chefs and home cooks looking to experiment with diverse flavors and ingredients. Moreover, the expanding fast-food industry and the proliferation of Mexican and Tex-Mex restaurants worldwide contribute to the growing consumption of tortilla bread. Additionally, the rising disposable incomes in emerging economies have led to increased spending on dining out and packaged food products, further boosting the demand for tortilla bread.

Opportunities:

The tortilla bread market presents several opportunities for manufacturers and retailers to capitalize on. Expanding product offerings to include organic, gluten-free, and flavored variants can cater to the diverse preferences of consumers. Moreover, leveraging innovative packaging solutions to enhance shelf life and convenience can attract more consumers, especially those seeking on-the-go meal options. Collaborations with foodservice providers and restaurant chains to incorporate tortilla bread into their menus can also create new revenue streams for market players. Furthermore, expanding distribution networks and entering untapped markets can help companies unlock new growth opportunities in the global tortilla bread market.

Challenges:

Despite its growth prospects, the tortilla bread market faces certain challenges that need to be addressed. One such challenge is the availability of raw materials, particularly corn, which is the primary ingredient in traditional tortilla bread. Fluctuations in corn prices and supply chain disruptions can impact the production and pricing of tortilla bread, posing challenges for manufacturers. Additionally, maintaining product quality and consistency can be challenging, especially for mass-produced tortilla bread. Addressing these challenges requires effective supply chain management, investment in quality control measures, and strategic partnerships with suppliers to ensure a steady supply of raw materials.

Read Also: Tissue Expanders Market Size to Attain USD 1,309.69 Mn by 2033

Recent Developments

- In March 2024, Tortilla Restaurants unveiled an enticing offer for evening diners: a £10 evening meal deal complete with a choice of burritos, tacos, naked burritos, or salads, accompanied by a side of sweetcorn ribs in sour cream, tortilla chips and salsa, or queso fundido.

- In October 2023, Doritos unveiled Doritos Dinamita, a fiery addition to its lineup, tailored specifically for the Indian market. These rolled tortilla chips come in two bold flavors: Fiery Lime and Chilli and Sizzlin’ Hot. Accompanied by a sizzling campaign, Doritos aims to ignite taste buds with its spicy offerings.

Tortilla Bread Market Companies

- Grupo Bimbo SAB de CV

- General Mills

- Aranda’s Tortilla Company Inc.

- Ole Mexican Foods Inc

- Easy Foods Inc.

- Gruma SAB de CV

- PepsiCo Inc.

- La Tortilla Factory

- Catallia Mexican Foods

- Tyson Foods Inc.

- Azteca Foods Inc.

Segments Covered in The Report

By Ingredients

- Wheat

- Corn

By Processing Type

- Fresh

- Frozen

By Product Type

- Tortilla Chips

- Taco Shells

- Tostadas

- Flour Tortillas

- Corn Tortillas

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/