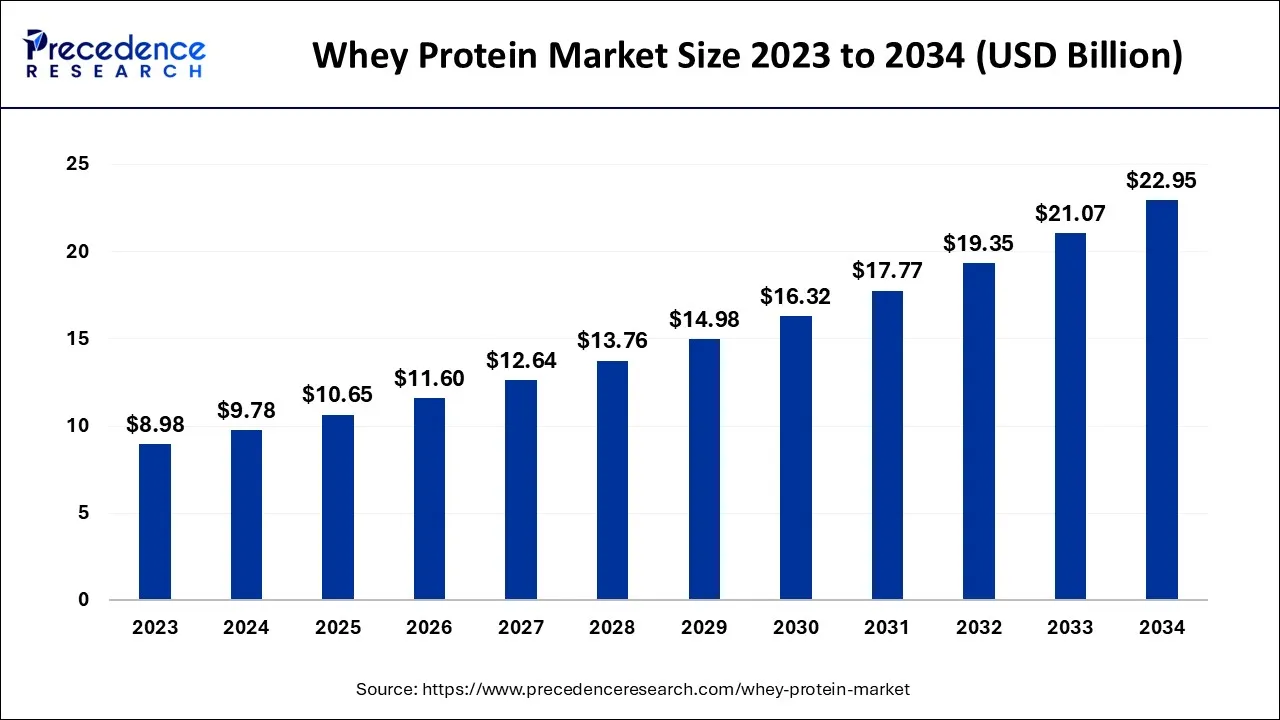

The global whey protein market size was valued at USD 8.98 billion in 2023, and is anticipated to surpassed USD 22.95 billion by 2034. It is expanding at a CAGR of 8.9% between 2024 and 2034.

Whey protein has become popular among sportspersons, fitness enthusiasts, and health-conscious people due to its excellent amino acid profile and quick absorption. Due to beneficial features, such as antihypertensive and antibacterial activity, whey protein is widely used in cereals, beverages, chocolate, dairy snacks, and baked goods, hence the prevailing demand for the product in the region. Other factors fueling the market include the growing focus on healthy living and the rising demand for nutritional supplements.

Key Insights

- North America dominated the market in 2023 with revenue share of 38%.

- Europe is expected to grow at a significant rate during the forecast period.

- By type, the concentrate segment is projected to generate the highest revenue between 2023 and 20234.

- By application, the sports and performance nutrition segment dominated the market in 2023.

- By distribution channel, the supermarkets/hypermarkets segment is projected to lead the market.

- By end-user, the athletes segment dominated the market in 2023.

North America dominated the market in 2023

- North America dominated the market with the largest share in 2023. Factors like increasing disposable income and the rising adoption of whey protein as a functional food and dietary supplement among consumers in the region are major factors that contributed to the market growth.

- In addition, the rising awareness about health and active living and the high prevalence of lifestyle-related diseases further bolstered the market. The use of whey protein is also popular among fitness center operators, aiding in the market’s growth.

U.S. Whey Protein Market Size, 2024 to 2034 (USD Billion)

| Year | Market Size (USD Billion) |

| 2024 | USD 8.92 |

| 2025 | USD 9.33 |

| 2026 | USD 9.75 |

| 2027 | USD 10.19 |

| 2028 | USD 10.65 |

| 2029 | USD 11.13 |

| 2030 | USD 11.63 |

| 2031 | USD 12.15 |

| 2032 | USD 12.70 |

| 2033 | USD 13.27 |

| 2034 | USD 14.06 |

Europe is expected to expand at a significant rate

- The market in Europe is expected to expand at a significant rate throughout the forecast period. The regional market growth is mainly attributed to the rising demand for healthcare products and protein supplements. Regional market players are expanding their facilities to enhance supply chain and production capabilities.

- The growing busy lifestyles and higher income levels in Europe propel the growth of market. Another factor boosting the whey protein market in Europe is the high availability of raw materials, especially for dairy protein supplements.

Type Insights

The concentrate segment is projected to generate the highest revenue between 2023 and 2034. Whey concentrates are water-soluble minerals and lipids used widely in yogurts, dairy products, and beverages. In infant nutrition, they are used in protein-fortified foods. Whey protein concentrate is increasingly being embraced due to its high protein and low-fat profile. Whey concentrates contain ingredients such as manganese, phosphorus, and B vitamins that play a crucial role in managing cognition.

- In November 2023, Finnish dairy company Valio introduced Valio Eila MPC 65, a lactose-free milk protein concentrate that enhances the taste and texture of protein products for better digestive comfort.

Application Insights

The sports and performance nutrition segment dominated the market in 2023. Nutrition is vital for athletes, as it provides the energy required for training, strength, performance, and recovery. The food type and timing during the day affect workout recovery rates and performance levels. Athletes should eat low-fat, low- to medium-level protein foods and carbs two hours before activity. Due to its multiple benefits, such as speeding athletic performance and healing damaged muscles, whey has become an indispensable item in the diet of every sportsperson. It promotes muscle growth, thus enhancing body composition, increasing muscle mass and strength, and enhancing endurance. It also increases serotonin synthesis in the brain, thereby reducing fatigue.

Distribution Channel Insights

The supermarkets/hypermarkets segment is projected to lead the market in the coming years. This is mainly due to the availability of a wide range of products at low costs under single roof. Department stores rely on sales from regular customers to generate revenue. The big box concepts of retailing provide consumers with the convenience of everything under one roof. Supermarkets often use promotional activities, provide additional services, offers, and discounts, thus enhancing the overall customer experience and increasing footfall.

End-user Insights

The athletes segment dominated the market in 2023, capturing a large share of the market. Whey protein is a commonly used supplement by bodybuilders due to its multiple health benefits. It helps in the synthesis of vitamin E antagonists, weight loss, performance boosts, recovering speed, minimizing muscle inflammation, and building and repairing tissues. Of all the essential amino acids included in whey protein, leucine is crucial for repairing and building muscles after workouts. Whey protein also helps heal injuries and manage appetite to achieve weight loss by preventing excessive eating. The increasing awareness of the health benefits associated with whey protein leads to a higher consumption rate among athletes over the studied period.

- In June 2023, DC Doctor’s Choice, India’s leading bodybuilding supplement brand, unveiled its three Whey Fusion Protein at the International Health, Sports, and Fitness Festival.

Whey Protein Market Dynamics

Driver

The demand for nutritional supplements is rising at a rapid pace due to the outbreak of the COVID-19 pandemic, increasing health awareness, and rising instances of undernourishment. Health-conscious consumers are increasingly using supplements to fill the nutritional void and prevent the onset of diseases. Due to its high biological value and high content of amino acids, whey protein is increasingly added to supplements, especially by bodybuilders, professional athletes, and fitness enthusiasts. It helps in muscle development and reduces fatigue.

- In September 2024, Arla Foods Ingredients launched a campaign to encourage dairy manufacturers to create high-protein products, including whey protein.

Restraint

Challenges in dried whey powder production

Whey, a nutrient-rich by-product, is a crucial component of dairy products. It is usually produced in large quantities, and its disposal poses environmental risks. However, processing whey powder involves several challenges that reduce the powder yield and quality, especially caking. These challenges are surmountable by optimizing product formulation and processing parameters. The quality of the product is highly dependent on the composition of whey in the initial stage. For instance, excess minerals or lactic acid contribute to lower powder yield as they create adhesion of lactose-containing powders to the drying equipment. Since excessive amorphous lactose content makes the product sticky and prone to caking during storage, proper pre-crystallization of lactose is necessary.

Opportunity

Novel product development

The increasing popularity of personalized nutrition has resulted in a high demand for tailored whey protein blends. The growing trend toward healthy and active living among consumers leads them to search for products that cater to their specific health goals, like weight loss, muscle building, or general fitness. Consequently, there has been heightened demand for whey protein supplements that come with customized amino acid compositions, varying levels of proteins, and unique taste profiles. This trend induces favorable changes for manufacturers, giving them opportunities to develop innovative products that serve acute dietary needs. The demand for whey protein with a unique profile is rising among athletes and fitness enthusiasts who wish to enhance their muscle repair and performance capabilities, thus fueling the market.

Recent Developments

- In September 2024, Amazon’s Great Indian Festival Sale 2024 offers pre-deals on whey protein, vitamin supplements, and more, with up to 50% off.

- In September 2024, Avvatar, a leading health and fitness brand, introduced Avvatar 100% Performance Whey Protein, offering a versatile, high-quality protein suitable for all.

- In September 2024, the lifestyle brand GHOST introduced the “MINT” cookie, with the release of GHOST WHEY x OREO “MINT.”

- In June 2024, Steadfast Nutrition launched three new supplements, including protein supplements, whey protein and LIV Raw, and a vegetarian Multivitamin mega pack, at Asia’s largest health and fitness festival.

- In February 2024, Vivici, a Netherlands-based producer of animal-free dairy proteins, launched a precision-fermented nature-identical whey protein, containing all amino acids and high leucine.

Which are the top companies operating in the Whey Protein Market?

The companies operating in the whey protein market are below

- Glanbia plc. (Ireland)

- The Simply Good Food Co (U.S.)

- Now Health Group, Inc. (U.S.)

- Nutiva Inc (U.S.)

- The Nature’s Bounty Co. (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm Corporation (U.S.)

- Kerry Group Plc (Ireland)

- CytoSport, Inc. (U.S.)

- Reliance Vitamin Company, Inc. (U.S.)

- True Nutrition (U.S.)

- Danone SA (France)

- Herbalife Nutrition, Inc. (U.S.)

- General Nutrition Centers (GNC) Holdings, Inc. (U.S.)

- Orgain Inc. (U.S.)

Segments Covered in the Report

By Type

- Isolates

- Concentrates

- Demineralized

- Hydrolysate

By Application

- Nutritional

- Personal Care

- Food

- Feed

- Infant Formula

- Sports and Performance Nutrition

- Functional/Fortified Food

By Distribution channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Other Distribution Channels

By End Users

- Athletes

- Bodybuilders

- Lifestyle Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/2530

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344